Investing in OpenAI presents unique challenges due to its current status as a private entity. Unlike publicly traded companies, where shares can be bought and sold freely on stock exchanges, OpenAI is not listed on any major stock market. This situation limits direct investment opportunities for most retail investors. However, there are several indirect ways to gain exposure to OpenAI’s innovations and potential growth in the artificial intelligence sector.

OpenAI has gained significant attention due to its groundbreaking advancements in AI technology, particularly with products like ChatGPT. As of late 2024, the company has achieved a valuation of $157 billion following a substantial $6.6 billion funding round. This funding is aimed at enhancing its research capabilities and expanding its product offerings. Despite its impressive valuation, OpenAI operates under a hybrid structure of a non-profit and for-profit entity, which complicates investment avenues.

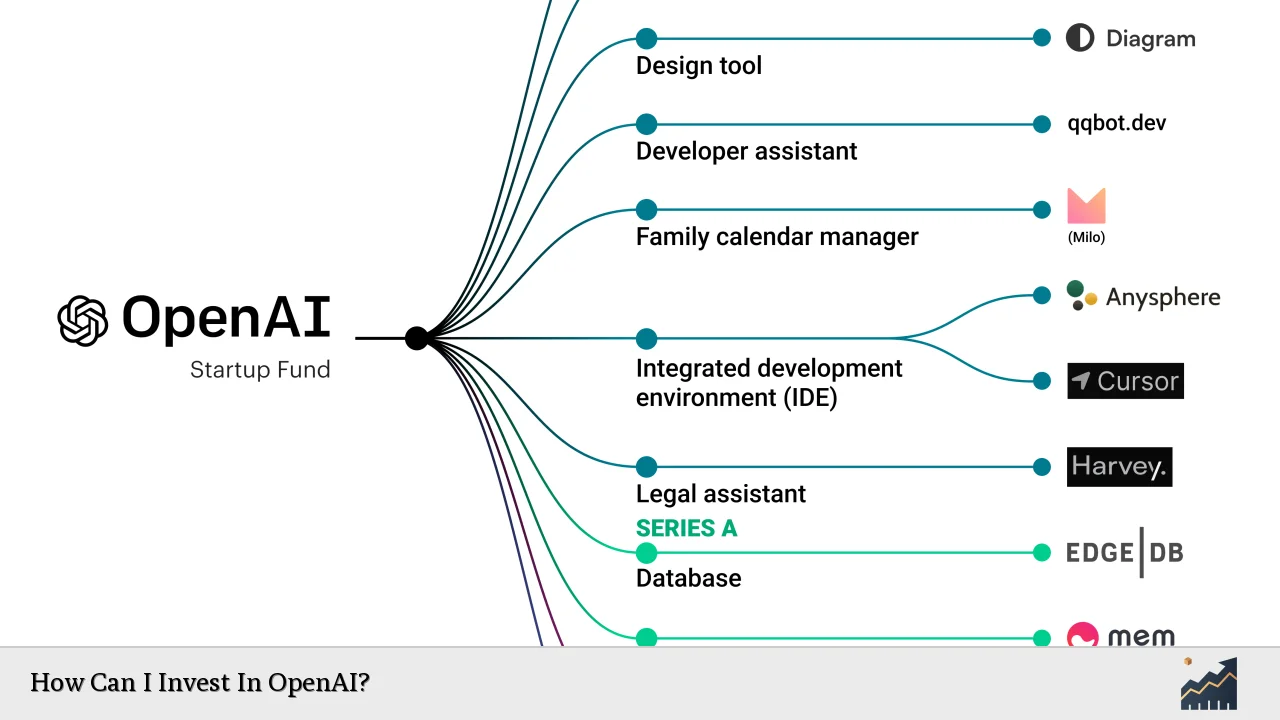

For those looking to invest in OpenAI or related technologies, understanding the available options is crucial. Below is a concise overview of how to approach investing in OpenAI and similar ventures.

| Investment Method | Description |

|---|---|

| Direct Investment | Not currently available as OpenAI is privately held. |

| Indirect Investment via Microsoft | Investing in Microsoft provides exposure as it holds a significant stake in OpenAI. |

| Venture Capital Funds | Investing in funds that include OpenAI as part of their portfolio. |

| Tech-focused ETFs | Investing in ETFs that hold shares of companies involved in AI. |

Understanding OpenAI’s Structure

OpenAI operates under a unique organizational structure that includes both non-profit and for-profit components. Initially established as a non-profit organization, it has evolved into a for-profit entity governed by a non-profit parent company. This structure allows OpenAI to attract significant investments while pursuing its mission of developing artificial general intelligence (AGI) that benefits humanity.

