Tracking your Conflux (CFX) holdings and transaction history is essential for managing your cryptocurrency investments effectively. As the Conflux network continues to gain traction in the blockchain space, investors and users need reliable methods to monitor their assets and activities. This comprehensive guide will explore various tools and strategies to help you keep tabs on your Conflux investments, ensuring you have a clear picture of your financial position in this dynamic digital ecosystem.

| Key Concept | Description/Impact |

|---|---|

| Blockchain Explorers | Web-based tools that allow users to view all transactions and blocks on the Conflux network |

| Wallet Applications | Software that stores private keys and allows users to send, receive, and monitor CFX tokens |

| Portfolio Trackers | Applications that aggregate data from multiple sources to provide a comprehensive view of cryptocurrency holdings |

| Transaction Receipts | Data structures containing information about transaction execution results on the Conflux network |

Market Analysis and Trends

The Conflux network has been gaining momentum in the cryptocurrency market, with its native token CFX experiencing significant price movements and increased trading volume. As of December 2024, Conflux’s market capitalization stands at approximately $970 million, with a circulating supply of around 4.7 billion CFX tokens. The network’s unique Tree-Graph consensus mechanism and high throughput capabilities have attracted attention from both individual investors and institutional players.

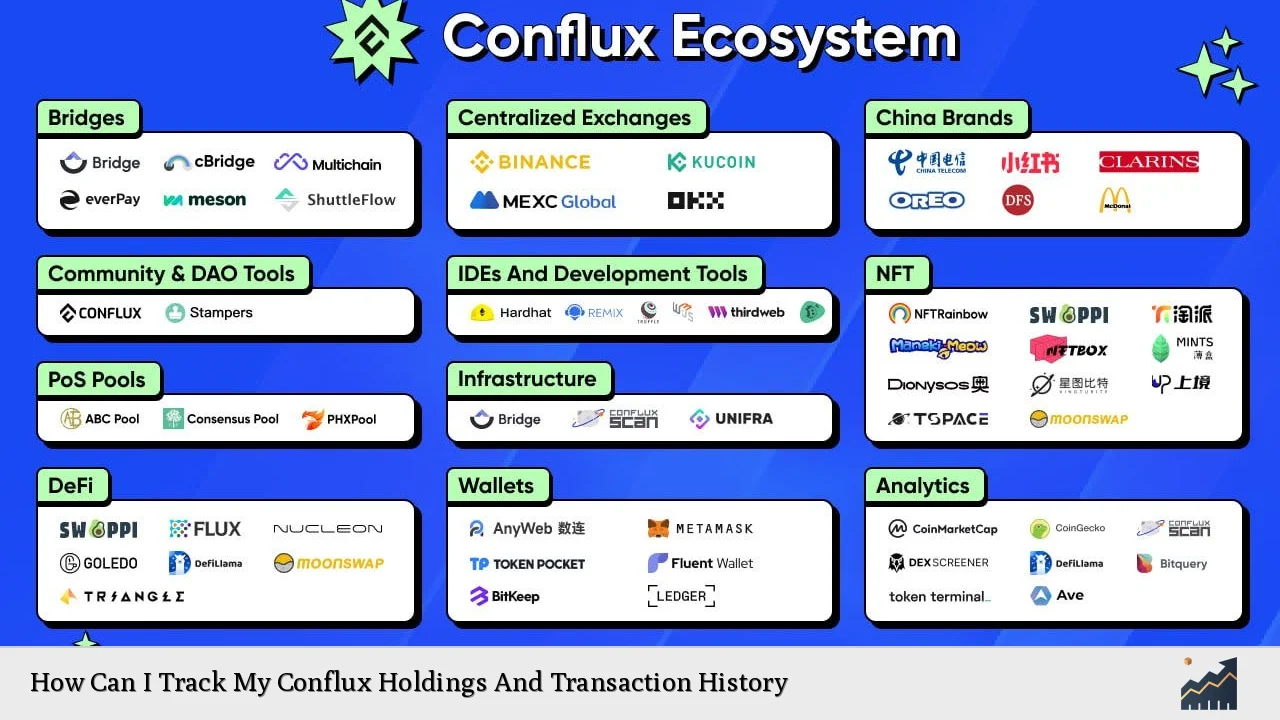

Recent trends show a growing interest in decentralized finance (DeFi) applications built on the Conflux network, which has led to an increase in transaction volume and network activity. This surge in usage underscores the importance of efficient tracking tools for Conflux holders to monitor their investments and interact with various DApps seamlessly.

Implementation Strategies

To effectively track your Conflux holdings and transaction history, consider implementing the following strategies:

1. Utilize Blockchain Explorers

Blockchain explorers are powerful tools that provide real-time information about the Conflux network. The most popular explorers for Conflux include:

- ConfluxScan: The official explorer for the Conflux network, offering detailed information on transactions, blocks, and accounts.

- Conflux Blockchain Explorer: An alternative explorer that provides additional analytics and visualization tools.

To use these explorers, simply enter your Conflux address in the search bar to view your complete transaction history, current balance, and other relevant data.

