Required Minimum Distributions (RMDs) are mandatory withdrawals that individuals must take from their retirement accounts, such as traditional IRAs and 401(k)s, once they reach a certain age. As of now, this age is 73, and the IRS mandates these distributions to ensure that retirement savings are eventually taxed. Many retirees find themselves in a position where they do not need these funds for immediate living expenses. This situation raises the question: how can one effectively invest their RMD?

Investing RMDs can be a strategic move, allowing retirees to enhance their investment portfolios while managing tax implications. The options for utilizing RMDs include reinvesting in taxable accounts, funding educational expenses, or even making charitable contributions. Understanding the various avenues available for investing RMDs can help retirees maximize their financial situation during retirement.

| Aspect | Details |

|---|---|

| RMD Age | 73 years old |

| Tax Treatment | Ordinary income tax applies |

Understanding RMDs

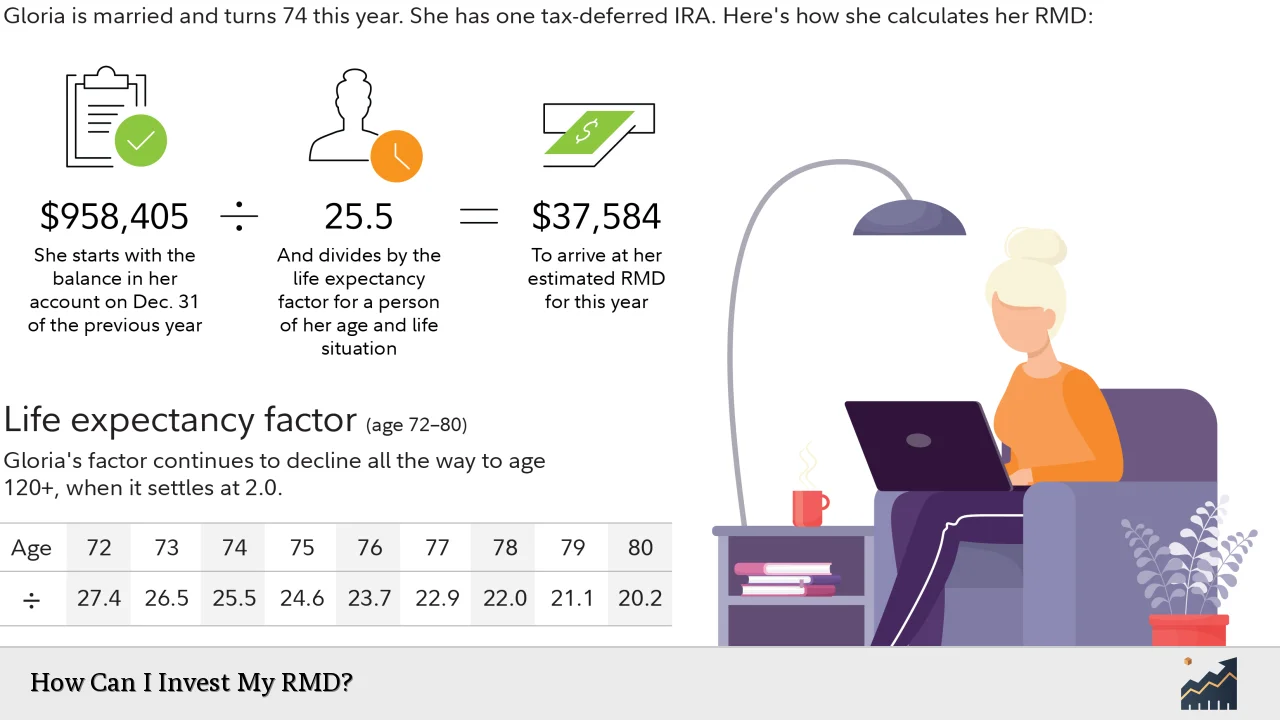

RMDs are designed to ensure that individuals withdraw funds from their tax-advantaged retirement accounts during their lifetime. The IRS requires these distributions to start at age 73, following changes in legislation. The amount of the RMD is calculated based on the account balance at the end of the previous year divided by a life expectancy factor provided by the IRS.

Retirees often face a dilemma when they do not need the funds for living expenses. Important info to note is that failing to take the required distribution can result in severe penalties, amounting to 25% of the shortfall. Therefore, understanding how to manage these distributions is crucial.

