Decentralized Finance (DeFi) has emerged as a revolutionary concept in the financial sector, enabling users to engage in financial transactions without intermediaries. However, the rapid growth of DeFi has also attracted malicious actors, leading to significant security concerns. As of 2024, DeFi protocols have accounted for over $1.12 billion lost to hacks, emphasizing the critical need for robust security measures. This article explores how DeFi protocols ensure security against hacks, analyzing current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Smart Contract Audits | Regular audits by third-party firms identify vulnerabilities in smart contracts before deployment, reducing the risk of exploitation. |

| Multi-Factor Authentication (MFA) | MFA enhances user account security by requiring multiple forms of verification, making unauthorized access more difficult. |

| Bug Bounty Programs | Incentivizing ethical hackers to find vulnerabilities helps improve security through community engagement and proactive identification of flaws. |

| Decentralized Oracles | Using decentralized oracles mitigates risks associated with data manipulation by aggregating information from multiple sources. |

| Emergency Protocols | Implementing circuit breakers allows protocols to halt operations during suspicious activities or market anomalies to prevent losses. |

| User Education | Educating users on security best practices reduces risks associated with phishing and social engineering attacks. |

Market Analysis and Trends

The DeFi market has seen exponential growth, with total value locked (TVL) in DeFi protocols estimated at over $37 billion as of late 2024. Despite this growth, DeFi remains a prime target for hackers due to its open-source nature and the significant amounts of capital involved.

Recent statistics indicate that in 2024 alone, DeFi exploits accounted for approximately 82% of all cryptocurrency thefts, highlighting an ongoing trend where attackers exploit vulnerabilities inherent in decentralized systems. The most common types of attacks include:

- Protocol Logic Exploits: Flaws in smart contract design can lead to unauthorized fund withdrawals.

- Flash Loan Attacks: Attackers manipulate prices using borrowed funds within a single transaction.

- Oracle Manipulation: Altering external data feeds can lead to incorrect execution of smart contracts.

The need for enhanced security measures is underscored by the fact that the BNB Chain has become a top target for attacks, surpassing Ethereum in 2024.

Implementation Strategies

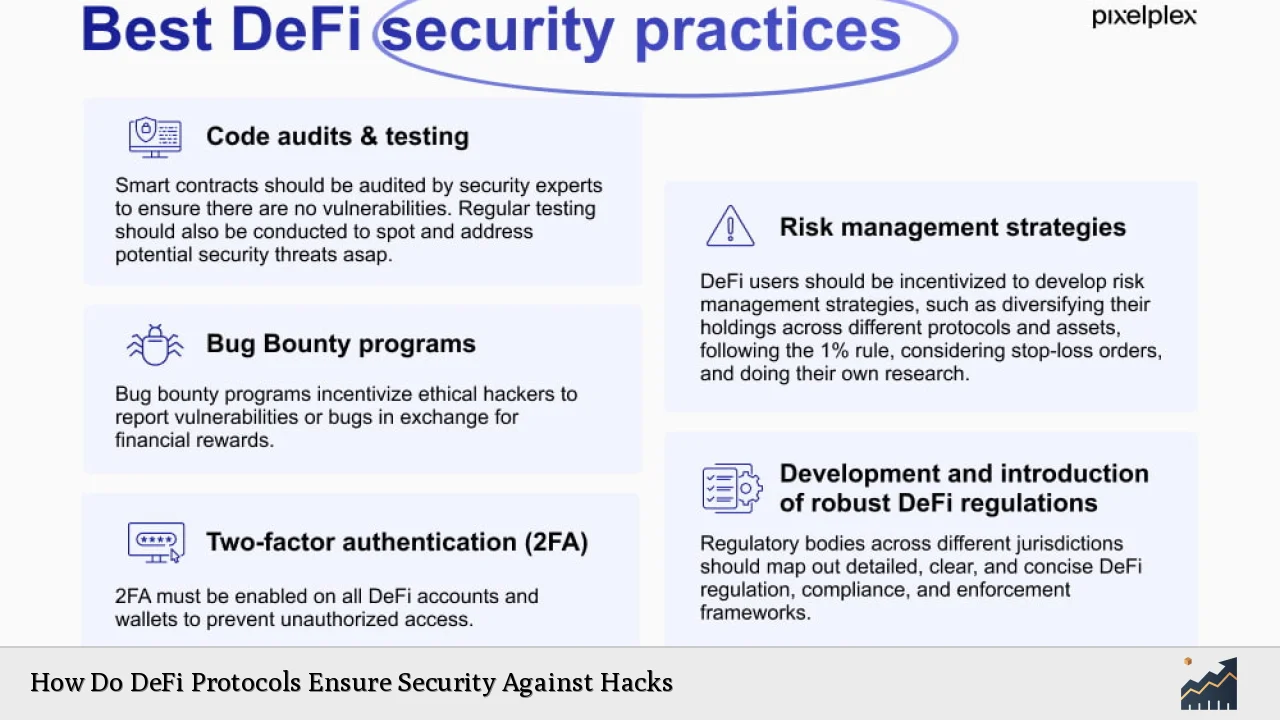

To combat the risks associated with hacks, DeFi protocols are adopting several key strategies:

