The emergence of Decentralized Finance (DeFi) platforms has sparked a significant transformation in the financial landscape, particularly in how traditional currency markets operate. By leveraging blockchain technology and smart contracts, DeFi offers an alternative to conventional financial systems, which has implications for liquidity, market dynamics, and the overall accessibility of financial services. This article delves into the intricate relationship between DeFi platforms and traditional currency markets, exploring their impacts, challenges, and future prospects.

| Key Concept | Description/Impact |

|---|---|

| Disintermediation | DeFi eliminates intermediaries such as banks and brokers, allowing users to engage directly in financial transactions. This reduces costs and increases transaction speed. |

| Market Liquidity | DeFi platforms enhance liquidity in cryptocurrency markets by allowing users to lend and borrow assets without traditional constraints, impacting currency valuations. |

| Accessibility | DeFi democratizes access to financial services, enabling unbanked populations to participate in the economy, which can influence demand for traditional currencies. |

| Volatility | The high volatility associated with DeFi assets can spill over into traditional currency markets, affecting exchange rates and investor sentiment. |

| Regulatory Challenges | The rise of DeFi poses significant regulatory questions for traditional finance, as authorities grapple with how to integrate these new systems without stifling innovation. |

| Tokenization of Assets | DeFi facilitates the tokenization of real-world assets, which can create new investment opportunities and alter the demand dynamics for traditional currencies. |

| Smart Contracts | The use of smart contracts automates financial transactions, reducing the need for manual oversight and potentially lowering operational risks in currency markets. |

Market Analysis and Trends

The DeFi sector has experienced exponential growth over recent years. According to Statista, the revenue from the DeFi market is projected to reach approximately $418.7 million by 2024, despite an anticipated decline of nearly 10% in subsequent years due to market corrections and regulatory pressures. This growth is primarily driven by increasing demand for decentralized services that promise greater accessibility and lower costs compared to traditional finance.

Current Trends

- Rise of Decentralized Exchanges (DEXs): DEXs allow users to trade cryptocurrencies directly without intermediaries, enhancing liquidity while challenging centralized exchanges.

- Yield Farming: Users can earn returns on their crypto holdings by providing liquidity to various protocols, creating new revenue streams that influence traditional investment strategies.

- Integration with NFTs: The merging of DeFi with non-fungible tokens (NFTs) is creating innovative collateralization methods that could reshape asset valuation in both crypto and traditional markets.

- Emerging Economies: The adoption of DeFi is particularly pronounced in emerging economies where traditional banking infrastructure is lacking. This trend not only challenges existing financial models but also alters currency demand dynamics as more individuals engage with digital assets.

Implementation Strategies

For investors looking to navigate the intersection of DeFi and traditional currency markets, several strategies can be employed:

- Diversification: Incorporating both DeFi assets and traditional currencies into an investment portfolio can mitigate risks associated with volatility in either market.

- Utilizing Stablecoins: Stablecoins provide a bridge between volatile crypto assets and traditional currencies, allowing investors to hedge against market fluctuations while participating in DeFi activities.

- Monitoring Regulatory Developments: Staying informed about regulatory changes is crucial as governments worldwide seek to establish frameworks governing DeFi operations.

- Engaging with Hybrid Models: Financial institutions are increasingly exploring hybrid models that combine elements of both DeFi and traditional finance. Engaging with these models can provide insights into future trends.

Risk Considerations

While DeFi presents numerous opportunities, it also introduces a range of risks that investors must consider:

- Security Vulnerabilities: Smart contracts can be susceptible to bugs or exploits, leading to potential losses. High-profile hacks have highlighted these vulnerabilities within the DeFi space.

- Market Volatility: The inherent volatility of cryptocurrencies can affect the stability of investments tied to DeFi platforms. Investors should be prepared for rapid price fluctuations.

- Regulatory Uncertainty: The lack of clear regulatory guidelines poses risks for both investors and institutions involved in DeFi. Changes in regulation could significantly impact market dynamics.

- Liquidity Risks: While DeFi aims to enhance liquidity, certain platforms may experience sudden drops in liquidity during market downturns, affecting asset valuations.

