Market downturns are an inevitable part of the investment cycle, often catching investors off guard and potentially causing significant financial stress. However, with proper planning and strategic decision-making, investors can safeguard their portfolios against severe losses and even position themselves to capitalize on opportunities that arise during turbulent times. This comprehensive guide explores effective strategies for protecting your investments when the market takes a turn for the worse.

| Key Concept | Description/Impact |

|---|---|

| Diversification | Spreading investments across various asset classes to reduce overall portfolio risk |

| Asset Allocation | Balancing portfolio holdings based on risk tolerance and investment goals |

| Defensive Stocks | Investing in companies with stable earnings and dividends that tend to outperform during downturns |

| Cash Reserves | Maintaining liquid assets to provide stability and take advantage of buying opportunities |

| Hedging Strategies | Using financial instruments to offset potential losses in investment positions |

Market Analysis and Trends

Understanding current market conditions and trends is crucial for implementing effective portfolio protection strategies. As of late 2024, global markets have shown increased volatility due to various factors, including geopolitical tensions, inflationary pressures, and shifting monetary policies.

The S&P 500, a key benchmark for U.S. stock market performance, has experienced significant fluctuations, with recent data indicating a year-to-date gain of 10.5% and a 12-month increase of 17.7%. However, these gains mask periods of intense volatility, including a recent single-day plunge where the Nasdaq dropped 3.4%, the S&P 500 fell 3%, and the Dow Jones Industrial Average declined by 2.6%.

Investors should note that market corrections, defined as declines of 10% or more from recent highs, occur relatively frequently. Since 1950, the S&P 500 has experienced 13 instances of declines of 20% or more, with an average decline of 32.73% lasting approximately 338 days. However, it’s important to remember that bull markets following these crashes tend to be robust and enduring, emphasizing the importance of long-term investment strategies.

Implementation Strategies

To protect your portfolio during market downturns, consider implementing the following strategies:

Diversification

Diversification remains one of the most effective ways to mitigate risk during market turbulence. By spreading investments across various asset classes, sectors, and geographic regions, investors can reduce the impact of poor performance in any single area. Consider including a mix of:

- Equities across different sectors and market capitalizations

- Bonds of varying credit qualities and durations

- Real estate investments

- Commodities

- International markets, both developed and emerging

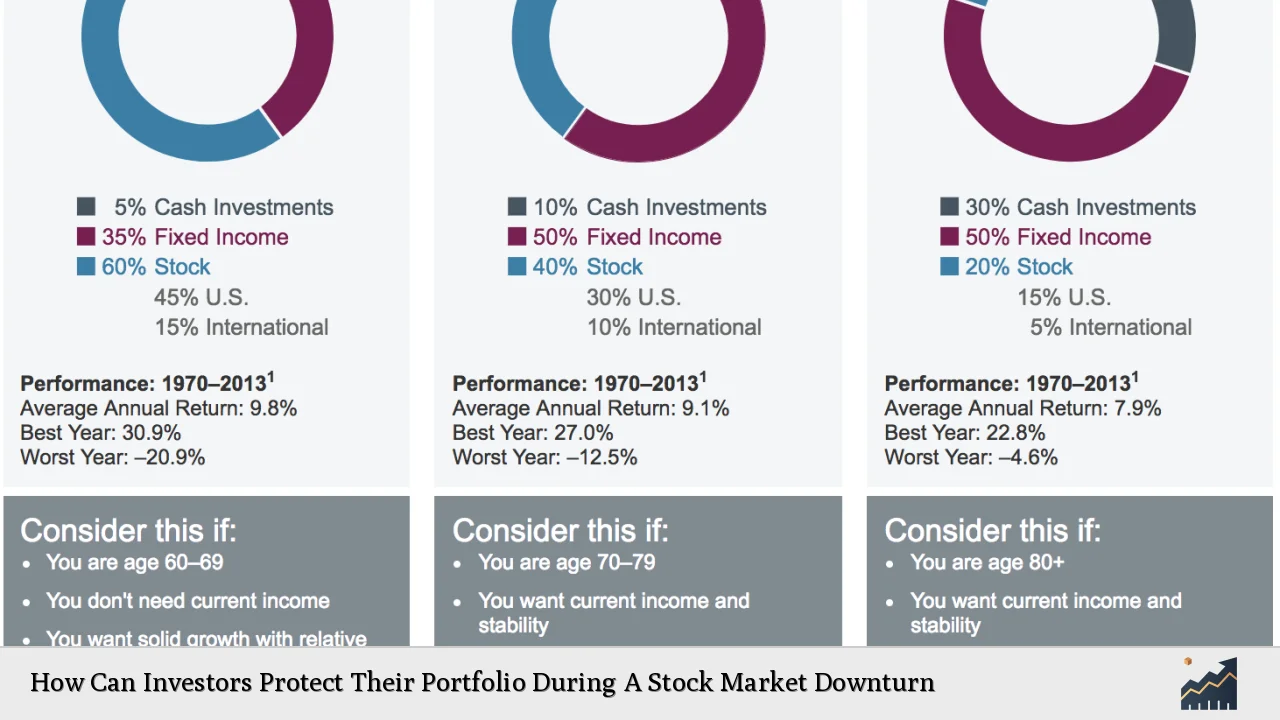

Asset Allocation

Regularly review and adjust your asset allocation to ensure it aligns with your risk tolerance and investment goals. During periods of market uncertainty, consider shifting towards more defensive allocations:

