Wise, formerly known as TransferWise, is a popular financial technology company that specializes in international money transfers and multi-currency accounts. It provides users with the ability to send money across borders at competitive rates, utilizing the mid-market exchange rate and low fees. However, many users wonder about the transfer limits associated with Wise accounts. Understanding these limits is crucial for individuals and businesses planning to make significant transactions.

Wise imposes various transfer limits depending on several factors, including the type of account (personal or business), the payment method, and the currencies involved. This structured approach ensures compliance with financial regulations and enhances security for users.

| Key Concept | Description/Impact |

|---|---|

| Account Types | Wise offers both personal and business accounts, each with different transfer limits. |

| Payment Methods | Transfer limits vary based on whether users are sending money via bank transfer, ACH, debit/credit cards, or SWIFT. |

| Currency Variations | The maximum amount that can be sent depends on the currency being transferred; for example, USD transfers have specific caps. |

| Compliance and Security | Limits are set to comply with regulatory requirements and enhance user security against fraud. |

| High-Value Transfers | Users can often negotiate higher limits for significant transactions by contacting Wise support. |

Market Analysis and Trends

The global remittance market is rapidly evolving, with increasing demand for fast, affordable, and secure money transfer services. Wise has positioned itself favorably within this competitive landscape by offering:

- Low Fees: Wise charges minimal fees compared to traditional banks, making it an attractive option for both personal and business users.

- Mid-Market Exchange Rates: Unlike many competitors who add a markup on exchange rates, Wise provides users with the mid-market rate, ensuring transparency.

- High Transfer Limits: Generally, Wise allows transfers of up to 1 million USD for bank transfers and 6 million USD when using a Wise account balance. This flexibility appeals to high-value customers.

As of 2024, Wise has processed approximately £118.5 billion in cross-border payments, indicating robust growth and increasing user trust in its platform.

Implementation Strategies

To effectively utilize Wise’s services while adhering to transfer limits:

- Understand Your Account Type: Determine whether you need a personal or business account based on your transaction needs.

- Choose the Right Payment Method: Different methods have varying limits; for instance:

- Bank transfers can reach up to 1 million USD.

- ACH payments are limited to 50,000 USD per day.

- Credit/debit card transactions are capped at 2,000 USD per day.

- Plan Large Transfers: For high-value transactions exceeding standard limits, consider splitting payments into multiple transfers or contacting Wise support for potential limit increases.

Risk Considerations

While Wise provides a secure platform for transferring funds internationally, users should remain aware of several risks:

- Regulatory Compliance: Users must ensure compliance with local laws regarding large transactions. Financial institutions often report transactions over 10,000 USD to authorities.

- Fraud Prevention: Although Wise employs advanced security measures, users should remain vigilant against phishing attempts or fraudulent activities.

- Market Fluctuations: Currency values can fluctuate significantly during the transfer process. Users should be aware that rates may change between initiating a transfer and its completion.

Regulatory Aspects

Wise operates under strict regulatory frameworks in various jurisdictions. The company is regulated by multiple financial authorities globally, including:

- Financial Conduct Authority (FCA) in the UK

- Financial Crimes Enforcement Network (FinCEN) in the US

- Other regulatory bodies depending on the country of operation

These regulations mandate that Wise implement specific transfer limits to prevent money laundering and ensure customer safety. Users are encouraged to familiarize themselves with these regulations as they pertain to their specific location.

Future Outlook

Looking ahead, Wise is poised for continued growth due to several factors:

- Expansion of Services: The company is constantly enhancing its offerings by integrating new features like invoicing for businesses and expanding its currency options.

- Increased Demand for Cross-Border Payments: As globalization continues to rise, more individuals and businesses will seek reliable methods for international transactions.

- Technological Advancements: Innovations in fintech will likely lead to improved user experiences and possibly higher transfer limits as systems become more secure.

In conclusion, understanding Wise’s transfer limits is essential for effective money management in an increasingly interconnected world. By leveraging its competitive advantages while remaining aware of regulatory requirements and market trends, users can maximize their financial operations through Wise’s platform.

Frequently Asked Questions About Does Wise Have A Transfer Limit

- What is the maximum amount I can send using Wise?

