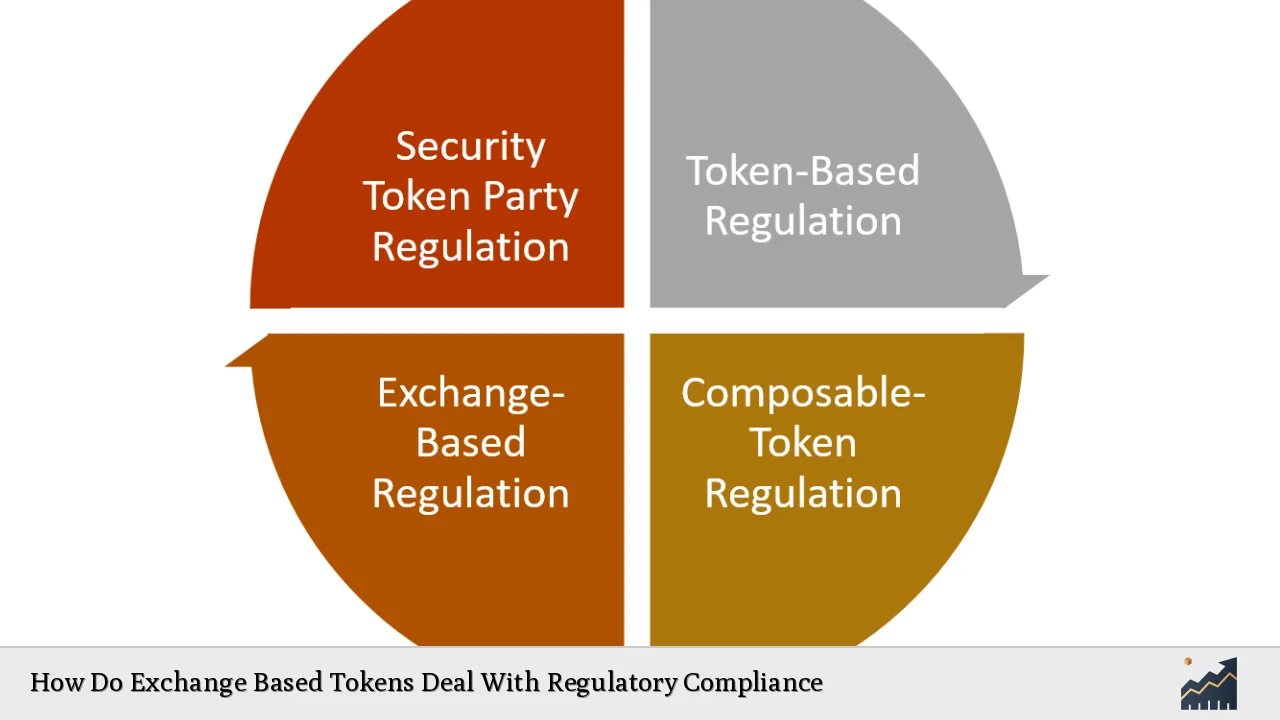

The rise of exchange-based tokens has transformed the cryptocurrency landscape, offering unique opportunities for exchanges and investors alike. However, as regulatory scrutiny intensifies globally, understanding how these tokens navigate compliance is essential for their sustainability and growth. Exchange-based tokens, often issued by cryptocurrency exchanges, serve various purposes including fee discounts, governance rights, and access to exclusive services. Their compliance with regulatory frameworks is crucial not only for their legitimacy but also for the broader acceptance of cryptocurrencies in traditional financial markets.

| Key Concept | Description/Impact |

|---|---|

| Regulatory Frameworks | Exchange-based tokens must comply with a myriad of regulations that vary by jurisdiction, including securities laws, anti-money laundering (AML) requirements, and consumer protection laws. |

| Know Your Customer (KYC) | KYC regulations require exchanges to verify the identities of their users to prevent fraud and ensure compliance with financial regulations. |

| Anti-Money Laundering (AML) | AML laws mandate that exchanges monitor transactions for suspicious activity and report any findings to relevant authorities to combat money laundering. |

| Securities Regulations | Some exchange tokens may be classified as securities, necessitating registration with regulatory bodies like the SEC in the U.S., which can lead to significant legal implications. |

| Market Manipulation Prevention | Regulations aimed at preventing market manipulation are critical in maintaining investor confidence and ensuring fair trading practices on exchanges. |

| Global Compliance Standards | The Financial Action Task Force (FATF) sets international standards that many countries adopt, influencing local regulations regarding cryptocurrency transactions. |

| Consumer Protection Laws | Exchanges must adhere to laws designed to protect consumers from fraud and ensure transparency in operations and token offerings. |

| Technological Solutions | Many exchanges implement advanced technology solutions for compliance, including blockchain analytics tools that help monitor transactions effectively. |

Market Analysis and Trends

The landscape for exchange-based tokens is rapidly evolving. The total market capitalization of cryptocurrencies reached approximately $2.5 trillion in late 2024, with exchange tokens representing a significant portion of this value. Notably, major exchange tokens like Binance Coin (BNB) and FTX Token (FTT) have historically provided discounts on trading fees and access to exclusive features, driving user engagement.

Current Market Dynamics

- Increased Regulatory Scrutiny: Following high-profile collapses like FTX, regulators worldwide are tightening their grip on cryptocurrency exchanges. The U.S. Securities and Exchange Commission (SEC) has ramped up enforcement actions against unregistered securities offerings, impacting many exchange tokens.

- Emergence of Comprehensive Regulations: The European Union’s Markets in Crypto-Assets (MiCA) regulation represents a significant step towards establishing a cohesive regulatory framework for cryptocurrencies within the EU. This regulation aims to enhance consumer protection and market integrity while fostering innovation.