- Increase allocation to bonds, particularly government bonds, which often perform well during stock market downturns

- Consider allocating a portion of your portfolio to gold or other precious metals, which can serve as a safe-haven asset

- Maintain a cash reserve to provide stability and allow for opportunistic buying during market dips

Focus on High-Quality, Defensive Stocks

Defensive stocks, typically found in sectors such as utilities, healthcare, and consumer staples, often outperform during market downturns due to their stable earnings and dividends. Look for companies with:

- Strong balance sheets

- Consistent cash flows

- History of dividend growth

- Low debt-to-equity ratios

Implement Stop-Loss Orders

Stop-loss orders can help limit potential losses by automatically selling a security when it reaches a predetermined price. While this strategy can protect against significant downside, it’s important to set stop-loss levels carefully to avoid being prematurely forced out of positions due to short-term volatility.

Consider Hedging Strategies

For more sophisticated investors, hedging strategies can provide additional portfolio protection:

- Put options: Purchasing put options gives you the right to sell a security at a specific price, providing downside protection

- Inverse ETFs: These funds are designed to move in the opposite direction of their underlying index, potentially offsetting losses in long positions

- Short selling: While risky, short selling can generate profits during market declines

Risk Considerations

While implementing protective strategies is crucial, it’s equally important to understand and manage the associated risks:

Opportunity Cost: Overly defensive positioning can lead to missed opportunities if markets rebound quickly.

Timing Risk: Attempting to time the market by moving in and out of positions can result in missed gains and realized losses.

Complexity: Some hedging strategies, such as options trading, require advanced knowledge and careful management.

Costs: Frequent trading and the use of complex financial instruments can increase transaction costs and potentially erode returns.

Regulatory Aspects

Investors should be aware of relevant regulations that may impact their investment strategies:

- The Securities and Exchange Commission (SEC) regulates the use of certain investment products and practices, including short selling and derivatives trading.

- Tax implications of investment decisions, such as realizing capital gains or losses, should be considered in the context of current tax laws.

- For retirement accounts, be mindful of contribution limits and withdrawal rules that may affect your ability to adjust your portfolio.

Future Outlook

As we look ahead, several factors are likely to influence market dynamics and portfolio protection strategies:

- The ongoing impact of monetary policy decisions by central banks globally

- Potential shifts in fiscal policies as governments address economic challenges

- Technological advancements and their effect on various sectors and investment opportunities

- The evolving landscape of environmental, social, and governance (ESG) investing

Investors should remain vigilant and adaptable, regularly reassessing their portfolio protection strategies in light of changing market conditions and personal circumstances.

Frequently Asked Questions About How Can Investors Protect Their Portfolio During A Stock Market Downturn

- What is the best asset to hold during a market crash?

While there’s no single “best” asset, U.S. Treasury securities, particularly long-term bonds, are often considered safe havens during market downturns due to their government backing and tendency to rise in value when stocks fall. - Should I sell my stocks during a market downturn?

Generally, it’s not advisable to sell stocks in a panic during a downturn. Long-term investors often benefit from staying invested and potentially buying more shares at lower prices. However, reassessing your risk tolerance and rebalancing your portfolio may be prudent. - How can I use options to protect my portfolio?

Put options can be used as a form of portfolio insurance. By purchasing put options, you gain the right to sell a security at a specific price, potentially offsetting losses if the market declines. However, options trading requires advanced knowledge and careful risk management. - What are some defensive sectors to consider during market turbulence?

Traditionally defensive sectors include utilities, healthcare, and consumer staples. These sectors tend to be less sensitive to economic cycles and often provide stable dividends, making them attractive during market downturns. - How much cash should I keep in my portfolio as a buffer?

The appropriate cash allocation varies based on individual circumstances, but many financial advisors suggest keeping 3-6 months of living expenses in cash or cash equivalents. For investment portfolios, a 5-10% cash allocation can provide stability and allow for opportunistic buying during market dips. - Can diversification really protect my portfolio during a market-wide downturn?

While diversification may not completely insulate your portfolio from losses during a broad market decline, it can help mitigate risk. By spreading investments across various asset classes, sectors, and geographic regions, you reduce the impact of poor performance in any single area. - How often should I rebalance my portfolio to maintain protection?

Most financial experts recommend rebalancing your portfolio at least annually. However, during periods of high market volatility, more frequent rebalancing (e.g., quarterly or based on predetermined thresholds) may be beneficial to maintain your desired asset allocation and risk profile.