Currency fluctuations play a significant role in shaping the dynamics of international stock markets, influencing investor behavior, corporate profits, and overall economic performance. As global financial markets become increasingly interconnected, understanding the relationship between foreign exchange rates and stock market performance is crucial for investors, policymakers, and financial analysts alike.

| Key Concept | Description/Impact |

|---|---|

| Exchange Rate Volatility | Affects stock market returns and investor sentiment |

| Corporate Earnings | Currency movements impact multinational companies’ profits |

| Trade Balance | Currency strength influences export competitiveness and import costs |

| Capital Flows | Exchange rates affect foreign investment in domestic stock markets |

| Economic Indicators | Currency values reflect broader economic health, influencing stock performance |

Market Analysis and Trends

The relationship between currency fluctuations and international stock markets is complex and multifaceted. Recent trends indicate that currency movements can have both direct and indirect effects on stock market performance across different regions.

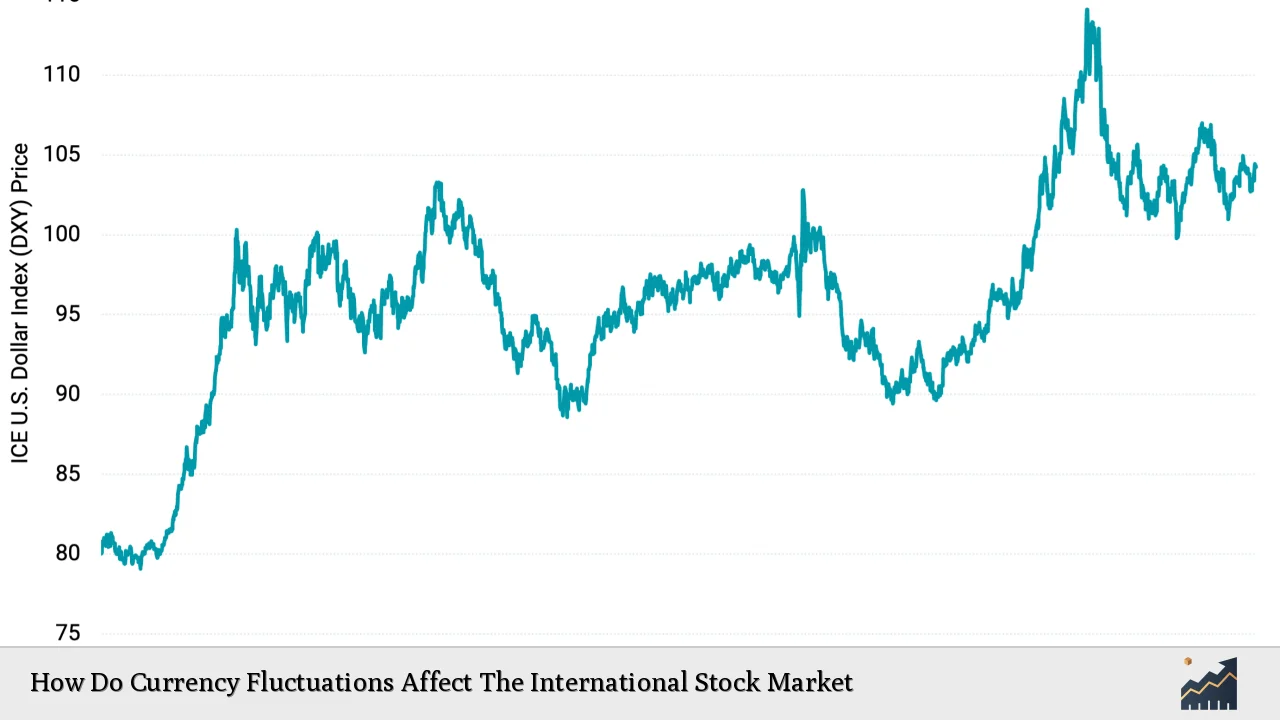

In developed markets, such as the United States and Europe, a strong domestic currency often correlates with positive stock market performance. For instance, the U.S. dollar’s strength in recent years has coincided with robust performance in U.S. equities. This relationship is partly attributed to the perception that a strong currency reflects a healthy economy, which in turn supports corporate profits and investor confidence.

However, the impact can be different for emerging markets. A weakening domestic currency can sometimes boost stock market returns in these economies, particularly for export-oriented sectors. This phenomenon was observed in countries like Brazil and India, where currency depreciation improved the competitiveness of exports, leading to increased corporate earnings and stock price appreciation.

The Japanese stock market presents an interesting case study. The yen’s depreciation against major currencies has generally been favorable for Japanese stocks, especially export-oriented companies. This trend is evident in the performance of the Nikkei 225 index, which has shown a negative correlation with the yen’s value against the U.S. dollar.

Recent data from 2024 indicates that currency volatility remains a significant factor in global stock market performance. For example, the EUR/USD exchange rate has shown increased volatility, with forecasts suggesting it may reach 1.05 by September 2024 and 1.09 by December 2024. Such movements can create both opportunities and challenges for international investors.

Implementation Strategies

Investors and fund managers employ various strategies to navigate the impact of currency fluctuations on international stock markets:

- Currency Hedging: This involves using financial instruments such as forwards, futures, or options to mitigate the risk of adverse currency movements. For instance, a U.S. investor holding European stocks might hedge against a potential decline in the euro’s value.

