Decentralized Finance (DeFi) platforms are transforming the financial landscape by enabling the tokenization of assets, which refers to the process of converting ownership rights of real-world assets into digital tokens on a blockchain. This innovative approach enhances liquidity, accessibility, and efficiency in trading and managing assets. As traditional financial systems face challenges such as high transaction costs and limited access for smaller investors, DeFi offers a solution that democratizes finance by allowing fractional ownership and seamless transactions without intermediaries.

Tokenization in DeFi facilitates a wide range of applications, from real estate and commodities to art and intellectual property. By representing these assets as digital tokens, DeFi platforms create opportunities for greater market participation and investment diversification. This article explores the current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook of asset tokenization within the DeFi ecosystem.

| Key Concept | Description/Impact |

|---|---|

| Asset Tokenization | The process of converting ownership rights of real-world assets into digital tokens on a blockchain, enhancing liquidity and accessibility. |

| Fractional Ownership | Allows multiple investors to own a share of high-value assets, reducing barriers to entry for investment. |

| Smart Contracts | Automated contracts that execute transactions when predefined conditions are met, ensuring transparency and efficiency. |

| Liquidity Provision | Tokenized assets can be easily traded on decentralized exchanges (DEXs), increasing market liquidity. |

| Regulatory Challenges | The need for compliance with varying regulations across jurisdictions can complicate the tokenization process. |

| Market Growth | The global tokenization market is projected to grow significantly, driven by increased adoption of blockchain technology in finance. |

Market Analysis and Trends

The tokenization market is experiencing rapid growth, with projections indicating it will expand from $2.8 billion in 2023 to approximately $3.45 billion in 2024 at a compound annual growth rate (CAGR) of 23.2%. The increasing demand for decentralized financial services is fueled by several factors:

- Increased Liquidity: Tokenization allows traditionally illiquid assets, such as real estate or art, to be traded more easily by creating fractional ownership opportunities.

- Accessibility: By lowering the minimum investment thresholds through fractional ownership, tokenization opens up investment opportunities to a broader audience.

- Technological Advancements: The integration of blockchain technology in financial services enhances transaction speed and security while reducing costs.

- Emergence of Real-World Assets (RWAs): The integration of RWAs into DeFi protocols is bridging the gap between traditional finance (TradFi) and decentralized finance. For instance, the market cap for tokenized RWAs reached an all-time high of $2.774 billion in early 2024.

Despite these positive trends, challenges remain. Regulatory uncertainty continues to pose risks to the widespread adoption of asset tokenization in DeFi. As various jurisdictions implement differing regulations regarding digital assets, navigating compliance becomes increasingly complex.

Implementation Strategies

To effectively implement asset tokenization within DeFi platforms, several key strategies should be considered:

- Defining Token Standards: Establishing clear standards for different types of tokens (e.g., fungible vs. non-fungible) is crucial for ensuring interoperability among various blockchain projects.

