Health Savings Accounts (HSAs) offer a unique opportunity to save for medical expenses while also serving as a powerful investment tool. These accounts provide triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. While many people use HSAs for current medical costs, investing your HSA funds can potentially lead to significant long-term growth, especially if you’re able to pay for medical expenses out-of-pocket and let your HSA investments compound over time.

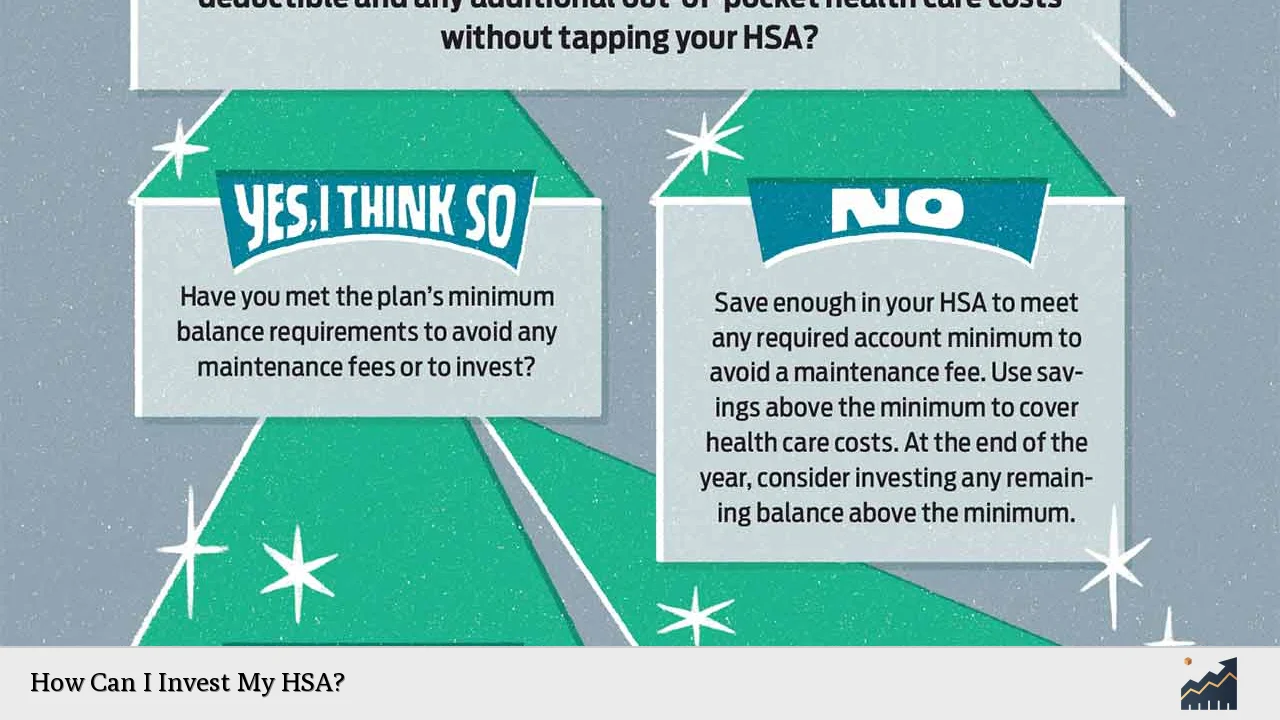

To start investing your HSA, you typically need to meet a minimum balance requirement in your cash account. This threshold varies by HSA provider but is often around $1,000 to $2,000. Once you’ve met this requirement, you can begin exploring investment options. It’s important to note that not all HSA providers offer investment options, so you may need to shop around for a provider that aligns with your investment goals.

| HSA Feature | Benefit |

|---|---|

| Triple Tax Advantage | Tax-deductible contributions, tax-free growth, tax-free withdrawals for qualified expenses |

| Investment Potential | Opportunity for long-term growth through various investment options |

HSA Investment Options

When it comes to investing your HSA funds, you’ll typically have access to a range of options similar to those found in 401(k) plans or IRAs. These may include:

- Mutual Funds: Many HSA providers offer a selection of mutual funds, including both actively managed and index funds. These can provide diversification across various asset classes.

- Exchange-Traded Funds (ETFs): ETFs are becoming increasingly popular in HSA investment lineups due to their low costs and ability to track specific market indices.

- Target-Date Funds: These funds automatically adjust their asset allocation as you approach retirement age, making them a convenient option for hands-off investors.

