Investing in stocks has long been recognized as a powerful strategy for building wealth and achieving financial goals. Over time, the stock market has historically provided higher returns compared to other asset classes, such as bonds or cash equivalents. However, investing in stocks also involves risks that must be carefully assessed. This article delves into the myriad benefits of stock investing, analyzes current market trends, and addresses risk management strategies to equip investors with the knowledge necessary to navigate the complexities of the stock market.

| Key Concept | Description/Impact |

|---|---|

| Wealth Accumulation | Historically, stocks have outperformed other investments, allowing investors to build wealth over time through capital appreciation and dividends. |

| Inflation Hedge | Stocks generally provide returns that outpace inflation, helping to preserve purchasing power over the long term. |

| Liquidity | The stock market offers high liquidity, enabling investors to buy and sell shares quickly compared to other asset classes like real estate. |

| Diversification | Investing in a variety of stocks across different sectors reduces risk and enhances potential returns through diversification. |

| Ownership and Rights | Stockholders gain partial ownership in companies, providing them with voting rights and a stake in the company’s success. |

Market Analysis and Trends

As we look ahead into 2024, several key trends are shaping the stock market landscape:

- Sustainability and ESG Investing: There is a growing emphasis on environmental, social, and governance (ESG) factors. Companies that prioritize sustainability are likely to attract more investment as consumers and investors become increasingly conscious of corporate responsibility.

- Technological Advancements: The rise of technologies such as artificial intelligence, blockchain, and fintech continues to disrupt traditional industries. Investors focusing on tech-driven companies may see significant growth potential.

- Healthcare Sector Growth: The pandemic has accelerated innovations in healthcare, including telemedicine and biotechnology. Companies in these fields are expected to experience robust growth.

- Emerging Markets: With developed markets showing signs of saturation, emerging markets in Asia, Africa, and Latin America present new opportunities for growth due to their rapid economic development.

Current statistics indicate that the S&P 500 index has increased by approximately 27% since the beginning of 2024, reflecting strong investor sentiment despite recent volatility[5]. However, analysts caution that while optimism prevails, there is potential for increased market fluctuations as economic conditions evolve[6].

Implementation Strategies

To maximize the benefits of investing in stocks, individuals should consider the following strategies:

- Buy-and-Hold Strategy: This long-term approach involves purchasing stocks with the intention of holding them for several years. Historically, this strategy has yielded substantial returns as markets tend to recover from downturns over time.

- Dollar-Cost Averaging: This strategy involves regularly investing a fixed amount in stocks regardless of market conditions. This approach helps mitigate the impact of volatility by averaging out purchase prices over time.

- Dividend Growth Investing: Focusing on companies with a strong history of increasing dividends can provide both income and capital appreciation. Dividend-paying stocks often exhibit lower volatility during market downturns.

- Index Fund Investing: For those seeking broad market exposure at lower costs, index funds offer an efficient way to invest in a diversified portfolio without needing extensive market knowledge.