The transition from a purely non-profit model was largely driven by the need for substantial funding to support its ambitious goals. As of now, major investors include Microsoft, which has invested over $13 billion, and other tech giants like Nvidia and SoftBank. This funding strategy enables OpenAI to focus on research and development without the immediate pressures associated with public trading.

Despite its high valuation and substantial backing, OpenAI has yet to turn a profit, projecting losses around $5 billion for the year 2024. This financial outlook raises questions about the company’s future direction and whether it will eventually pursue an initial public offering (IPO) to allow public investment.

Investment Options for Retail Investors

While direct investment in OpenAI is not possible at this time, there are several indirect methods for retail investors to gain exposure to the company’s growth:

- Investing in Microsoft (MSFT): Microsoft is the largest investor in OpenAI, holding approximately 49% of the company. By purchasing Microsoft stock, investors can indirectly benefit from OpenAI’s success as Microsoft’s products increasingly integrate AI technologies developed by OpenAI.

- Venture Capital Funds: For accredited investors, platforms like Hiive offer opportunities to invest in private equity markets where shares of companies like OpenAI may be available through secondary markets. However, these opportunities are typically limited to high-net-worth individuals.

- Tech-focused ETFs: Exchange-traded funds (ETFs) that concentrate on technology and AI sectors often include stocks from companies closely related to OpenAI’s operations. For example, funds like the Vanguard Information Technology ETF or Fidelity MSCI Information Technology Index ETF provide diversified exposure while holding shares of Microsoft and Nvidia.

- Investing in Nvidia (NVDA): Nvidia produces critical hardware used by AI applications, including those developed by OpenAI. As demand for AI technology grows, Nvidia’s stock may benefit significantly from this trend.

These indirect investment strategies allow retail investors to tap into the potential growth associated with AI technologies without needing direct access to OpenAI shares.

Future Outlook: The Potential IPO

The prospect of an IPO remains uncertain but could significantly impact how investors approach OpenAI. If the company decides to go public, it would allow retail investors direct access to its shares for the first time. However, this decision hinges on various factors including financial performance, market conditions, and strategic goals.

Analysts speculate that an IPO could occur if OpenAI continues to demonstrate robust growth and begins generating consistent profits. The potential influx of capital from public markets could further accelerate its research initiatives and product development efforts.

Investors should monitor developments regarding an IPO closely. Engaging with financial news sources and keeping track of announcements from OpenAI will be crucial for those interested in investing directly once shares become available.

Risks and Considerations

Investing in AI technologies carries inherent risks due to the volatility associated with emerging markets and technological advancements. Potential investors should consider several factors:

- Market Competition: The AI sector is highly competitive with numerous players vying for market share. Companies like Google and Amazon also invest heavily in AI technologies, which could impact OpenAI’s growth trajectory.

- Regulatory Environment: As AI technologies evolve, regulatory frameworks may change, potentially affecting operational capabilities and profitability.

- Financial Performance: With projections indicating significant losses for the foreseeable future, investors should weigh their risk tolerance against potential returns carefully.

Understanding these risks will help investors make informed decisions about their investments related to OpenAI and the broader AI landscape.

FAQs About Investing In OpenAI

- Can I buy stock directly in OpenAI?

No, currently you cannot buy stock directly as OpenAI is privately held. - How can I invest indirectly in OpenAI?

You can invest indirectly by purchasing stocks like Microsoft or Nvidia that have ties to OpenAI. - Is there an expected IPO for OpenAI?

An IPO is possible but not confirmed; it depends on future financial performance. - What are some good ETFs for investing in AI?

ETFs like Vanguard Information Technology ETF provide exposure to companies involved in AI. - What risks should I consider when investing in AI?

Consider market competition, regulatory changes, and financial performance risks before investing.

In conclusion, while direct investment opportunities in OpenAI are currently unavailable for most retail investors, there are multiple avenues through which one can gain exposure to this innovative company’s potential growth within the artificial intelligence sector. By strategically investing in related companies or funds, investors can position themselves favorably as the market continues to evolve.