Central banks play a pivotal role in shaping the financial landscape through their monetary policies, which significantly influence stock market dynamics. By adjusting interest rates and controlling the money supply, central banks can stimulate or restrain economic activity, thereby affecting investor behavior and market valuations. This article delves into the intricate relationship between central bank policies and stock markets, exploring how these policies impact stock prices, market trends, and investment strategies globally.

| Key Concept | Description/Impact |

|---|---|

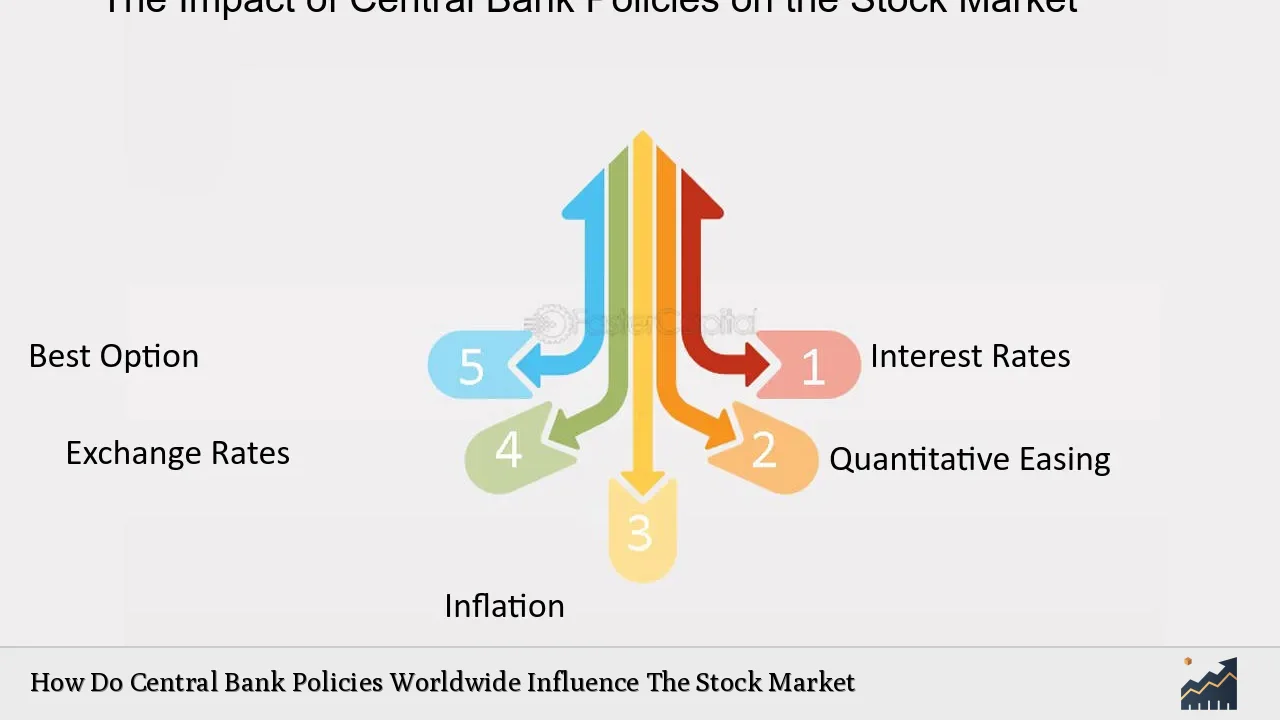

| Interest Rate Adjustments | Lowering interest rates reduces borrowing costs, encouraging investment and spending, which typically boosts stock prices. Conversely, raising rates can dampen economic activity and lead to falling stock prices. |

| Money Supply Control | Increasing the money supply can enhance liquidity in the market, leading to higher stock valuations. Reducing the money supply has the opposite effect, potentially lowering stock prices. |

| Market Sentiment | Central bank announcements can significantly influence investor sentiment. Positive signals regarding economic growth can lead to bullish market behavior, while signals of tightening can trigger sell-offs. |

| Global Spillover Effects | Monetary policy decisions by major central banks like the Federal Reserve and the European Central Bank have global repercussions, impacting foreign exchange rates and international equity markets. |

| Inflation Control | Central banks aim to control inflation through monetary policy. High inflation often leads to tighter monetary policy, which can negatively impact stock markets due to increased borrowing costs. |

| Quantitative Easing (QE) | QE involves large-scale asset purchases by central banks to inject liquidity into the economy. This often leads to rising asset prices, including stocks, as investors seek higher returns in a low-yield environment. |

Market Analysis and Trends

The relationship between central bank policies and stock markets is multifaceted. Recent trends indicate that as central banks navigate post-pandemic recovery, their policies have become increasingly influential on equity markets.

