Investing through Fidelity can be a straightforward process, whether you are a beginner or an experienced investor. Fidelity offers a variety of investment options, account types, and tools to help you manage your investments effectively. This guide will walk you through the steps to invest on Fidelity, including selecting the right account, funding it, choosing your investments, and utilizing available resources.

| Step | Description |

|---|---|

| 1 | Choose an appropriate account type. |

| 2 | Open the account and fund it. |

| 3 | Select your investment options. |

| 4 | Utilize Fidelity’s tools and resources. |

Choosing the Right Account Type

The first step in investing with Fidelity is selecting the right account type based on your financial goals. Here are some common options:

- Brokerage Account: Ideal for general investing and trading without retirement restrictions. It allows you to buy and sell various securities like stocks, ETFs, and mutual funds.

- Retirement Accounts: Options include Traditional IRAs, Roth IRAs, and Rollover IRAs. These accounts offer tax advantages for retirement savings.

- 529 College Savings Plan: Designed for education savings, offering tax-free growth when used for qualified education expenses.

- Fidelity Youth Account: Aimed at younger investors to help them learn about investing early on.

Selecting the right account is crucial as it impacts your investment strategy and tax implications. Consider your long-term goals and how actively you want to manage your investments.

Opening Your Fidelity Account

Once you have chosen an account type, the next step is to open your account. This process is generally straightforward:

- Visit the Fidelity website and navigate to the account opening section.

- Fill out the required personal information, including your name, address, Social Security number, and employment details.

- Choose your core position, which is where uninvested cash will be held.

- Review the terms and conditions before submitting your application.

After opening your account, you will need to fund it. You can link a bank account for easy transfers or set up automatic deposits to ensure consistent contributions. Fidelity does not require a minimum deposit for most accounts, making it accessible for new investors.

Selecting Your Investments

With your account funded, it’s time to choose your investments. Fidelity offers a wide range of investment options:

- Stocks: Invest in individual shares of companies. This option requires research into company performance and market conditions.

- ETFs (Exchange-Traded Funds): These are funds that trade like stocks but hold a basket of securities. They can be passively or actively managed.

