Pocket Network is a decentralized protocol designed to provide reliable data relay services between various blockchain networks and decentralized applications (dApps). At the core of its ecosystem is the POKT token, which not only serves as the native cryptocurrency but also plays a crucial role in governance within the Pocket Network. This article delves into the governance structure associated with POKT, its implications for stakeholders, and the broader context of Pocket Network’s operations.

| Key Concept | Description/Impact |

|---|---|

| POKT Token | The native cryptocurrency of Pocket Network used for payments, staking, and governance participation. |

| Governance Model | POKT holders can vote on proposals affecting the network, ensuring community involvement in decision-making. |

| Staking Mechanism | Node operators must stake POKT to participate in the network, which enhances security and decentralization. |

| Decentralized Infrastructure | Pocket Network operates a decentralized network of nodes that relay data requests, promoting resilience and efficiency. |

| Economic Incentives | The structure encourages node operation and participation through rewards distributed in POKT tokens. |

Market Analysis and Trends

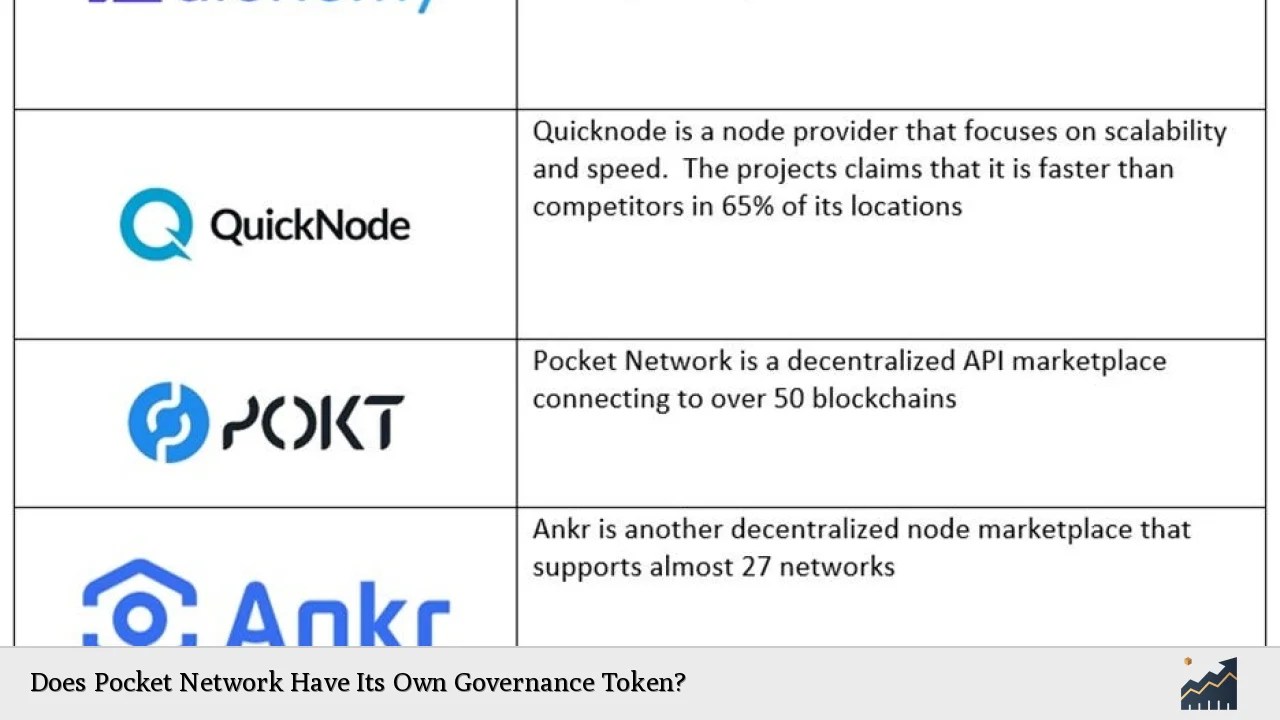

The Pocket Network operates within a rapidly evolving landscape of blockchain technology, where demand for decentralized infrastructure is surging. As developers increasingly seek alternatives to centralized RPC providers like Infura, Pocket Network positions itself as a critical player by offering a decentralized solution that enhances data accessibility across multiple blockchains.

Current Market Statistics

- Market Capitalization: As of December 2024, Pocket Network’s market cap stands at approximately $82 million.

- Token Price: The current price of POKT is around $0.050, reflecting a volatile market influenced by broader cryptocurrency trends.

