The security of digital platforms is a pressing concern for investors and users alike, especially in the rapidly evolving landscape of decentralized finance (DeFi). KLEVA Protocol, a notable player in the DeFi space, has garnered attention for its unique offerings and potential. However, questions regarding its security and history of hacks or compromises are paramount for current and prospective users.

KLEVA Protocol operates on the Klaytn blockchain and focuses on yield farming and liquidity provision. As with any financial platform, especially those dealing with cryptocurrencies, understanding its security history is vital. This article delves into KLEVA’s security measures, historical incidents, and the broader implications for users.

| Key Concept | Description/Impact |

|---|---|

| KLEVA Protocol Overview | KLEVA is a DeFi protocol that facilitates leveraged yield farming, allowing users to maximize returns on their investments. |

| Security Measures | KLEVA employs robust security protocols, including smart contract audits and decentralized governance to mitigate risks. |

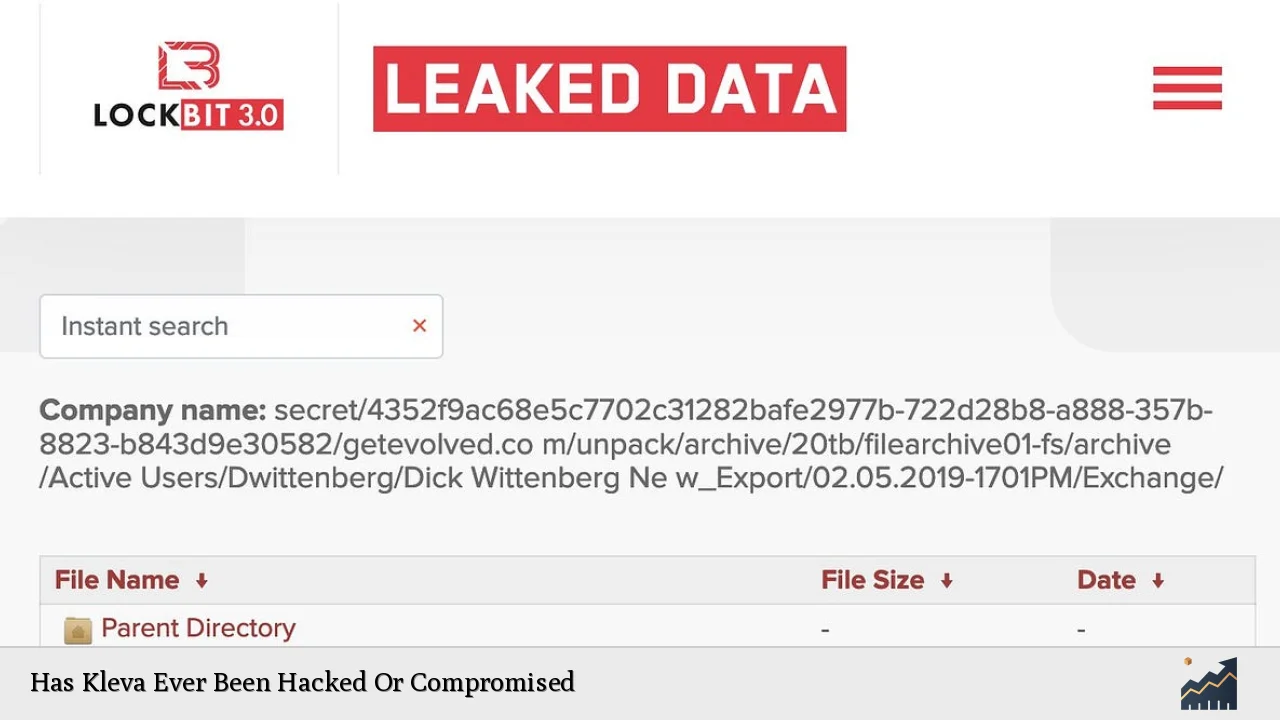

| Historical Security Incidents | As of now, there have been no reported hacks or compromises specifically targeting KLEVA Protocol. |

| Market Position | KLEVA has a market cap of approximately $2.27 million, ranking it within the lower tiers of DeFi projects but showing potential for growth. |

| User Trust Factors | The lack of historical breaches contributes positively to user trust; however, ongoing vigilance is necessary in the DeFi space. |

Market Analysis and Trends

The decentralized finance sector has experienced exponential growth over recent years. According to industry reports, the total value locked (TVL) in DeFi protocols surged from approximately $1 billion in early 2020 to over $100 billion by late 2021. This rapid expansion has attracted both retail and institutional investors seeking high yields typically unavailable through traditional financial instruments.

