Investors often face the decision of whether to invest in mutual funds or exchange-traded funds (ETFs). Both investment vehicles offer unique advantages and disadvantages, making them suitable for different types of investors and investment strategies. Understanding the key differences, market trends, and strategic considerations can help investors make informed decisions that align with their financial goals.

| Key Concept | Description/Impact |

|---|---|

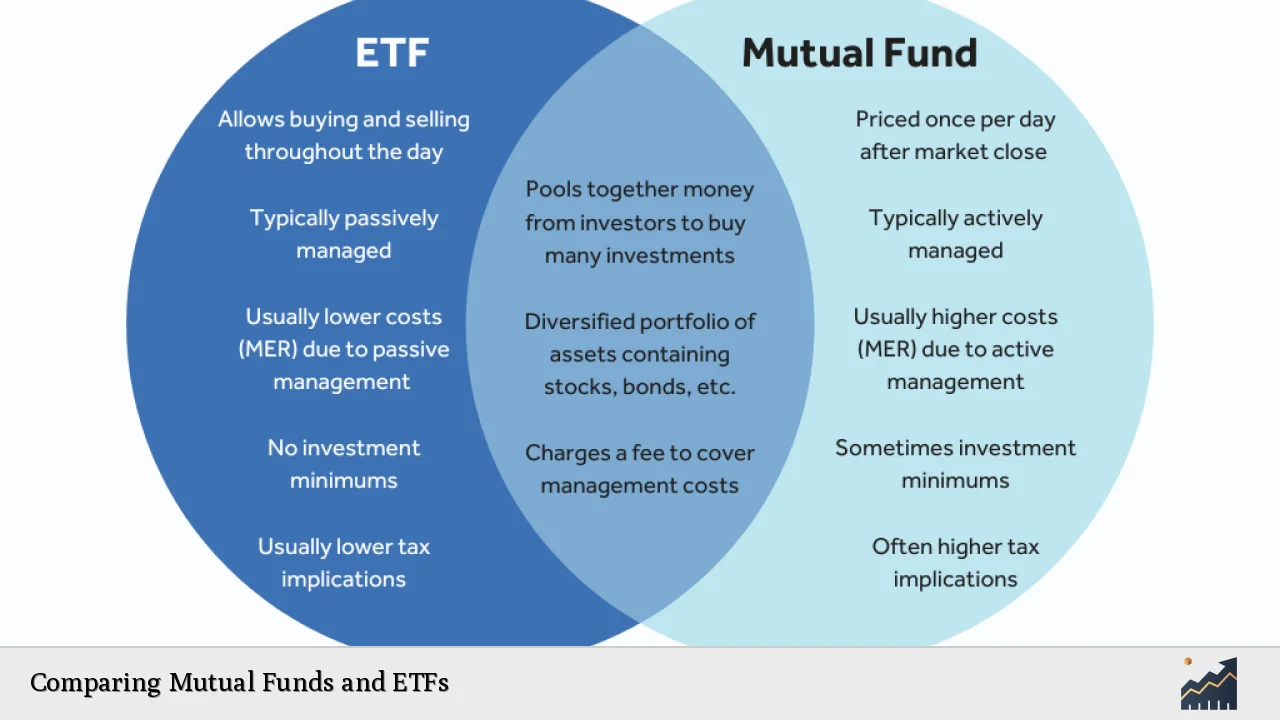

| Trading Flexibility | ETFs can be traded throughout the day on stock exchanges like individual stocks, allowing for real-time pricing and liquidity. In contrast, mutual funds are only traded at the end of the trading day at their net asset value (NAV). |

| Management Style | Mutual funds are typically actively managed, which may lead to higher fees but potentially greater returns. ETFs are mostly passively managed, tracking indices to minimize costs. |

| Tax Efficiency | ETFs generally offer better tax efficiency due to their structure, which allows for in-kind redemptions that minimize capital gains distributions. Mutual funds may incur capital gains taxes from frequent trading within the fund. |

| Cost Structure | ETFs usually have lower expense ratios compared to mutual funds. However, investors must consider trading commissions when buying ETFs, which can affect overall costs. |

| Investment Minimums | Mutual funds often have minimum investment requirements that can be substantial, while ETFs can be purchased per share without a minimum investment. |

| Accessibility | ETFs are more accessible for individual investors due to their availability on stock exchanges and lower entry costs. Mutual funds may require navigating through fund companies or brokers. |

| Investor Behavior | The choice between mutual funds and ETFs can reflect investor behavior; ETFs attract those who prefer active trading, while mutual funds appeal to long-term investors seeking professional management. |

| Market Trends | The ETF market has seen significant growth, with assets under management reaching approximately $9 trillion globally as of 2024, driven by increasing retail participation and innovation in product offerings. |

Market Analysis and Trends

The investment landscape has evolved dramatically over the past decade, with ETFs gaining popularity at an unprecedented rate. As of 2024, ETFs represent about 13% of equity assets in the U.S., up from just over 10% in 2019. This growth is fueled by several factors:

- Increased Retail Participation: Individual investors have increasingly turned to ETFs for their perceived advantages in cost and flexibility. Retail ownership of ETFs has surged to nearly $1.4 trillion, representing 19% of total ETF assets.

- Innovation in Products: The introduction of actively managed ETFs has broadened the appeal of this investment vehicle. Active ETFs now account for approximately 7% of total U.S. ETF assets, signaling a shift towards more dynamic investment strategies.

- Tax Efficiency: The structural advantages of ETFs allow them to maintain lower capital gains distributions compared to mutual funds, making them particularly attractive in taxable accounts.

- Global Expansion: The ETF market is not limited to the U.S.; it is expanding rapidly in regions like Europe and Asia-Pacific, where younger investors are increasingly adopting these products.

Implementation Strategies

When considering whether to invest in mutual funds or ETFs, investors should evaluate their specific needs and circumstances:

- Investment Goals: For long-term growth with minimal trading activity, mutual funds may be suitable due to their professional management. Conversely, if an investor seeks flexibility and lower costs, ETFs might be more appropriate.

- Tax Considerations: Investors in high tax brackets may prefer ETFs due to their tax efficiency. However, those investing through tax-deferred accounts (like IRAs) might not see a significant difference.

- Market Conditions: In volatile markets where quick access to liquidity is crucial, ETFs provide a significant advantage due to their ability to be traded intraday.

- Cost Analysis: Investors should compare expense ratios alongside potential trading costs associated with ETF transactions. While ETFs generally have lower fees, frequent trading can diminish those savings.

Risk Considerations

Both mutual funds and ETFs carry inherent risks that investors must consider:

- Market Risk: Both investment types are subject to market fluctuations. An investor’s portfolio value can decline based on market performance regardless of the fund structure.

- Management Risk: Actively managed mutual funds may underperform their benchmarks if fund managers fail to make successful investment decisions. Similarly, actively managed ETFs face the same risks.

- Liquidity Risk: While ETFs offer intraday trading flexibility, they can be subject to liquidity issues during market downturns if trading volumes drop significantly.

- Expense Ratios: Higher fees associated with actively managed mutual funds can erode returns over time compared to low-cost index-tracking ETFs.

Regulatory Aspects

The regulatory environment surrounding mutual funds and ETFs has evolved significantly:

- SEC Oversight: Both types of funds are regulated by the Securities and Exchange Commission (SEC), which mandates transparency through regular reporting requirements.

- New Regulations: Recent amendments require all mutual funds and ETFs to file monthly portfolio disclosures, enhancing transparency for investors regarding fund holdings.

- Tax Regulations: Mutual funds must distribute capital gains annually if they sell securities at a profit; this requirement does not apply as stringently to ETFs due to their unique redemption structure.

Future Outlook

The future of mutual funds and ETFs looks promising but will likely continue evolving:

- Continued Growth of ETFs: With assets projected to reach approximately $88 trillion by 2030, driven by innovation and increased adoption among retail investors, ETFs are expected to dominate the investment landscape.

- Shift Towards Passive Management: The trend towards passive investing shows no signs of reversing; over $4 trillion has flowed into passive strategies over the past decade.

- Technological Integration: Advancements in technology will further enhance ETF accessibility and efficiency in trading platforms, likely attracting more investors seeking low-cost options.

Frequently Asked Questions About Comparing Mutual Funds and ETFs

- What is the primary difference between mutual funds and ETFs?

The main difference lies in how they are traded; ETFs trade like stocks throughout the day on exchanges while mutual fund transactions occur at the end of each trading day at NAV. - Are mutual funds or ETFs better for tax efficiency?

Generally, ETFs are more tax-efficient due to their structure that minimizes capital gains distributions compared to mutual funds. - