A Tax-Free Savings Account (TFSA) is a versatile investment vehicle available to Canadian residents that allows them to grow their savings without incurring taxes on the income earned or capital gains. Since its inception in 2009, the TFSA has become increasingly popular due to its flexibility and tax advantages. Unlike traditional savings accounts, which typically offer low-interest rates, TFSAs can hold a variety of investments, including stocks, bonds, mutual funds, and more. This means that individuals can tailor their investment strategies to meet specific financial goals while enjoying the benefits of tax-free growth.

To maximize the potential of a TFSA, it is essential to understand how it works, what types of investments can be held within it, and the best strategies for utilizing this account effectively. The following sections will delve into these aspects, providing practical guidance on how to invest in a TFSA.

| Feature | Details |

|---|---|

| Tax-Free Growth | All income earned within a TFSA is not subject to taxes. |

| Contribution Limits | You can contribute up to $6,500 per year (as of 2023). |

Understanding TFSA Basics

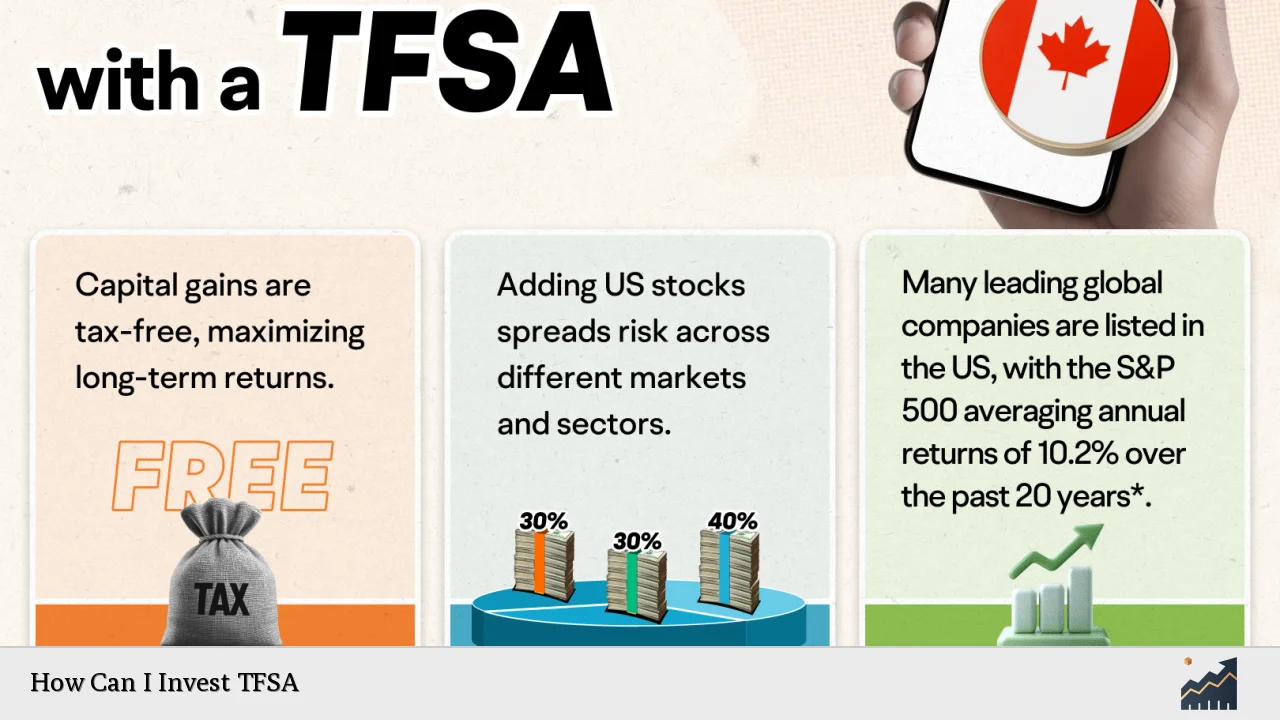

The TFSA allows Canadians to save and invest money without paying taxes on any income or capital gains generated within the account. Contributions are made with after-tax dollars, meaning that while you won’t receive a tax deduction for your contributions, your withdrawals—including any growth—are completely tax-free. This feature makes the TFSA an attractive option for both short-term and long-term savings goals.

Important info: Each year, Canadians are given a contribution limit for their TFSAs. As of 2023, this limit is set at $6,500, and any unused contribution room can be carried forward to future years. If you have never contributed before and are eligible since the account’s introduction in 2009, you may have accumulated significant contribution room.

When considering how to invest within a TFSA, it’s essential to understand what qualifies as an investment. The Canada Revenue Agency (CRA) allows various investments in TFSAs, including:

- Stocks

- Bonds

- Mutual funds

- Exchange-Traded Funds (ETFs)

- Guaranteed Investment Certificates (GICs)

- Cash

However, certain investments are prohibited or may incur penalties if not managed correctly. Therefore, it’s crucial to familiarize yourself with these guidelines.

Types of TFSA Investments

Investors have several options when it comes to choosing investments for their TFSA accounts. The type of investment you select should align with your financial goals and risk tolerance.

Savings Accounts and GICs

For those who prefer low-risk options, savings accounts and GICs are popular choices. These options provide guaranteed returns without the volatility associated with stocks or mutual funds. While they may not yield high returns compared to other investment types, they offer stability and liquidity.

Stocks and ETFs

If you are looking for higher growth potential, investing in stocks or ETFs may be more suitable. Stocks can provide significant returns over time but come with higher risks due to market fluctuations. ETFs allow investors to diversify their portfolios by holding a collection of stocks or bonds within a single fund.

Mutual Funds

Mutual funds are another option for those who prefer a managed approach. These funds pool money from multiple investors to purchase a diversified portfolio of assets. They can be actively managed by professionals or passively track an index.

Bonds

Investing in bonds, whether government or corporate, can provide steady income through interest payments while generally being less volatile than stocks. They are suitable for conservative investors seeking regular income.

Important info: When selecting investments for your TFSA, consider factors such as your investment horizon, risk tolerance, and financial goals. A well-diversified portfolio can help mitigate risks while maximizing potential returns.

Strategies for Investing in a TFSA

To make the most out of your TFSA investments, consider implementing specific strategies tailored to your financial objectives.

Set Clear Investment Goals

Establishing clear investment goals is crucial when investing in a TFSA. Whether you’re saving for a car, home down payment, retirement, or education expenses, having defined targets will guide your investment decisions and help you stay focused on your objectives.

Regular Contributions

To maximize the benefits of your TFSA, make regular contributions throughout the year rather than waiting until the deadline. Contributing consistently allows your investments more time to grow tax-free and helps you take full advantage of your annual contribution limit.

Diversify Your Portfolio

Diversification is key to managing risk within your investment portfolio. By spreading your investments across different asset classes—such as stocks, bonds, ETFs, and mutual funds—you can reduce the impact of poor performance from any single investment on your overall portfolio.

Monitor Your Investments

Regularly reviewing your TFSA investments is essential for ensuring they align with your financial goals and risk tolerance. Market conditions change over time; therefore, staying informed will help you make necessary adjustments to optimize returns.

Consider Long-Term Growth

While TFSAs can be used for short-term savings goals, they are particularly effective for long-term growth strategies. Investing in higher-growth assets like equities within a TFSA allows you to benefit from tax-free capital gains over time.

Common Mistakes When Investing in a TFSA

Even experienced investors can make mistakes when managing their TFSAs. Being aware of these pitfalls can help you avoid costly errors.

Over-Contributing

One common mistake is exceeding the annual contribution limit. Over-contributions may result in penalties imposed by the CRA at a rate of 1% per month on the excess amount until it is withdrawn or until new contribution room becomes available.

Ignoring Investment Types

Some individuals mistakenly use their TFSAs solely as savings accounts rather than taking advantage of the various investment options available. This approach limits potential growth opportunities that could be achieved through diversified investments.

Frequent Trading

Engaging in frequent trading within a TFSA could attract scrutiny from the CRA. If deemed as carrying on a business rather than investing for personal use, any gains could be considered taxable income rather than tax-free growth.

FAQs About How Can I Invest TFSA

- What is a Tax-Free Savings Account (TFSA)?

A TFSA is an investment account that allows Canadians to earn tax-free income and capital gains. - What types of investments can I hold in my TFSA?

You can hold stocks, bonds, mutual funds, ETFs, GICs, and cash. - How much can I contribute to my TFSA each year?

The annual contribution limit is $6,500 as of 2023. - Are withdrawals from my TFSA taxable?

No, withdrawals from a TFSA are completely tax-free. - Can I buy foreign investments in my TFSA?

Yes, but be aware of potential withholding taxes on foreign dividends.

Conclusion

Investing in a Tax-Free Savings Account (TFSA) offers Canadians an excellent opportunity to grow their wealth without incurring taxes on earnings or capital gains. By understanding how TFSAs work and strategically selecting investments that align with personal financial goals, individuals can maximize their savings potential over time. Whether opting for low-risk options like GICs or high-growth assets like stocks and ETFs, careful planning and regular monitoring will ensure that your TFSA remains an effective tool for achieving financial success.