- Institutional Interest: There is a growing trend of institutional investment in cryptocurrencies, which necessitates higher compliance standards from exchanges. Institutions demand transparency and security, pushing exchanges to adopt robust regulatory practices.

Implementation Strategies

To effectively deal with regulatory compliance, exchanges must adopt multifaceted strategies:

KYC and AML Compliance

- Robust KYC Processes: Exchanges need to implement stringent KYC protocols that verify user identities through government-issued IDs and other documentation. This helps prevent fraud and ensures compliance with local laws.

- Transaction Monitoring Systems: Continuous monitoring of transactions allows exchanges to detect suspicious activities in real-time. Automated systems can flag unusual patterns that may indicate money laundering or other illicit activities.

Regulatory Partnerships

- Engagement with Regulators: Establishing open lines of communication with regulatory bodies can help exchanges stay ahead of compliance requirements. Regular consultations can lead to better understanding and adaptation to evolving regulations.

- Legal Advisory Teams: Employing legal experts specializing in cryptocurrency regulations ensures that exchanges navigate complex legal landscapes effectively.

Technology Adoption

- Blockchain Analytics Tools: Utilizing advanced analytics tools can enhance transaction monitoring capabilities. These tools help trace the flow of funds and identify potential risks associated with specific transactions.

- Smart Contracts for Compliance: Implementing smart contracts can automate compliance processes, such as KYC verification and transaction reporting, thereby reducing human error and increasing efficiency.

Risk Considerations

Despite the potential benefits of exchange-based tokens, several risks must be managed:

Regulatory Risks

- Changing Regulations: The dynamic nature of cryptocurrency regulations means that what is compliant today may not be tomorrow. Exchanges must remain agile to adapt quickly to new laws.

- Legal Consequences: Non-compliance can lead to severe penalties, including fines or operational shutdowns. For example, the SEC’s actions against numerous crypto platforms highlight the importance of adhering to securities laws.

Market Risks

- Volatility of Exchange Tokens: The value of exchange-based tokens can be highly volatile due to market sentiment and regulatory news. This volatility poses risks for both investors and the exchanges themselves.

- Reputation Risk: Regulatory failures or security breaches can significantly damage an exchange’s reputation, leading to loss of user trust and market share.

Regulatory Aspects

Understanding the regulatory landscape is crucial for exchange-based tokens:

U.S. Regulations

The SEC has been particularly active in regulating cryptocurrencies under existing securities laws. Key points include:

- Securities Classification: Tokens may be classified as securities if they meet the Howey Test criteria established by a 1946 Supreme Court ruling. This classification requires issuers to register their tokens unless an exemption applies.

- Increased Enforcement Actions: In 2023 alone, the SEC initiated 26 enforcement actions against various crypto entities for violations related to unregistered securities offerings.

International Regulations

Globally, different jurisdictions are implementing their own regulations:

- European Union’s MiCA Regulation: This comprehensive framework aims to regulate crypto assets across EU member states, focusing on consumer protection and market integrity.

- FATF Recommendations: Many countries are adopting FATF guidelines on AML practices for virtual assets, emphasizing cross-border cooperation among regulatory bodies.

Future Outlook

The future of exchange-based tokens will likely be shaped by ongoing regulatory developments:

Enhanced Compliance Requirements

As regulators continue to evolve their frameworks, exchanges will face increased pressure to comply with stringent standards. This may include more rigorous KYC processes and enhanced consumer protection measures.

Integration with Traditional Finance

The convergence of cryptocurrency markets with traditional financial systems will necessitate greater transparency and regulatory adherence from exchanges. This integration could lead to more stable market conditions but will also require exchanges to align closely with existing financial regulations.

Technological Innovations

Advancements in technology will play a crucial role in facilitating compliance efforts. Blockchain technology itself can enhance transparency while AI-driven analytics tools will improve monitoring capabilities across platforms.

Frequently Asked Questions About How Do Exchange Based Tokens Deal With Regulatory Compliance

- What are exchange-based tokens?

Exchange-based tokens are digital assets issued by cryptocurrency exchanges that provide various benefits such as fee discounts or governance rights within the platform. - How do KYC regulations impact exchange-based tokens?

KYC regulations require exchanges to verify user identities before allowing them access to services involving exchange-based tokens, helping prevent fraud and ensure compliance. - What is the significance of AML laws for crypto exchanges?

AML laws mandate that exchanges monitor transactions for suspicious activity related to money laundering or terrorist financing, ensuring they operate within legal frameworks. - Are all exchange-based tokens considered securities?

No, whether an exchange token is classified as a security depends on its characteristics; some may fall under existing securities regulations while others do not. - What role does technology play in regulatory compliance?

Technology aids compliance through automated KYC processes, transaction monitoring systems, and blockchain analytics tools that enhance transparency and risk management. - How does global regulation affect local exchanges?

Global regulatory trends influence local jurisdictions; exchanges must adapt their operations according to both local laws and international standards like those set by FATF. - What are the risks associated with investing in exchange-based tokens?

The primary risks include regulatory changes leading to non-compliance penalties, market volatility affecting token value, and reputational damage from security breaches. - What is the future outlook for exchange-based tokens?

The future will likely see enhanced compliance requirements alongside greater integration with traditional finance sectors driven by technological innovations.

In conclusion, navigating regulatory compliance is paramount for the success of exchange-based tokens. As the landscape continues to evolve rapidly due to heightened scrutiny from regulators worldwide, it becomes increasingly important for exchanges to implement robust compliance strategies while leveraging technology effectively. By doing so, they can maintain trust among users while fostering growth within this innovative sector.