Risk Considerations

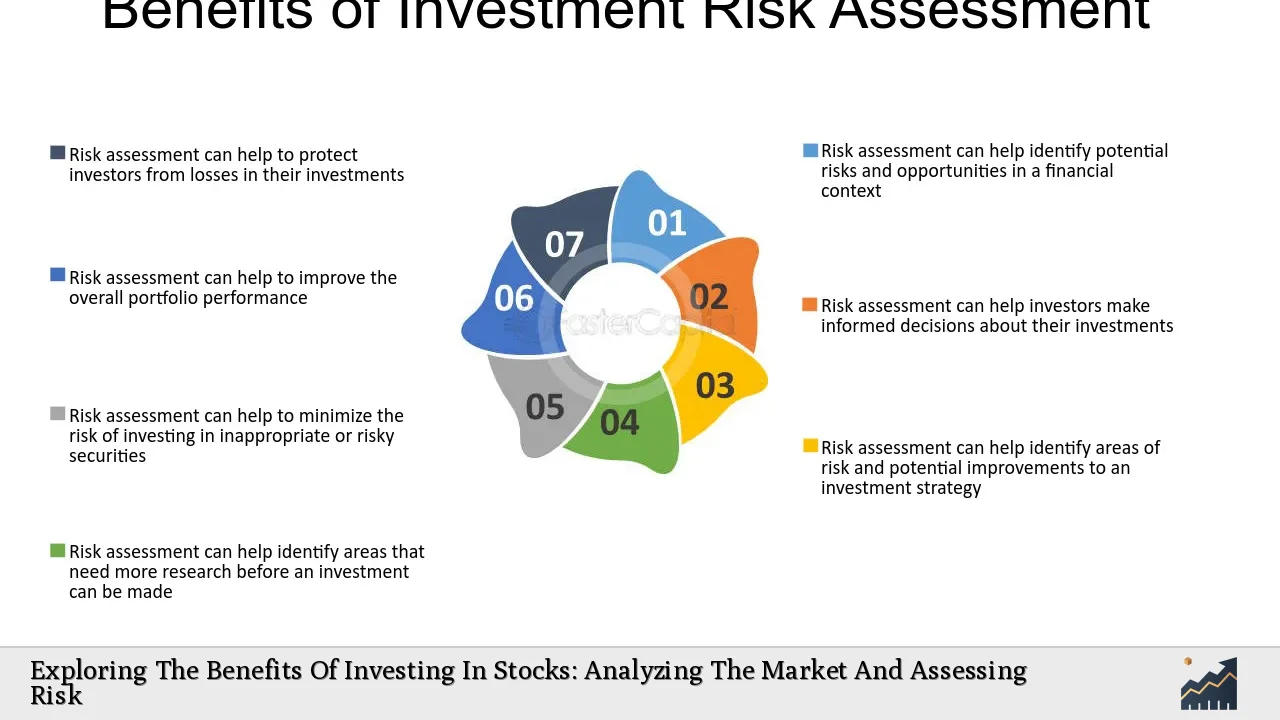

Understanding and managing risk is crucial for successful stock investing:

- Market Volatility: Stock prices can fluctuate significantly due to various factors including economic data releases, geopolitical events, and changes in interest rates. Investors should be prepared for short-term volatility while maintaining a long-term perspective.

- Company-Specific Risks: Individual stocks carry risks related to company performance. Thorough research into company fundamentals is essential before making investment decisions.

- Economic Indicators: Investors should monitor key economic indicators such as GDP growth rates, unemployment rates, and inflation trends as these can influence market performance.

- Risk Management Techniques: Effective risk management strategies include diversification across sectors and asset classes, setting stop-loss orders to limit potential losses, and regularly reviewing investment portfolios[9].

Regulatory Aspects

Investors must also be aware of regulatory considerations when participating in the stock market:

- Securities Regulation: The Securities and Exchange Commission (SEC) oversees securities transactions to protect investors from fraud. Understanding regulations surrounding trading practices is essential for compliance.

- Investment Limitations: Certain offerings may have restrictions based on investor qualifications (e.g., accredited investor status) or investment limits under Regulation A exemptions[8].

Staying informed about regulatory changes can help investors navigate compliance issues effectively.

Future Outlook

The outlook for stock investing remains promising but requires vigilance:

- Interest Rate Environment: With interest rates expected to remain higher than historical averages due to inflationary pressures, investors may need to adjust their portfolios accordingly[12].

- Sector Rotation: As economic conditions shift, certain sectors may outperform others. Investors should remain flexible and ready to adapt their strategies based on prevailing market trends.

- Global Economic Factors: Geopolitical events and global economic shifts will continue to influence markets. Investors should stay informed about international developments that could impact their investments.

In conclusion, while investing in stocks presents significant opportunities for wealth accumulation and financial security, it also requires careful analysis of market trends and risk management strategies. By staying informed and adopting disciplined investment practices, individuals can harness the benefits of stock investing while navigating its inherent risks.

Frequently Asked Questions About Investing In Stocks

- What are the primary benefits of investing in stocks?

Investing in stocks offers potential for high returns through capital appreciation and dividends while providing liquidity and opportunities for diversification. - How can I manage risks associated with stock investing?

Risks can be managed through diversification across different sectors, using stop-loss orders, conducting thorough research on investments, and maintaining a long-term perspective. - What is dollar-cost averaging?

Dollar-cost averaging is an investment strategy where an investor regularly buys a fixed dollar amount of a particular stock or fund regardless of its price fluctuations. - How do dividends work?

Dividends are payments made by companies to their shareholders from profits. They provide a source of income for investors alongside potential capital gains. - What role does regulation play in stock investing?

Regulation protects investors from fraud by overseeing securities transactions through bodies like the SEC. Understanding these regulations is crucial for compliance. - Are there specific sectors I should focus on when investing?

Sectors such as technology, healthcare, and sustainable industries are currently trending upward; however, it’s essential to conduct individual research based on personal investment goals. - How can I stay informed about market trends?

Regularly reading financial news articles, following reputable financial analysts on social media platforms, subscribing to investment newsletters, and using analytical tools can help keep you updated. - When should I seek professional financial advice?

If you are unsure about your investment strategy or need personalized guidance based on your financial situation or goals, consulting with a financial advisor is recommended.

This comprehensive exploration highlights the multifaceted nature of stock investing while providing practical insights into effective strategies for individual investors aiming for financial success.