- Rigorous Smart Contract Audits: Conducting thorough audits before deployment is essential. Reputable firms like Trail of Bits and ABDK Consulting provide these services to identify potential vulnerabilities.

- Multi-Signature Wallets: Utilizing multi-signature wallets requires multiple approvals for transactions, significantly reducing the risk of unauthorized access.

- Decentralized Oracle Networks: These networks aggregate data from various sources, minimizing the risk of manipulation by any single entity. This approach enhances the reliability of price feeds used in smart contracts.

- Continuous Monitoring and Threat Detection: Implementing real-time monitoring systems can help detect suspicious activities promptly. This proactive approach allows for quick responses to potential breaches.

- User-Centric Security Practices: Educating users about securing their private keys and recognizing phishing attempts is crucial. Best practices include using hardware wallets and enabling two-factor authentication.

Risk Considerations

Despite these measures, several risks persist within the DeFi landscape:

- Smart Contract Vulnerabilities: Even well-audited contracts can contain flaws that sophisticated attackers might exploit.

- Rapid Innovation vs. Security: The fast-paced nature of DeFi development can lead to overlooked vulnerabilities as teams rush to launch new features.

- Interoperability Risks: The interconnectedness of various DeFi protocols means that a vulnerability in one can jeopardize others.

- Regulatory Uncertainty: As governments begin to regulate DeFi, compliance with new laws may introduce additional complexities and risks.

Regulatory Aspects

The regulatory landscape for DeFi is evolving rapidly. Regulatory bodies are increasingly focusing on ensuring consumer protection while fostering innovation. Key considerations include:

- Mandatory Audits and Compliance Checks: Future regulations may require regular audits and adherence to specific security standards.

- Consumer Protection Laws: Regulations could mandate transparency regarding risks associated with investments in DeFi protocols.

- International Cooperation: As DeFi operates globally, international regulatory frameworks may emerge to standardize security practices across jurisdictions.

These regulations aim to create a safer environment for investors while encouraging responsible development within the DeFi space.

Future Outlook

Looking ahead, the future of DeFi security will likely involve:

- Advanced Security Protocols: The integration of predictive AI tools will enhance threat detection capabilities by analyzing patterns associated with fraudulent activities.

- Community Engagement: Ongoing collaboration between developers and users will be crucial in identifying vulnerabilities and improving overall security.

- Standardized Security Practices: The establishment of industry-wide standards will help ensure that all DeFi projects adhere to minimum security requirements.

As the DeFi ecosystem continues to evolve, prioritizing security will be essential for maintaining user trust and fostering sustainable growth.

Frequently Asked Questions About How Do DeFi Protocols Ensure Security Against Hacks

- What are smart contract audits?

A smart contract audit is a thorough review conducted by third-party firms to identify vulnerabilities in the code before deployment. - How do multi-signature wallets enhance security?

Multi-signature wallets require multiple approvals for transactions, making unauthorized access significantly more difficult. - What role do decentralized oracles play in DeFi security?

Decentralized oracles aggregate data from multiple sources, reducing the risk of manipulation by any single party. - What are flash loan attacks?

Flash loan attacks exploit borrowed funds within a single transaction to manipulate prices on decentralized exchanges. - How can users protect themselves from phishing attacks?

Users can protect themselves by verifying URLs, using hardware wallets, and enabling two-factor authentication on their accounts. - What is a bug bounty program?

A bug bounty program incentivizes ethical hackers to find and report vulnerabilities in exchange for rewards. - Why is user education important in DeFi?

User education helps individuals understand best practices for securing their assets and recognizing potential threats. - What are circuit breakers in DeFi?

Circuit breakers are mechanisms that halt trading or withdrawals during suspicious activities or market anomalies to prevent losses.

In conclusion, while DeFi presents exciting opportunities for financial innovation, it also poses significant security challenges. By implementing robust security measures and fostering a culture of transparency and education within the community, the industry can work towards mitigating risks and building a more resilient financial ecosystem.