Exchange-based tokens and traditional cryptocurrencies represent two distinct categories within the digital asset ecosystem, each with unique characteristics, functionalities, and implications for investors. Understanding these differences is critical for individual investors, finance professionals, and anyone interested in the evolving landscape of cryptocurrency. This article delves into the nuances of exchange-based tokens compared to traditional cryptocurrencies, exploring market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

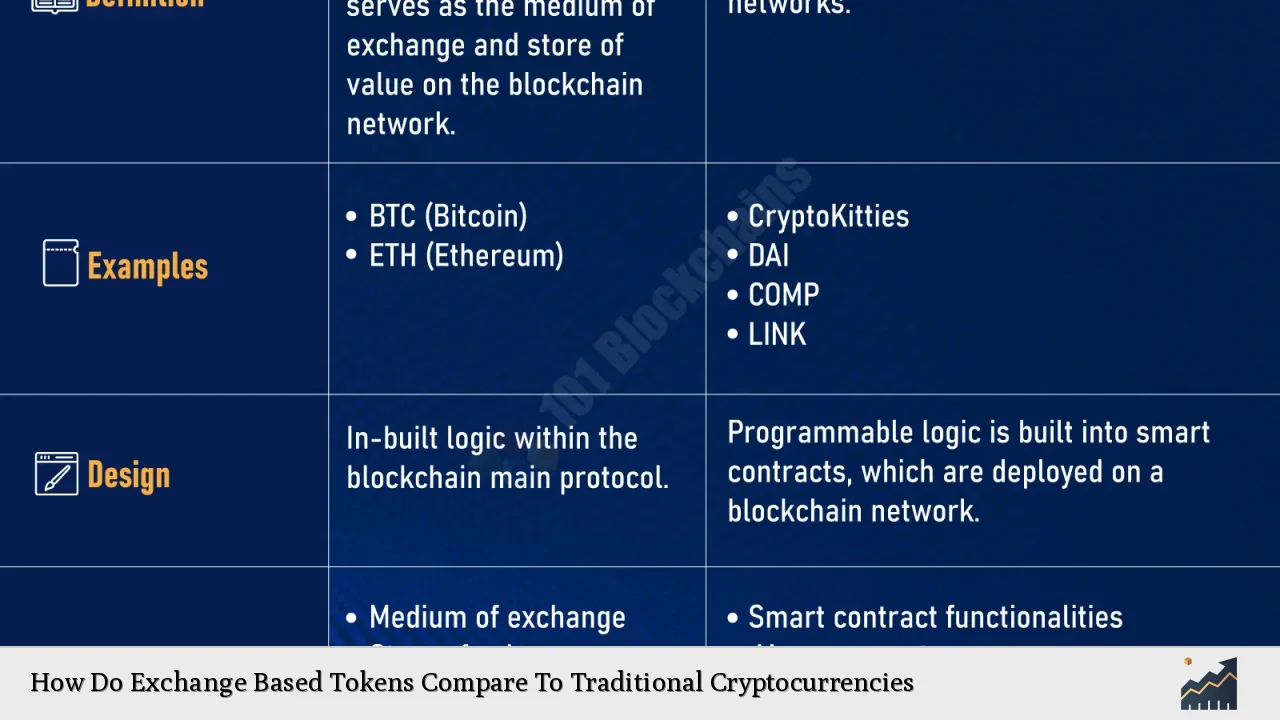

| Definition | Exchange-based tokens are issued by cryptocurrency exchanges and often provide users with benefits such as reduced trading fees and access to exclusive services. Traditional cryptocurrencies like Bitcoin and Ethereum operate independently as decentralized digital currencies. |

| Utility | Exchange tokens are primarily used within their respective platforms for trading fee discounts and governance rights. Traditional cryptocurrencies serve as a medium of exchange or a store of value. |

| Market Dynamics | The value of exchange tokens is closely tied to the performance and reputation of their parent exchanges, while traditional cryptocurrencies are influenced by broader market trends and technological advancements. |

| Liquidity | Exchange tokens often exhibit high liquidity due to their integration into trading platforms, whereas traditional cryptocurrencies can experience significant price volatility based on market sentiment. |

| Regulatory Environment | Exchange tokens may face specific regulatory scrutiny depending on their use case (e.g., utility vs. security), while traditional cryptocurrencies are increasingly being categorized under various regulatory frameworks globally. |

| Risks | Exchange tokens are susceptible to risks associated with centralized exchanges, including operational failures and regulatory challenges. Traditional cryptocurrencies face risks related to market volatility and technological vulnerabilities. |

Market Analysis and Trends

The cryptocurrency market has undergone significant transformations over the past few years. Exchange-based tokens have gained prominence as major players in this landscape. As of late 2024, the market capitalization of crypto exchange tokens has been estimated at around $100 billion, reflecting their growing importance in the overall ecosystem.