Investing your RMD wisely can help mitigate tax burdens and potentially grow your wealth. Here are several strategies for effectively utilizing your RMD.

Reinvesting Your RMD

One of the most straightforward options for handling your RMD is to reinvest it into a taxable brokerage account. This allows you to continue growing your investments without incurring additional taxes immediately.

When you reinvest your RMD:

- You have flexibility in choosing investment vehicles such as stocks, bonds, or mutual funds.

- Any growth from these investments will be subject to capital gains tax rather than ordinary income tax, which may be beneficial depending on your tax bracket.

- You can designate beneficiaries for this account without passing along future RMD obligations.

However, it’s essential to keep in mind that you cannot reinvest your RMD back into most retirement accounts. Understanding this limitation helps in planning your investment strategy effectively.

Utilizing In-Kind Transfers

Another option available for managing your RMD is through in-kind transfers. This approach allows you to withdraw assets from your retirement account without selling them first.

By using in-kind transfers:

- You maintain your investment positions while fulfilling your RMD requirement.

- This method can be particularly advantageous if you believe certain securities are undervalued and want to retain exposure.

- It also allows you to avoid potential capital gains taxes that would arise from selling appreciated assets.

In-kind transfers can be complex and may incur fees, so consulting with a financial advisor before proceeding is advisable.

Funding Educational Expenses

If you have grandchildren or family members pursuing higher education, consider using your RMD to fund a 529 college savings plan. This strategy not only provides financial support but also offers potential tax benefits.

Using RMDs for educational expenses has several advantages:

- Contributions to a 529 plan grow tax-free, and withdrawals for qualified education expenses are also tax-free.

- It can help reduce the size of your estate while providing a meaningful benefit to family members.

- Additionally, under recent legislation, you may roll over up to $35,000 from an IRA into a 529 plan over your lifetime.

This approach aligns with both personal financial goals and family support strategies.

Charitable Contributions

For those who wish to give back while managing their tax liability, making Qualified Charitable Distributions (QCDs) from their RMD can be an excellent option. QCDs allow you to donate up to $100,000 directly from your IRA to a qualified charity without incurring income taxes on that amount.

Benefits of QCDs include:

- Reducing your taxable income for the year when you make the donation.

- Supporting causes you care about without affecting your cash flow.

- Ensuring that funds go directly to charity rather than being taxed as part of your income.

This strategy not only fulfills the RMD requirement but also aligns with philanthropic goals.

Managing Tax Implications

Understanding how RMDs affect your overall tax situation is vital for effective retirement planning. Since RMDs are considered ordinary income, they can push retirees into higher tax brackets if not managed properly.

To mitigate this risk:

- Consider timing your withdrawals strategically throughout the year rather than taking them all at once.

- Explore options like Roth IRA conversions prior to taking your RMD if you anticipate being in a lower tax bracket now compared to later years.

- Consult with a tax professional who can provide personalized advice based on your financial situation.

By managing when and how you take your distributions, you can optimize your overall tax impact during retirement.

Creating an Investment Strategy

When deciding how best to invest your RMDs, having a clear investment strategy is crucial. Considerations should include:

- Your risk tolerance: Determine how much risk you’re willing to take with these funds.

- Investment goals: Are you looking for growth, income generation, or preservation of capital?

- Market conditions: Assess current market trends and economic indicators before making significant investments.

A well-thought-out strategy will help ensure that you make informed decisions regarding your investments post-RMD withdrawal.

FAQs About Investing Your RMD

- What happens if I don’t take my RMD?

You will face a penalty of 25% on the amount not withdrawn. - Can I reinvest my RMD?

You can reinvest it in a taxable account but not back into most retirement accounts. - What is an in-kind transfer?

An in-kind transfer allows you to withdraw assets without selling them first. - Can I use my RMD for charitable donations?

Yes, using QCDs allows you to donate directly from your IRA without incurring taxes. - How are my RMD amounts calculated?

Your RMD is calculated based on your account balance and life expectancy factor provided by the IRS.

In conclusion, investing your Required Minimum Distributions offers numerous opportunities for financial growth and strategic planning during retirement. By understanding how best to utilize these distributions—whether through reinvestment in taxable accounts, funding educational expenses, or making charitable contributions—you can enhance both your financial situation and overall quality of life in retirement. Always consider consulting with financial professionals when navigating complex decisions regarding investments and taxes related to RMDs.