Wise, formerly known as TransferWise, has emerged as a leading platform for international money transfers and financial services. The company has developed a robust mobile application that enhances user experience by allowing individuals and businesses to manage their finances seamlessly across borders. This article explores the features of the Wise app, its market position, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

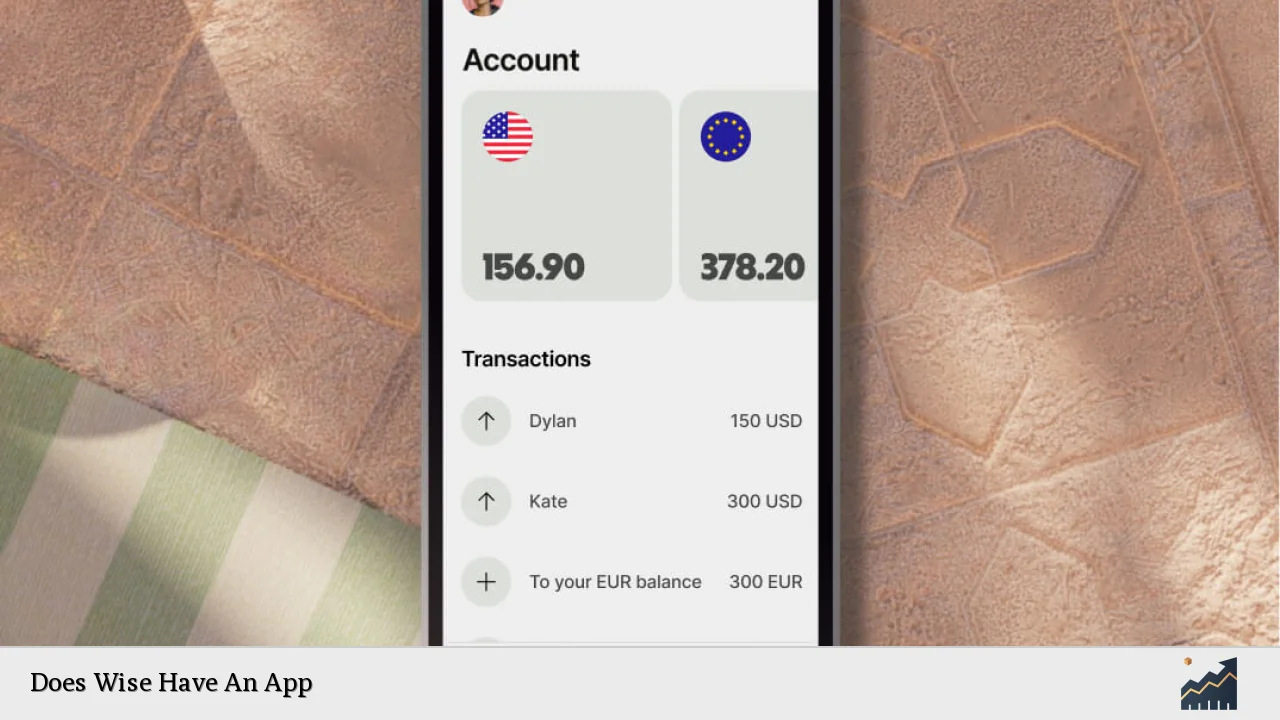

| Multi-Currency Accounts | Allows users to hold and manage funds in over 40 currencies, facilitating easy conversions and transfers at mid-market rates. |

| Instant Transfers | 62% of transfers are completed instantly, enhancing user satisfaction and operational efficiency. |

| User-Friendly Interface | The app is designed for ease of use, with intuitive navigation that simplifies the process of sending money internationally. |

| Regulatory Compliance | Wise operates under stringent regulations in multiple countries, ensuring safety and transparency for users. |

| Customer Growth | Wise reported a 29% increase in active customers year-over-year, highlighting the growing reliance on its services. |

| Cost Efficiency | Wise offers competitive fees compared to traditional banks, making it an attractive option for international transactions. |

Market Analysis and Trends

The global digital remittance market is projected to grow significantly, with estimates suggesting it will expand from $15.27 billion in 2021 to $36.54 billion by 2028. Wise is positioned as a key player in this market, leveraging its innovative technology and customer-centric approach to capture a larger share of cross-border payments.