- Individual Stocks and Bonds: Some HSA providers offer self-directed brokerage options, allowing you to invest in individual securities.

- Money Market Funds: While not technically an investment, these funds can offer slightly higher yields than savings accounts for funds you want to keep liquid.

It’s crucial to consider your investment time horizon and risk tolerance when selecting HSA investments. If you anticipate needing the funds for medical expenses in the near future, you may want to keep a portion of your HSA in cash or low-risk investments. For long-term growth, a more aggressive allocation might be appropriate.

Choosing the Right Investment Mix

When determining your HSA investment strategy, consider the following factors:

- Your Age: Younger investors may be able to take on more risk, while those closer to retirement might prefer a more conservative approach.

- Overall Financial Situation: Your HSA investments should complement your other retirement accounts and overall financial plan.

- Expected Medical Expenses: If you anticipate significant medical costs in the near future, you may want to keep more funds in cash.

- Investment Fees: Pay attention to expense ratios and any account fees, as these can eat into your returns over time.

HSA Investment Strategies

To maximize the potential of your HSA investments, consider these strategies:

1. Maximize Contributions: In 2024, individuals can contribute up to $4,150, and families can contribute up to $8,300. If you’re 55 or older, you can make an additional $1,000 catch-up contribution.

2. Pay Medical Expenses Out-of-Pocket: If possible, pay for current medical expenses with after-tax dollars and let your HSA investments grow tax-free.

3. Invest for the Long Term: Treat your HSA like a retirement account, focusing on long-term growth rather than short-term gains.

4. Rebalance Regularly: Review and adjust your investments periodically to maintain your desired asset allocation.

5. Consider a Two-Account Strategy: Keep some funds in a cash account for near-term expenses and invest the rest for long-term growth.

Automating Your HSA Investments

Many HSA providers offer tools to automate your investment strategy:

- Automatic Investing: Set up recurring transfers from your HSA cash account to your investment account.

- Auto-Rebalancing: Some providers offer automatic rebalancing to maintain your target asset allocation.

- Threshold-Based Investing: Automatically invest any funds above a certain cash balance.

By automating these processes, you can ensure consistent investing and reduce the temptation to time the market.

Managing HSA Investments

Effective management of your HSA investments is crucial for long-term success. Here are some best practices:

- Regular Review: Check your HSA investments at least annually to ensure they align with your goals and risk tolerance.

- Keep Records: Maintain detailed records of your medical expenses, even if you don’t immediately reimburse yourself from your HSA.

- Understand Tax Implications: While HSA withdrawals for qualified medical expenses are tax-free, non-qualified withdrawals before age 65 are subject to income tax and a 20% penalty.

- Consider Future Healthcare Costs: As you approach retirement, factor in potential healthcare expenses when determining your investment strategy.

Remember that HSA funds can be used tax-free for Medicare premiums once you reach age 65, making them a valuable tool for retirement healthcare planning.

Potential Pitfalls to Avoid

While investing your HSA can be beneficial, there are some potential pitfalls to be aware of:

- Overinvesting: Don’t invest funds you may need for short-term medical expenses.

- Neglecting Diversification: Avoid concentrating your investments in a single sector or asset class.

- Ignoring Fees: High fees can significantly impact your long-term returns, so choose low-cost investment options when possible.

- Forgetting to Invest: Some HSA holders contribute funds but forget to actually invest them, missing out on potential growth.

By being aware of these potential issues, you can make more informed decisions about your HSA investments and avoid common mistakes.

FAQs About HSA Investing

- Can I invest all of my HSA funds?

Most providers require you to maintain a minimum cash balance before investing, typically $1,000 to $2,000. - What happens to my HSA investments if I change jobs?

Your HSA, including investments, remains yours regardless of employment changes. - Are HSA investment earnings taxed?

No, earnings grow tax-free and remain tax-free if used for qualified medical expenses. - Can I use my HSA investments for non-medical expenses?

Yes, but withdrawals for non-medical expenses before age 65 incur taxes and a 20% penalty. - How often should I review my HSA investments?

It’s recommended to review your HSA investments at least annually or when your financial situation changes significantly.

Investing your HSA can be a powerful strategy for long-term financial health, combining the benefits of tax-advantaged growth with the flexibility to cover medical expenses. By understanding your options, implementing a thoughtful investment strategy, and regularly reviewing your choices, you can maximize the potential of your HSA and build a stronger financial future. Remember to consult with a financial advisor or tax professional to ensure your HSA investment strategy aligns with your overall financial plan and goals.