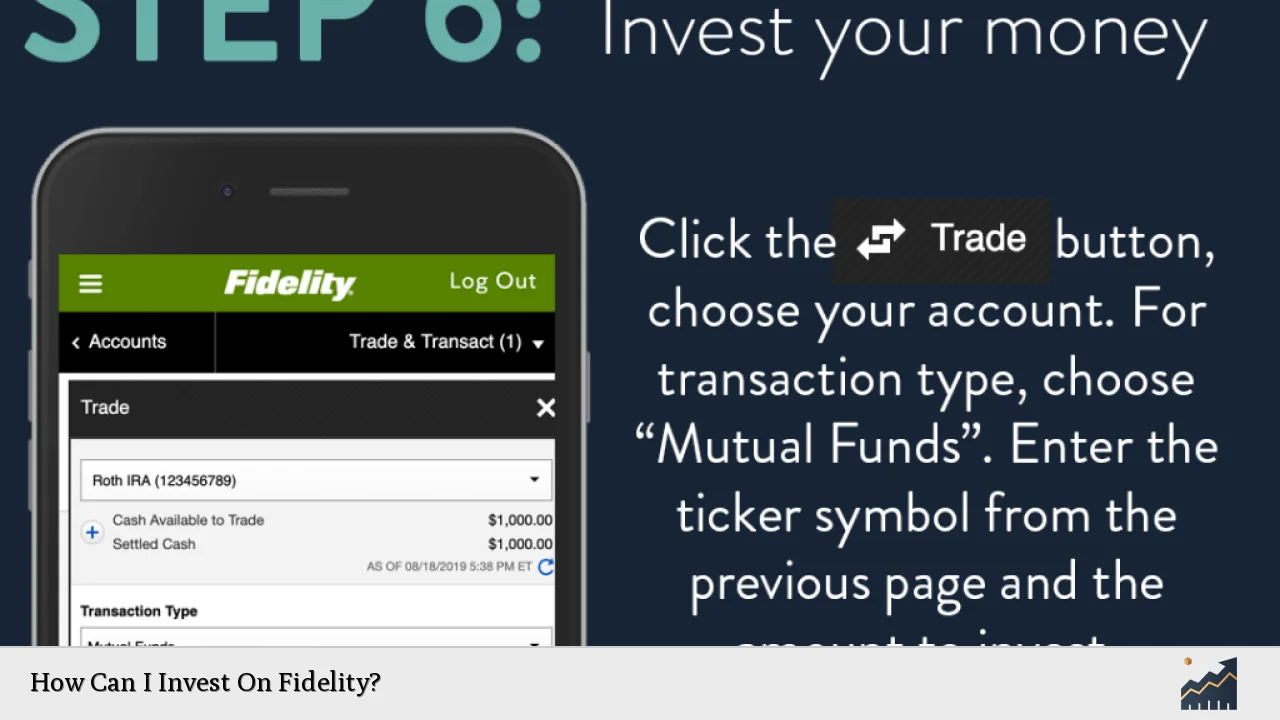

- Mutual Funds: Choose from various funds managed by Fidelity or other firms. These are priced daily after market close.

- Bonds: Consider bonds for income generation and risk diversification.

- Options: For more advanced strategies, options can provide flexibility in various market conditions.

When selecting investments, consider factors such as risk tolerance, investment horizon, and financial goals. Utilizing tools like Fidelity’s research platform can help you analyze potential investments based on performance metrics and historical data.

Utilizing Fidelity’s Tools and Resources

Fidelity provides numerous tools and resources to enhance your investing experience:

- Research Tools: Access comprehensive research reports on stocks, ETFs, and mutual funds to inform your decisions.

- Investment Screeners: Use screeners to filter investments based on criteria such as performance history and expense ratios.

- Educational Resources: Take advantage of articles, webinars, and tutorials that cover various investing topics from basic concepts to advanced strategies.

- Automated Investing Options: If you prefer a hands-off approach, consider Fidelity’s managed accounts or robo-advisory services that automatically invest based on your risk tolerance and goals.

These resources can significantly improve your understanding of investing and help you make informed decisions tailored to your financial situation.

Managing Your Investments

Once you’ve made your initial investments, it’s essential to regularly review and manage them. Here are some key practices:

- Monitor Performance: Keep an eye on how your investments perform over time. Utilize Fidelity’s tracking tools to assess gains or losses.

- Rebalance Your Portfolio: Periodically adjust your asset allocation to maintain your desired risk level. This may involve selling some assets while buying others based on market performance.

- Stay Informed: Keep up with market trends and news that may affect your investments. Use Fidelity’s news updates and alerts to stay informed about relevant changes in the market landscape.

Regular management ensures that your portfolio aligns with changing financial goals or market conditions.

FAQs About Investing On Fidelity

- What types of accounts can I open with Fidelity?

You can open brokerage accounts, IRAs (Traditional or Roth), 529 plans for education savings, and youth accounts. - Is there a minimum deposit required to open an account?

No minimum deposit is required for most accounts at Fidelity. - How do I choose my investments?

Consider factors like risk tolerance, investment horizon, and financial goals when selecting stocks, ETFs, mutual funds, or bonds. - Can I automate my investments with Fidelity?

Yes, you can set up automatic contributions or use managed accounts for automated investing. - What resources does Fidelity offer for beginner investors?

Fidelity provides educational articles, webinars, research tools, and investment screeners tailored for beginners.

Investing with Fidelity offers a robust platform equipped with diverse options tailored to meet various financial goals. By understanding the different account types available, effectively managing investments through their tools, and staying informed about market changes, investors can optimize their strategies for long-term success. Whether you’re starting small or looking to diversify an existing portfolio, Fidelity provides the necessary resources to support effective investing practices.