- Diversification: Building a portfolio with exposure to multiple currencies can help spread risk. This approach can involve investing in multinational companies or using currency-hedged ETFs that provide exposure to foreign markets while minimizing currency risk.

- Active Currency Management: Some investors actively manage their currency exposure, adjusting their positions based on macroeconomic trends and forecasts. This strategy requires in-depth analysis of global economic indicators and central bank policies.

- Carry Trade Strategies: Advanced investors might exploit interest rate differentials between countries, borrowing in low-yield currencies to invest in high-yield currencies and associated stock markets.

- Factor in Currency Trends: When selecting international stocks, investors may consider the potential impact of currency trends on company earnings. For example, favoring exporters in countries with weakening currencies.

Risk Considerations

While currency fluctuations can provide opportunities, they also introduce significant risks to international stock market investments:

Exchange Rate Risk: The primary risk is that unfavorable currency movements can erode returns even if the underlying stocks perform well. For instance, a U.S. investor in Japanese stocks might see their returns diminished if the yen weakens against the dollar.

Volatility: Currency markets can be highly volatile, especially during periods of economic or political uncertainty. This volatility can lead to increased risk in international stock investments.

Correlation Risk: The relationship between currencies and stock markets is not always consistent and can change over time, making it challenging to predict outcomes.

Transaction Costs: Implementing currency hedging strategies can involve additional costs, potentially reducing overall returns.

Emerging Market Risks: Currencies in emerging markets can be particularly volatile and subject to government interventions, adding an extra layer of risk to stock investments in these regions.

Regulatory Aspects

The regulatory environment plays a crucial role in how currency fluctuations impact international stock markets:

- Central Bank Policies: Monetary policies, including interest rate decisions and quantitative easing programs, significantly influence currency values and, by extension, stock market performance.

- Capital Controls: Some countries impose restrictions on currency exchange or capital flows, which can affect the ability of international investors to enter or exit stock markets.

- Reporting Requirements: Companies with significant international operations may be required to report the impact of currency fluctuations on their financial statements, providing transparency to investors.

- Tax Implications: Currency gains or losses can have tax consequences for investors, varying by jurisdiction.

- Market Interventions: Some governments or central banks may intervene in currency markets to stabilize exchange rates, which can indirectly impact stock market performance.

Future Outlook

Looking ahead, several factors are likely to shape the relationship between currency fluctuations and international stock markets:

Global Economic Recovery: As economies recover from recent challenges, divergent growth rates may lead to increased currency volatility, potentially creating opportunities in certain stock markets.

Technological Advancements: The rise of digital currencies and blockchain technology could introduce new dynamics to currency markets and their interaction with stocks.

Geopolitical Shifts: Changes in global trade relationships and political alliances may influence currency values and the competitiveness of different stock markets.

Climate Change Policies: As countries implement various environmental policies, this could lead to shifts in currency values and stock market performance across different sectors and regions.

Evolving Monetary Policies: Central banks’ approaches to inflation and economic stability may lead to new patterns in currency movements and their impact on stock markets.

In conclusion, the relationship between currency fluctuations and international stock markets remains a critical consideration for global investors. As markets continue to evolve, staying informed about these dynamics will be essential for making informed investment decisions and managing risks effectively.

Frequently Asked Questions About How Do Currency Fluctuations Affect The International Stock Market

- How does a strong dollar impact U.S. stocks versus international stocks?

A strong dollar typically benefits U.S. companies that primarily operate domestically but can hurt the earnings of multinational U.S. companies when converted back to dollars. For international stocks, a strong dollar can reduce returns for U.S. investors when foreign earnings are converted to dollars. - Can currency hedging completely eliminate exchange rate risk in international stock investments?

While currency hedging can significantly reduce exchange rate risk, it cannot completely eliminate it due to factors such as imperfect hedging instruments, transaction costs, and the dynamic nature of currency markets. - How do currency fluctuations affect dividend payments from international stocks?

Currency fluctuations can impact the value of dividend payments when converted to an investor’s home currency. A strengthening home currency can reduce the value of foreign dividends, while a weakening home currency can increase their value. - Are there any stock market sectors that are particularly sensitive to currency fluctuations?

Export-oriented sectors such as technology, automotive, and luxury goods are often more sensitive to currency fluctuations. Additionally, sectors with significant international revenue exposure, like multinational consumer goods companies, can be heavily impacted. - How can individual investors protect their international stock portfolios from currency risk?

Individual investors can protect against currency risk by diversifying across multiple currencies, investing in currency-hedged ETFs, focusing on companies with natural currency hedges, or using currency-hedged share classes of mutual funds. - Do emerging market stocks react differently to currency fluctuations compared to developed market stocks?

Yes, emerging market stocks often show a different relationship with currency fluctuations. A weakening local currency can sometimes boost emerging market stocks, especially in export-oriented sectors, by improving international competitiveness. - How do sudden, large currency movements impact global stock markets?

Sudden, large currency movements can cause significant volatility in global stock markets. They can lead to rapid shifts in capital flows, impact corporate earnings expectations, and influence investor sentiment, potentially causing short-term market disruptions.