Regulatory Aspects

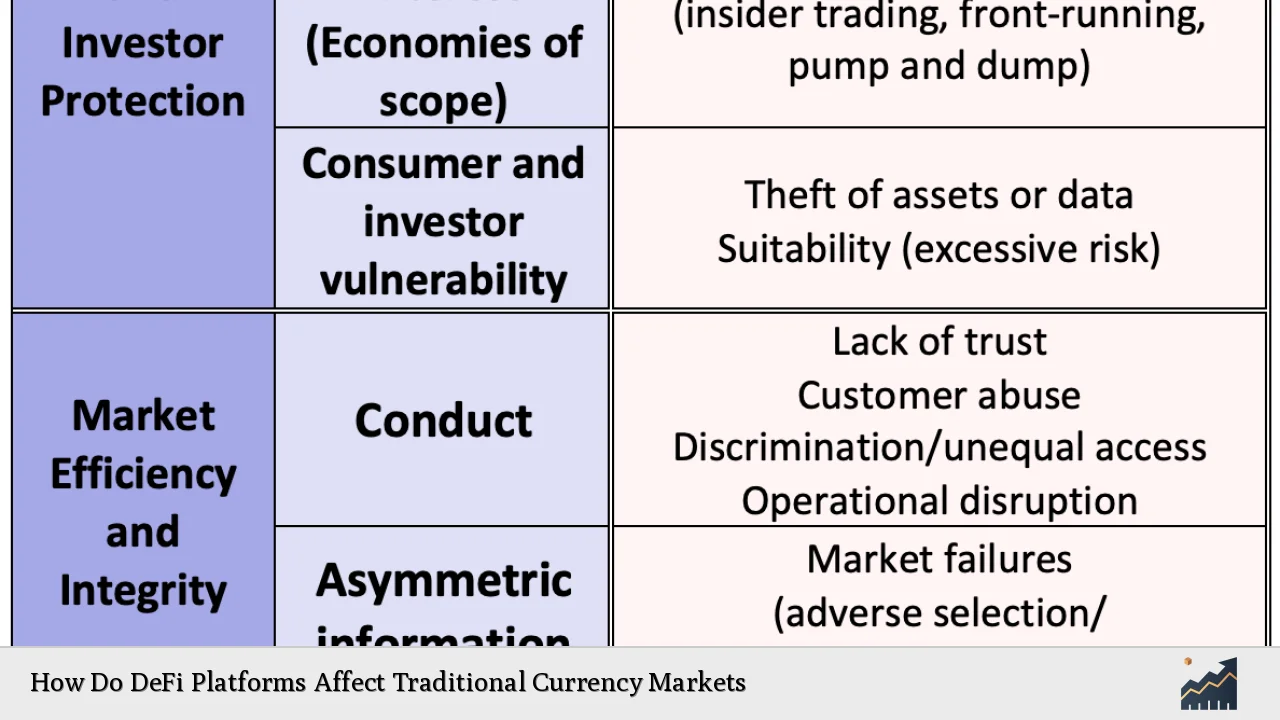

The rise of DeFi has prompted regulators worldwide to reconsider their approaches to financial oversight. Key considerations include:

- Consumer Protection: Regulators are focused on ensuring that consumers engaging with DeFi platforms are protected from fraud and other risks associated with unregulated markets.

- Tax Implications: As transactions on DeFi platforms often lack clear reporting mechanisms, tax implications remain a complex issue that requires careful navigation by users.

- Compliance Frameworks: Establishing compliance frameworks that balance innovation with consumer protection is crucial for fostering a sustainable environment for both DeFi and traditional finance.

- International Coordination: Given the global nature of cryptocurrency markets, international cooperation among regulators will be essential in addressing cross-border challenges posed by DeFi.

Future Outlook

Looking ahead, the interplay between DeFi platforms and traditional currency markets is likely to evolve significantly:

- Increased Collaboration: Traditional financial institutions may increasingly adopt blockchain technologies and collaborate with DeFi platforms to enhance their service offerings while maintaining regulatory oversight.

- Innovative Financial Products: The integration of advanced technologies will lead to the development of new financial products that blend features from both worlds, potentially reshaping investment strategies.

- Greater Financial Inclusion: As more individuals gain access to decentralized financial services, demand for traditional currencies may shift as consumers diversify their portfolios beyond conventional assets.

- Evolving Regulatory Landscape: Ongoing developments in regulatory frameworks will shape how both sectors interact. A balanced approach will be crucial for fostering innovation while ensuring stability.

Frequently Asked Questions About How Do DeFi Platforms Affect Traditional Currency Markets

- What are Decentralized Finance (DeFi) platforms?

DeFi platforms utilize blockchain technology to provide financial services without intermediaries like banks or brokers. - How do DeFi platforms impact liquidity?

DeFi enhances liquidity by allowing users to lend and borrow assets directly through smart contracts without relying on centralized entities. - What risks are associated with investing in DeFi?

Investing in DeFi involves risks such as security vulnerabilities, market volatility, regulatory uncertainty, and liquidity risks. - Can traditional banks benefit from DeFi?

Yes, many banks are exploring hybrid models that integrate blockchain technology from DeFi while retaining necessary regulatory frameworks. - How does volatility in crypto affect traditional currencies?

The volatility associated with cryptocurrencies can influence investor sentiment towards traditional currencies, impacting exchange rates. - What role do stablecoins play in this ecosystem?

Stablecoins act as a bridge between volatile cryptocurrencies and fiat currencies, providing stability for transactions within the DeFi space. - How are regulators responding to the rise of DeFi?

Regulators are developing frameworks aimed at protecting consumers while fostering innovation within the rapidly evolving landscape of decentralized finance. - What is the future outlook for the relationship between DeFi and traditional finance?

The future will likely see increased collaboration between both sectors as they adapt to changing market dynamics and consumer needs.

The integration of decentralized finance into traditional currency markets presents both opportunities and challenges. As this landscape continues to evolve, stakeholders must remain vigilant about emerging trends while navigating potential risks associated with this transformative shift.