As we enter 2025, the investment landscape presents both challenges and opportunities. With economic uncertainties and shifting market dynamics, investors need to carefully consider their options to protect and grow their wealth. This article explores some promising investment ideas for 2025, taking into account current market trends, expert opinions, and potential growth areas.

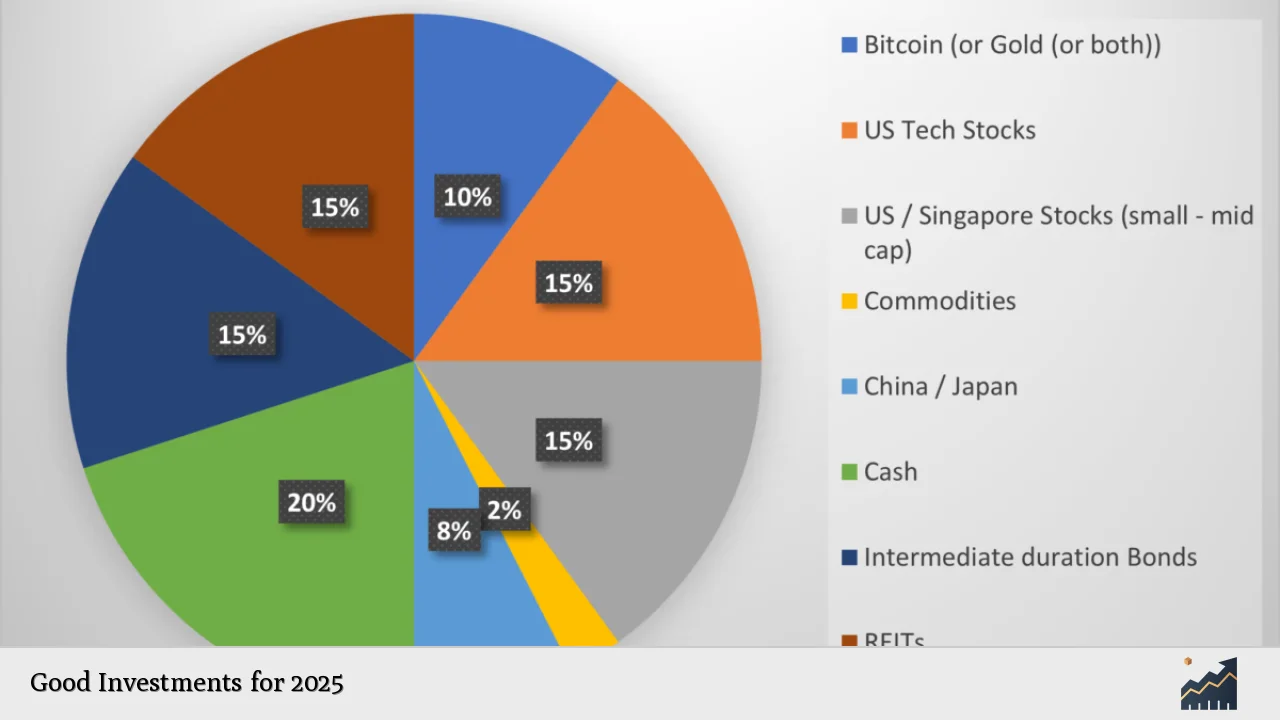

The investment outlook for 2025 is shaped by several key factors, including interest rate trends, global economic conditions, and technological advancements. Investors should focus on diversifying their portfolios and balancing risk with potential returns. Here’s a quick overview of some top investment ideas for 2025:

| Investment Type | Potential Benefits |

|---|---|

| Large-cap stocks | Stability and potential growth |

| Bonds (short-term and floating rate) | Income generation and interest rate protection |

| Technology and AI-focused funds | Exposure to innovative sectors |

| ESG investments | Alignment with sustainability trends |

Equity Investments

In 2025, equity investments remain a crucial component of a well-balanced portfolio. However, experts advise a conservative approach to equity investments, particularly focusing on large-cap stocks. These established companies often offer more stability and better risk-reward profiles compared to their mid- and small-cap counterparts.

Large-cap stocks are expected to perform well in 2025 due to their ability to navigate economic uncertainties and capitalize on global opportunities. Investors should consider diversifying their equity holdings across different sectors to mitigate risks. Some sectors that show promise include:

- Technology: With ongoing advancements in artificial intelligence, cloud computing, and cybersecurity, tech stocks continue to offer growth potential.

- Healthcare: An aging global population and medical innovations drive growth in this sector.