KLEVA Protocol is part of this trend, focusing on leveraging yield farming strategies that appeal particularly to younger investors looking for innovative investment opportunities. The integration of blockchain technology allows for transparent transactions and reduced reliance on intermediaries, which is a significant draw for many users.

Current Market Statistics

- Market Capitalization: KLEVA currently holds a market cap of about $2.27 million.

- Price Volatility: The price has seen fluctuations typical of the crypto market; it recently traded around $0.05729 with a 24-hour trading volume of approximately $83,807.

- User Base Growth: The user base is expanding as more individuals become aware of DeFi opportunities.

Implementation Strategies

For users considering KLEVA Protocol as an investment vehicle or financial tool, several strategies can enhance their experience:

- Diversification: Users should consider diversifying their investments across multiple DeFi platforms to mitigate risks associated with potential vulnerabilities.

- Regular Monitoring: Keeping abreast of updates from KLEVA regarding security audits and protocol changes can help users make informed decisions.

- Utilizing Security Features: Engaging with features such as two-factor authentication (2FA) and ensuring proper wallet security can further protect investments.

Risk Considerations

Despite KLEVA’s current security standing, inherent risks in the DeFi space remain:

- Smart Contract Vulnerabilities: Even though KLEVA has not been hacked, smart contracts can be susceptible to bugs or exploits that may lead to significant losses.

- Market Volatility: The cryptocurrency market is notoriously volatile; price swings can lead to rapid gains or losses.

- Regulatory Risks: As governments worldwide begin to scrutinize cryptocurrencies more closely, regulatory changes could impact operations significantly.

Regulatory Aspects

The regulatory environment surrounding cryptocurrencies and DeFi platforms like KLEVA is still developing. Regulatory bodies are increasingly focused on ensuring user protection while fostering innovation. Compliance with regulations not only enhances user trust but also ensures the longevity of platforms in a competitive market.

Key Regulatory Considerations

- KYC/AML Compliance: Many platforms are implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to align with regulatory expectations.

- Data Protection Laws: Adherence to data protection regulations such as GDPR is crucial for maintaining user trust and operational integrity.

Future Outlook

The future for KLEVA Protocol appears promising given the ongoing growth in the DeFi sector. As more users seek accessible investment solutions, platforms that offer innovative features while prioritizing security will likely thrive.

Potential Growth Drivers

- Increased Adoption of DeFi: As financial literacy improves among younger demographics, more individuals are likely to engage with platforms like KLEVA.

- Technological Advancements: Ongoing improvements in blockchain technology could enhance KLEVA’s offerings and security measures.

- Market Expansion: The global shift towards digital finance presents significant opportunities for growth within emerging markets.

Frequently Asked Questions About Has Kleva Ever Been Hacked Or Compromised

- Has KLEVA ever been hacked?

No reported hacks or compromises have targeted KLEVA Protocol as of now. - What security measures does KLEVA employ?

KLEVA utilizes smart contract audits and decentralized governance structures to enhance security. - How does KLEVA compare to other DeFi protocols?

KLEVA offers unique leveraged yield farming opportunities but operates within a competitive landscape. - What are the risks associated with using KLEVA?

Risks include smart contract vulnerabilities, market volatility, and potential regulatory changes. - Is my investment safe with KLEVA?

While there have been no breaches reported, all investments carry inherent risks that should be carefully considered. - What should I do if I want to invest in KLEVA?

Diversifying your portfolio and staying informed about platform updates can help manage risks effectively. - How can I ensure my assets are secure on KLEVA?

Utilizing strong passwords, enabling two-factor authentication (2FA), and regularly monitoring your account can enhance security. - What is the future outlook for KLEVA?

The future looks promising due to growing interest in DeFi; however, ongoing vigilance regarding security remains essential.

In conclusion, while KLEVA Protocol has not experienced any hacks or compromises thus far, it remains crucial for users to stay informed about potential risks and implement robust security practices when engaging with any DeFi platform. The landscape is dynamic; thus continuous monitoring and adaptation are key strategies for success in this evolving market.