Current Market Position

- Active Customers: As of September 2024, Wise has approximately 11.4 million active customers, with a notable increase of 25% in the last six months.

- Transaction Volume: The company processed £68.4 billion in transactions during this period, reflecting a year-on-year growth of 19%.

- Revenue Growth: Wise’s revenue increased by 19% year-on-year to £591.9 million in the first half of fiscal 2025.

Competitive Landscape

Wise faces competition from various fintech companies such as Revolut and PayPal. However, its commitment to transparency and low fees sets it apart. The company’s mid-market exchange rates without hidden fees have garnered trust among users who prioritize cost-effectiveness in their financial transactions.

Implementation Strategies

To enhance user engagement and retention, Wise has implemented several strategies:

- Feature Expansion: The introduction of features like multi-currency accounts, instant transfers, and the Wise debit card has attracted a diverse customer base.

- User Experience Focus: Continuous improvements to the app’s interface ensure that users can navigate easily and complete transactions quickly.

- Partnerships: Collaborations with financial institutions like Standard Chartered have expanded Wise’s reach and service offerings globally.

Risk Considerations

While Wise has established itself as a leader in the digital payments space, there are inherent risks:

- Regulatory Challenges: As a fintech company operating across various jurisdictions, Wise must navigate complex regulatory environments that can impact operations.

- Market Competition: The increasing number of competitors entering the market could affect Wise’s market share and pricing strategies.

- Technological Vulnerabilities: Cybersecurity threats pose risks to user data and transaction integrity; thus, Wise must invest continuously in security measures.

Regulatory Aspects

Wise operates under strict regulatory frameworks set by authorities such as the Financial Conduct Authority (FCA) in the UK. Compliance with anti-money laundering (AML) regulations and Know Your Customer (KYC) requirements is paramount for maintaining operational legitimacy and customer trust.

Compliance Measures

- Identity Verification: Users must verify their identity upon account creation by providing personal identification documents.

- Transaction Monitoring: Continuous monitoring of transactions helps detect suspicious activities that could indicate fraud or money laundering.

Future Outlook

The future looks promising for Wise as it continues to innovate and expand its services. Key trends influencing its trajectory include:

- Increased Demand for Cross-Border Payments: As globalization continues, more individuals and businesses will seek efficient ways to transfer money internationally.

- Technological Advancements: Ongoing investments in technology will enhance transaction speed and security features within the app.

- Expansion into New Markets: Wise aims to penetrate emerging markets where demand for affordable financial services is growing rapidly.

In conclusion, the Wise app not only facilitates international money transfers but also serves as a comprehensive financial management tool for users worldwide. Its focus on transparency, low costs, and user experience positions it well within the competitive landscape of fintech solutions.

Frequently Asked Questions About Does Wise Have An App

- What features does the Wise app offer?

The Wise app allows users to send money internationally at mid-market rates, manage multi-currency accounts, perform instant transfers, and access a debit card for spending abroad. - How does Wise ensure transaction security?

Wise employs advanced encryption technologies and complies with regulatory standards to protect user data and ensure secure transactions. - Is there a fee for using the Wise app?

While Wise charges competitive fees for currency conversion and transfers, these are typically lower than traditional banks. Users can check specific fees within the app before making transactions. - Can I use the Wise app for business purposes?

Yes, businesses can utilize the Wise app for managing international payments efficiently with features tailored for business needs. - How does Wise compare to traditional banks?

Wise generally offers lower fees and faster transaction times compared to traditional banks while providing transparent pricing without hidden charges. - Is customer support available through the app?

The Wise app includes access to customer support resources; however, direct contact may be limited compared to traditional banking services. - What currencies can I hold in my Wise account?

You can hold over 40 different currencies in your Wise account, making it easy to manage international finances. - How do I get started with the Wise app?

You can download the app from your device’s app store, create an account by verifying your identity, and start using its features immediately.

This comprehensive analysis highlights how Wise’s mobile application serves as a pivotal tool for managing international finances effectively while addressing current market trends and future growth potential.