- Node Growth: The network has expanded to over 24,000 nodes globally, facilitating billions of relays per day.

Trends Influencing Pocket Network

- Increased Decentralization: As Web3 applications proliferate, there is a growing emphasis on decentralized solutions that reduce reliance on centralized entities.

- Regulatory Scrutiny: Heightened regulatory focus on cryptocurrency projects may impact operational strategies and governance frameworks within Pocket Network.

- Technological Advancements: Upgrades like the Shannon protocol aim to enhance scalability and decentralization further, positioning Pocket Network for future growth.

Implementation Strategies

To effectively leverage its governance token and enhance its market position, Pocket Network employs several strategic initiatives:

- Community Engagement: By empowering POKT holders to vote on key proposals, the network fosters a sense of ownership among its users. This participatory approach not only strengthens community ties but also ensures that decisions reflect collective interests.

- Staking Incentives: The requirement for node operators to stake POKT creates an economic barrier that promotes commitment to network integrity. This mechanism discourages malicious behavior while rewarding participants with additional tokens based on their contributions.

- Partnership Development: Collaborating with other blockchain projects enhances interoperability and broadens the user base for Pocket Network’s services. These partnerships can lead to increased demand for POKT as more developers integrate with the platform.

Risk Considerations

Investing in Pocket Network and its governance token involves several risks that potential investors should consider:

- Market Volatility: The cryptocurrency market is notoriously volatile. Price fluctuations can significantly impact the value of POKT and investor returns.

- Regulatory Risks: As governments around the world continue to develop regulations for cryptocurrencies, Pocket Network may face compliance challenges that could affect its operations.

- Technological Risks: Dependence on blockchain technology means that any vulnerabilities or failures in the underlying infrastructure could have severe implications for network performance and security.

Regulatory Aspects

The regulatory landscape surrounding cryptocurrencies is complex and constantly evolving. For Pocket Network, compliance with regulations is crucial for maintaining legitimacy and fostering trust among users. Key considerations include:

- Securities Regulations: Depending on jurisdiction, POKT may be classified as a security. This classification would require adherence to specific regulatory frameworks governing securities offerings.

- Data Privacy Laws: Given that Pocket Network facilitates data relays across various platforms, adherence to data protection regulations (like GDPR) is essential to avoid legal repercussions.

- Tax Implications: Investors should be aware of the tax obligations associated with trading or holding cryptocurrencies like POKT in their respective jurisdictions.

Future Outlook

The future of Pocket Network appears promising as it continues to carve out its niche within the decentralized infrastructure space. Key factors influencing its trajectory include:

- Growing Demand for Decentralized Services: As more developers seek decentralized alternatives for application infrastructure, Pocket Network stands to benefit from increased usage of its services.

- Technological Innovations: Continued enhancements to its protocols will likely improve efficiency and attract more users, further driving demand for POKT tokens.

- Community Development: Strengthening community engagement through governance will ensure that user interests are prioritized in future developments, fostering loyalty and long-term growth.

Frequently Asked Questions About Does Pocket Network Have Its Own Governance Token?

- What is the role of the POKT token in Pocket Network?

The POKT token serves multiple purposes including payments for services within the network, staking for node operators, and governance participation where holders can vote on proposals affecting the network. - How does governance work within Pocket Network?

POKT holders participate in a decentralized governance model where they can vote on important proposals related to protocol upgrades and operational changes. - What are the benefits of staking POKT tokens?

Staking POKT tokens allows users to earn rewards while contributing to network security. It also grants them voting power in governance decisions. - How does Pocket Network ensure decentralization?

The network operates through a global array of independent nodes that relay requests without relying on centralized infrastructure. - What risks should investors be aware of?

Investors should consider market volatility, regulatory risks, and potential technological vulnerabilities when investing in POKT. - What future developments can we expect from Pocket Network?

Future developments may include enhancements to scalability through protocol upgrades and increased partnerships with other blockchain projects. - How does Pocket Network generate revenue?

The network generates revenue through transaction fees paid by developers using its services and incentivizes node operators with rewards from these fees. - Is there a maximum supply of POKT tokens?

The total supply of POKT tokens is capped at 1 billion tokens; however, inflationary mechanisms are in place based on network usage.

In conclusion, Pocket Network’s governance token plays a pivotal role in shaping its ecosystem by empowering users through participatory governance while ensuring robust economic incentives align with network growth. With ongoing developments and increasing adoption of decentralized technologies, Pocket Network is well-positioned for continued success in the evolving landscape of blockchain infrastructure.