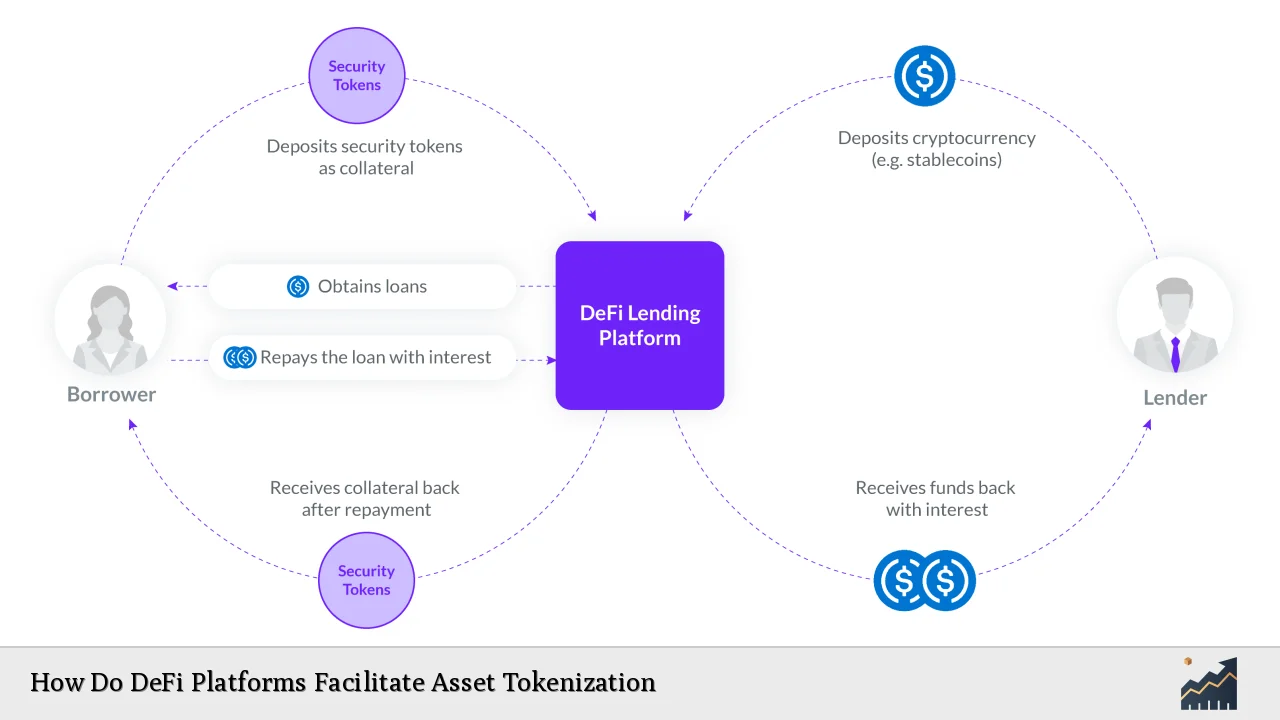

- Utilizing Smart Contracts: Smart contracts automate processes related to asset management and trading. They ensure that transactions are executed only when predefined conditions are met, enhancing trust among participants.

- Choosing the Right Blockchain: Selecting an appropriate blockchain platform is critical for scalability and security. Ethereum remains a popular choice due to its robust ecosystem; however, other blockchains like Solana are gaining traction due to lower transaction costs.

- Incorporating Off-chain Data: Reliable off-chain data sources are essential for ensuring that tokenized assets are accurately represented on-chain. This includes using secure oracles for data verification.

- Creating User-friendly Interfaces: Simplifying user interactions with DeFi platforms can enhance adoption rates among non-technical users.

Risk Considerations

While asset tokenization presents numerous advantages, it also comes with inherent risks:

- Regulatory Risks: The evolving regulatory landscape can impact the legality and operational frameworks of tokenized assets in different regions.

- Security Vulnerabilities: Despite blockchain's inherent security features, vulnerabilities in smart contracts or exchange platforms can expose users to hacking risks.

- Market Volatility: The value of tokenized assets can be highly volatile due to market speculation and changes in investor sentiment.

- Lack of Public Awareness: Many potential users may not fully understand how DeFi works or the benefits of asset tokenization, which could hinder adoption.

Regulatory Aspects

Regulatory compliance is a significant concern for DeFi platforms involved in asset tokenization. Key considerations include:

- Jurisdictional Variability: Different countries have varying regulations regarding digital assets. Platforms must navigate these differences carefully to ensure compliance.

- Consumer Protection: Regulators are increasingly focused on protecting consumers from fraud and ensuring that investors understand the risks associated with tokenized investments.

- Anti-Money Laundering (AML) Compliance: Implementing robust AML practices is essential for maintaining trust and legitimacy within the DeFi ecosystem.

Efforts are underway globally to establish clearer regulatory frameworks that will facilitate the growth of asset tokenization while protecting investors' interests.

Future Outlook

The future of asset tokenization within DeFi appears promising:

- Continued Market Growth: The global tokenization market is projected to reach approximately $23.84 billion by 2032. This growth will be driven by increased adoption across various sectors including finance, real estate, healthcare, and supply chain management.

- Integration with Traditional Finance: As more traditional financial institutions recognize the benefits of tokenization, partnerships between DeFi platforms and traditional banks may become more common.

- Innovative Financial Products: The ability to tokenize diverse asset classes will lead to the creation of new financial instruments that cater to different investor needs, including synthetic assets and decentralized derivatives.

- Enhanced User Experience: Ongoing advancements in user interface design will make DeFi platforms more accessible to everyday users, potentially increasing participation rates significantly.

In summary, asset tokenization facilitated by DeFi platforms represents a transformative shift in how investors interact with financial markets. By leveraging blockchain technology's unique capabilities, these platforms not only enhance liquidity and accessibility but also pave the way for innovative investment opportunities that were previously unattainable for many individuals.

Frequently Asked Questions About How Do DeFi Platforms Facilitate Asset Tokenization

- What is asset tokenization?

Asset tokenization refers to converting ownership rights of real-world assets into digital tokens on a blockchain. - How does DeFi enable asset tokenization?

DeFi leverages smart contracts and blockchain technology to facilitate seamless transactions without intermediaries. - What are the benefits of asset tokenization?

Benefits include increased liquidity, fractional ownership opportunities, enhanced security through blockchain technology, and broader access to investment opportunities. - What risks are associated with asset tokenization?

Risks include regulatory uncertainty, security vulnerabilities from hacking or smart contract flaws, market volatility, and lack of public awareness. - How do regulations affect asset tokenization?

Regulations vary by jurisdiction; compliance with local laws is essential for operating legally within different markets. - What is the future outlook for asset tokenization?

The future looks promising with projected market growth driven by increased adoption across various sectors and innovations in financial products. - Can traditional assets be tokenized?

Yes, traditional assets such as real estate, stocks, bonds, and commodities can be represented as digital tokens on a blockchain. - How do smart contracts work in asset tokenization?

Smart contracts automate transactions based on predefined conditions set by parties involved in the agreement.

This comprehensive analysis highlights how DeFi platforms facilitate asset tokenization while addressing current trends and challenges within this rapidly evolving sector.