Wise allows transfers up to 1 million USD per transaction for bank transfers and up to 6 million USD when using a Wise account balance. - Are there daily or monthly limits on transfers?

While there are no strict daily limits on bank transfers, ACH payments are limited to 50,000 USD per day. - Can I increase my transfer limit?

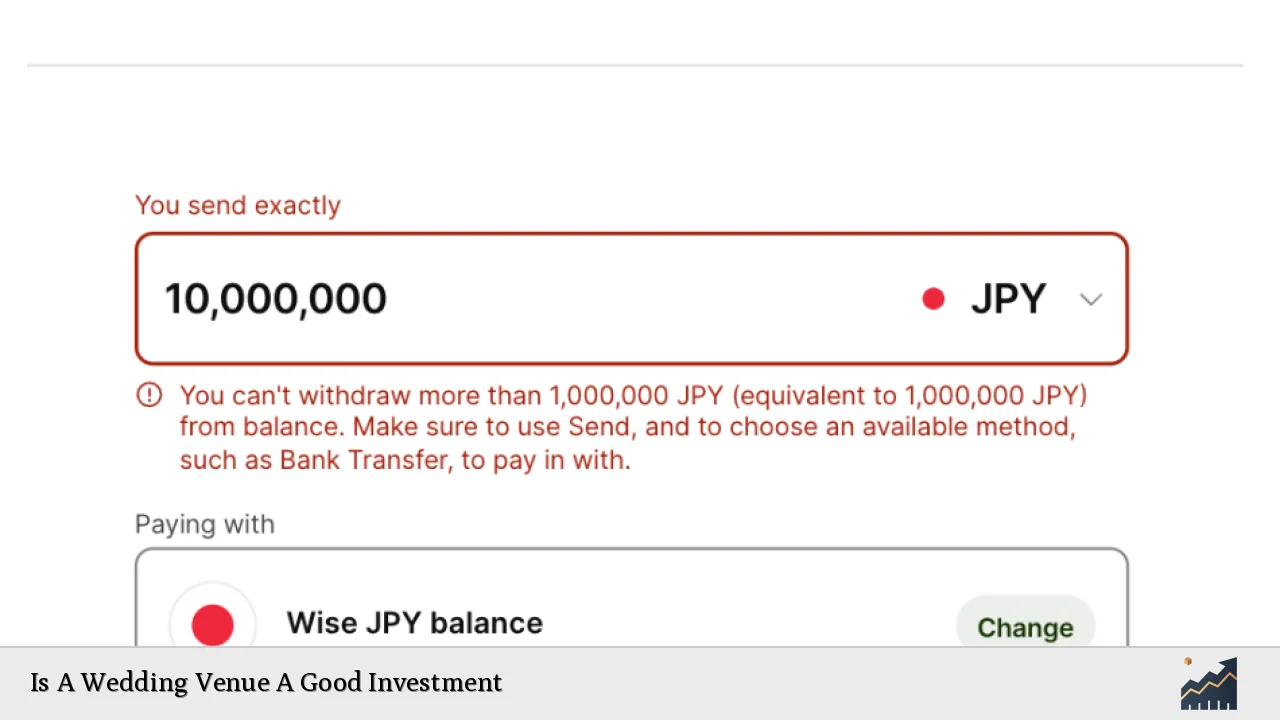

If you require higher limits for significant transactions, you can contact Wise support to discuss your options. - What happens if I exceed my transfer limit?

If you exceed your limit during a transaction setup, you will receive a notification. You may need to split your payment into smaller amounts. - Are there fees associated with high-value transfers?

Yes, while fees are generally low compared to traditional banks, they may vary based on the amount being transferred. - How does Wise ensure security during transfers?

Wise employs advanced security features including two-factor authentication and regulatory compliance measures to protect user funds. - What should I do if I encounter issues with my transfer?

If you face any problems or have questions regarding your transfer limits or transactions, you can reach out to Wise’s customer support for assistance. - Can businesses benefit from higher transfer limits?

Yes! Business accounts often have higher limits compared to personal accounts and may also qualify for additional features tailored for frequent high-value transactions.

This comprehensive overview of Wise’s transfer limits provides valuable insights into how individuals and businesses can effectively utilize its services while navigating potential challenges.