- Consumer discretionary: As economic conditions improve, companies in this sector may benefit from increased consumer spending.

- Financial services: Banks and financial institutions may perform well if interest rates stabilize or decrease.

While large-caps are favored, investors shouldn’t completely ignore mid- and small-cap stocks. These segments can offer growth opportunities, especially after recent market corrections. However, it’s crucial to be selective and focus on companies with strong fundamentals and growth prospects.

Fixed Income Strategies

In the fixed income space, 2025 presents unique challenges and opportunities. With Treasury yields expected to normalize in the 4-5% range, investors need to adopt strategies that balance income generation with protection against interest rate volatility.

A barbell strategy combining floating rate and yield-enhanced funds can be effective in this environment. This approach involves investing in:

- Floating rate bonds: These securities offer interest payments that adjust based on prevailing rates, providing protection against rising rates.

- Short-term bonds: With lower duration, these bonds are less sensitive to interest rate changes.

- High-yield bonds: While riskier, they can offer higher income potential in a low-yield environment.

Investors should also consider investment-grade corporate bonds, particularly those issued by large, globally important banks in the US and Europe. These bonds may offer attractive yields while maintaining relatively low risk profiles.

Another interesting option for 2025 is convertible bonds. These hybrid securities pay interest like regular bonds but can be converted into the issuing company’s stock. They offer potential upside if stock prices rise while providing some downside protection through their bond-like characteristics.

International Diversification

Diversifying internationally can help spread risk and capture growth opportunities in different markets. For 2025, two regions stand out as particularly promising:

Japan

Japan’s stock market shows potential for strong performance in 2025. The country’s corporate governance reforms and focus on shareholder returns are driving improved profitability. Investors might consider:

- Currency-hedged Japanese equity funds to mitigate foreign exchange risk

- Funds focusing on Japanese small-cap stocks, which may benefit from domestic economic growth

India

India’s economic expansion makes it an attractive market for long-term investors. The country’s young population, growing middle class, and digital transformation present significant opportunities. Consider:

- Broad-based Indian equity funds for exposure to the overall market

- Sector-specific funds targeting areas like technology or consumer goods

When investing internationally, it’s crucial to be aware of currency risks and geopolitical factors that can impact returns.

Alternative Investments

Alternative investments can provide diversification benefits and potentially higher returns, albeit with increased risk. Some alternative investment ideas for 2025 include:

- Real estate investment trusts (REITs): These offer exposure to the real estate market without direct property ownership.

- Commodities: With ongoing global tensions and supply chain issues, certain commodities may see increased demand.

- Private equity: For accredited investors, private equity can offer access to companies not available in public markets.

- Infrastructure funds: As governments worldwide focus on infrastructure development, these funds may benefit.

It’s important to note that alternative investments often come with higher fees and less liquidity compared to traditional investments. They should typically make up a smaller portion of an overall portfolio.

ESG Investing

Environmental, Social, and Governance (ESG) investing continues to gain traction and is expected to be a significant trend in 2025. Investors are increasingly looking to align their portfolios with their values while still seeking financial returns.

ESG investments can span various asset classes, including:

- ESG-focused equity funds

- Green bonds

- Sustainable infrastructure projects

- Clean energy ETFs

When considering ESG investments, it’s essential to research thoroughly and understand the specific criteria used by fund managers to select investments.

FAQs About Good Investments for 2025

- What are the safest investment options for 2025?

Generally, government bonds, high-quality corporate bonds, and blue-chip stocks are considered safer options. - Should I invest in cryptocurrency in 2025?

Cryptocurrency remains highly volatile; only invest what you can afford to lose and as part of a diversified portfolio. - How much of my portfolio should be in stocks vs. bonds in 2025?

The allocation depends on your risk tolerance and investment goals, but a common starting point is 60% stocks and 40% bonds. - Are real estate investments a good idea for 2025?

Real estate can offer diversification benefits, but consider REITs for easier access and liquidity. - What sectors are expected to perform well in 2025?

Technology, healthcare, and renewable energy sectors are anticipated to show strong growth potential.

In conclusion, the key to successful investing in 2025 lies in diversification, careful risk management, and staying informed about market trends. While these investment ideas provide a starting point, it’s crucial to align your investment strategy with your personal financial goals, risk tolerance, and time horizon. Consider consulting with a financial advisor to create a tailored investment plan that suits your individual needs and circumstances. Remember, all investments carry risk, and past performance doesn’t guarantee future results. Stay vigilant, regularly review your portfolio, and be prepared to adjust your strategy as market conditions evolve throughout 2025 and beyond.