2. Leverage Wallet Applications

Wallet applications not only secure your CFX tokens but also offer tracking functionalities. Some recommended wallets for Conflux include:

- Conflux Portal: A browser extension wallet similar to MetaMask, specifically designed for the Conflux network.

- Fluent Wallet: A user-friendly mobile and desktop wallet with built-in tracking features.

- Trust Wallet: A multi-chain wallet that supports Conflux and provides basic transaction history.

These wallets typically display your current balance and recent transactions, allowing for quick and easy monitoring of your holdings.

3. Employ Portfolio Tracking Tools

For a more comprehensive view of your cryptocurrency investments, including Conflux, consider using portfolio tracking tools such as:

- CoinGecko: Offers a portfolio feature that tracks multiple cryptocurrencies, including CFX.

- Delta: A popular mobile app that allows manual input of transactions and syncs with exchanges.

- CoinStats: Provides real-time portfolio tracking and analytics for a wide range of cryptocurrencies.

These tools often offer additional features like price alerts, performance analytics, and tax reporting assistance.

4. Monitor Transaction Receipts

For detailed information on specific transactions, utilize the transaction receipt feature of the Conflux network. Transaction receipts contain crucial data such as:

- Transaction status (success or failure)

- Gas used and fees paid

- Contract interactions

- Event logs

You can access this information through blockchain explorers or by using the cfx_getTransactionReceipt RPC method if you’re developing applications on Conflux.

Risk Considerations

While tracking your Conflux holdings is crucial, it’s important to be aware of potential risks:

- Security Risks: Always ensure that the tracking tools and wallets you use are reputable and secure. Be cautious of phishing attempts and never share your private keys.

- Privacy Concerns: Remember that blockchain transactions are public. Consider using multiple addresses to enhance privacy.

- Market Volatility: Cryptocurrency markets, including Conflux, can be highly volatile. Regular tracking is essential, but avoid making impulsive decisions based on short-term price movements.

- Technical Risks: The Conflux network, like any blockchain, may experience technical issues or upgrades that could temporarily affect tracking services.

Regulatory Aspects

As you track your Conflux holdings, be mindful of the regulatory landscape:

- Tax Implications: Many jurisdictions require reporting cryptocurrency transactions for tax purposes. Keep detailed records of your Conflux activities to ensure compliance.

- KYC/AML Regulations: If using centralized exchanges or services to track your holdings, you may need to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

- Evolving Regulations: Cryptocurrency regulations are still developing in many countries. Stay informed about changes that may affect how you track and report your Conflux investments.

Future Outlook

The future of Conflux tracking tools looks promising, with several developments on the horizon:

- Enhanced Integration: Expect to see more wallets and financial platforms integrating direct support for Conflux, making tracking easier and more accessible.

- Advanced Analytics: Future tracking tools may offer more sophisticated analytics, including DeFi protocol interactions and yield farming performance metrics.

- Cross-Chain Tracking: As interoperability between blockchains improves, tracking tools may provide a unified view of assets across multiple networks, including Conflux.

- AI-Powered Insights: Artificial intelligence could be employed to offer predictive analytics and personalized insights based on your Conflux transaction history.

- Regulatory Compliance Tools: As regulations mature, expect to see the emergence of tools designed to help Conflux users easily comply with reporting requirements.

By staying informed about these trends and utilizing the best available tools, you can maintain a clear and accurate picture of your Conflux holdings and transaction history. This knowledge will empower you to make informed decisions in the evolving landscape of cryptocurrency investments.

Frequently Asked Questions About How Can I Track My Conflux Holdings And Transaction History

- What is the best way to track my Conflux holdings if I’m a beginner?

For beginners, the easiest way to track Conflux holdings is by using a user-friendly wallet application like Conflux Portal or Fluent Wallet. These wallets provide a simple interface to view your balance and recent transactions without requiring extensive technical knowledge. - How often should I check my Conflux transaction history?

The frequency of checking your Conflux transaction history depends on your trading activity and investment strategy. For active traders, daily checks may be necessary. For long-term holders, weekly or monthly reviews might suffice. However, it’s advisable to check more frequently during periods of high market volatility. - Can I track my Conflux holdings across multiple wallets?

Yes, you can track Conflux holdings across multiple wallets using portfolio tracking tools like CoinGecko or Delta. These platforms allow you to add multiple wallet addresses and aggregate your holdings for a comprehensive view of your investments. - Are there any risks associated with using third-party tracking tools for Conflux?

While reputable third-party tracking tools are generally safe, there are potential risks such as data breaches or privacy concerns. To mitigate these risks, choose well-established tools, avoid sharing private keys, and consider using read-only API keys when connecting to exchanges. - How can I ensure the accuracy of my Conflux transaction history for tax purposes?

To ensure accuracy for tax purposes, regularly export your transaction history from blockchain explorers or wallet applications. Cross-reference this data with your personal records and consider using specialized cryptocurrency tax software that supports Conflux to generate accurate reports. - What should I do if I notice a discrepancy in my Conflux transaction history?

If you notice a discrepancy, first verify the information across multiple sources such as your wallet, blockchain explorer, and any exchanges you use. If the discrepancy persists, check for any pending transactions or network issues. For unresolved issues, consult the Conflux community forums or contact customer support of the platform you’re using.