Key Trends

- Increased Adoption: Many exchanges are launching their own tokens to enhance customer loyalty and create additional revenue streams through trading fee discounts and other incentives.

- Market Volatility: The prices of exchange tokens can be highly volatile, often mirroring the performance of Bitcoin and other leading cryptocurrencies. For example, during periods of Bitcoin price surges or declines, exchange tokens have shown similar patterns.

- Regulatory Scrutiny: As governments around the world tighten regulations on cryptocurrency activities, exchange tokens face increased scrutiny regarding their classification as securities or utility tokens.

- Interoperability: There is a growing trend toward interoperability between exchange tokens and other platforms, allowing users to leverage these assets across different ecosystems.

Implementation Strategies

Investors considering exchange-based tokens should adopt strategic approaches tailored to their unique characteristics:

- Diversification: Given the volatility associated with both exchange tokens and traditional cryptocurrencies, diversifying investments across multiple assets can mitigate risks.

- Understanding Use Cases: Investors should thoroughly understand the utility of specific exchange tokens—such as fee discounts or governance rights—before investing.

- Monitoring Exchange Performance: The success of an exchange token is often tied to the performance of its parent platform. Keeping abreast of news regarding exchanges can provide insights into potential token performance.

- Participating in Governance: Many exchange tokens offer holders governance rights. Engaging in these processes can provide valuable insights into the future direction of the platform.

Risk Considerations

Investing in exchange-based tokens comes with its own set of risks:

- Centralization Risks: Unlike traditional cryptocurrencies that operate on decentralized networks, exchange tokens are linked to centralized entities. This centralization can lead to vulnerabilities if an exchange faces operational issues or regulatory challenges.

- Market Manipulation: The relatively lower liquidity in some exchanges can lead to price manipulation by large investors or coordinated groups.

- Regulatory Risks: The evolving regulatory landscape poses risks for both exchanges and their associated tokens. Regulatory changes can impact token valuation significantly.

- Technological Vulnerabilities: Security breaches at exchanges can lead to substantial losses for token holders. Historical incidents (e.g., Mt. Gox) highlight these risks.

Regulatory Aspects

The regulatory environment for cryptocurrencies is complex and varies significantly across jurisdictions:

- Securities Classification: Some jurisdictions classify certain exchange tokens as securities, which subjects them to stringent regulations under securities laws.

- Utility Tokens vs. Security Tokens: The classification often depends on how the token is marketed and used. Tokens that provide access to services (utility) may face fewer regulations than those viewed as investment contracts (securities).

- Compliance Requirements: Exchanges must comply with anti-money laundering (AML) and know your customer (KYC) regulations, which can affect how they issue and manage their tokens.

Future Outlook

The future of exchange-based tokens appears promising but fraught with challenges:

- Integration with DeFi: As decentralized finance (DeFi) continues to grow, there may be increased opportunities for exchange tokens to participate in lending, borrowing, and yield farming activities.

- Institutional Adoption: Greater institutional interest in cryptocurrencies could bolster demand for both exchange-based tokens and traditional cryptocurrencies.

- Technological Advancements: Innovations such as layer 2 scaling solutions could enhance transaction speeds and reduce costs for both types of assets.

- Evolving Regulations: Ongoing regulatory developments will shape the landscape for both exchange-based tokens and traditional cryptocurrencies. Investors must remain vigilant about compliance changes that could impact their holdings.

Frequently Asked Questions About How Do Exchange Based Tokens Compare To Traditional Cryptocurrencies

- What are exchange-based tokens?

Exchange-based tokens are digital assets issued by cryptocurrency exchanges that offer benefits like trading fee discounts or governance rights within the platform. - How do they differ from traditional cryptocurrencies?

Traditional cryptocurrencies like Bitcoin operate independently on decentralized networks, while exchange-based tokens are tied directly to centralized exchanges. - What are the main benefits of holding exchange-based tokens?

Benefits include reduced trading fees, access to exclusive services on the platform, potential governance rights, and opportunities for price appreciation. - What risks should investors be aware of?

Investors should consider centralization risks, market manipulation potential, regulatory uncertainties, and technological vulnerabilities associated with exchanges. - How do regulatory frameworks affect these tokens?

The classification of exchange-based tokens as securities or utility assets impacts how they are regulated; compliance with AML/KYC regulations is also crucial. - Can I use exchange-based tokens outside their respective platforms?

While primarily designed for use within their platforms, some exchange-based tokens are becoming increasingly accepted across various ecosystems. - What is the future outlook for exchange-based tokens?

The future looks promising due to potential integration with DeFi applications, increasing institutional adoption, ongoing technological advancements, and evolving regulations. - Should I invest in exchange-based tokens or traditional cryptocurrencies?

The choice depends on individual investment goals; diversification across both categories may provide a balanced approach.

This comprehensive analysis provides insight into how exchange-based tokens compare to traditional cryptocurrencies. Understanding these distinctions is vital for making informed investment decisions in a rapidly evolving financial landscape.