Current Market Statistics:

- As of late 2024, the S&P 500 index has seen fluctuations correlated with Federal Reserve interest rate announcements.

- Global equity markets have experienced volatility in response to ECB policy shifts aimed at curbing inflation.

Key Trends:

- Interest Rate Sensitivity: Stock markets are highly sensitive to changes in interest rates. A decrease in rates typically results in increased stock valuations as cheaper borrowing costs stimulate corporate expansion.

- Inflationary Pressures: Rising inflation has prompted central banks to consider tightening monetary policy. This has led to increased volatility in equity markets as investors reassess future earnings potential.

- Global Interconnectivity: The spillover effects of U.S. monetary policy decisions on global markets have become more pronounced, with emerging markets particularly affected by shifts in capital flows.

Implementation Strategies

Investors must adapt their strategies based on central bank policies to optimize their portfolios:

- Diversification: Given the unpredictable nature of monetary policy impacts, diversifying across asset classes can mitigate risks associated with sudden policy changes.

- Sector Rotation: Investors should consider rotating into sectors that historically perform well during periods of low interest rates (e.g., technology) while being cautious of those that may suffer during tightening cycles (e.g., utilities).

- Monitoring Economic Indicators: Keeping an eye on key indicators such as inflation rates, employment figures, and GDP growth can provide insights into potential central bank actions.

Risk Considerations

Investing in an environment influenced by central bank policies carries inherent risks:

- Market Volatility: Policy changes can lead to sudden market shifts, making it crucial for investors to stay informed about central bank communications.

- Interest Rate Risk: Rising interest rates can lead to declines in bond prices and affect equity valuations negatively.

- Global Economic Risks: Economic slowdowns in major economies due to tight monetary policies can impact global markets and investor confidence.

Regulatory Aspects

Understanding regulatory frameworks is essential for navigating the implications of central bank policies:

- Central Bank Independence: The independence of central banks from political pressures is critical for maintaining market confidence.

- Regulatory Compliance: Investors must be aware of regulations surrounding trading practices influenced by monetary policy announcements.

Future Outlook

Looking ahead, several factors will shape how central bank policies influence stock markets:

- Continued Inflationary Pressures: With inflation remaining a concern globally, central banks may adopt more aggressive stances that could lead to increased market volatility.

- Technological Advancements: The rise of fintech and algorithmic trading may alter how quickly markets react to monetary policy changes.

- Geopolitical Factors: Trade tensions and geopolitical instability could further complicate the relationship between monetary policy and stock market performance.

Frequently Asked Questions About How Do Central Bank Policies Worldwide Influence The Stock Market

- What are the primary tools used by central banks?

The main tools include interest rate adjustments, open market operations (buying/selling government securities), and reserve requirements for banks. - How do lower interest rates affect stock prices?

Lower interest rates reduce borrowing costs for companies and consumers, leading to increased spending and investment, which typically boosts stock prices. - What is quantitative easing (QE)?

QE is a monetary policy where a central bank purchases financial assets to increase money supply and encourage lending and investment. - How do central bank announcements impact investor sentiment?

Announcements regarding monetary policy can significantly sway investor confidence; positive news often leads to bullish behavior while negative news can trigger sell-offs. - What are spillover effects from major central banks?

The decisions made by major institutions like the Federal Reserve can influence global financial markets through capital flows and currency valuations. - How should investors prepare for potential rate hikes?

Diversifying investments and focusing on sectors that are less sensitive to interest rate changes can help mitigate risks associated with rate hikes. - What role does inflation play in stock market performance?

High inflation typically prompts tighter monetary policy from central banks, which can negatively impact stock valuations due to increased borrowing costs. - Can individual investors influence central bank policies?

No direct influence; however, collective investor behavior can signal economic trends that may prompt central banks to adjust their policies accordingly.

In conclusion, understanding how central bank policies influence the stock market is crucial for individual investors and finance professionals alike. By analyzing current trends and implementing strategic approaches while considering risks and regulatory aspects, one can navigate this complex financial landscape effectively.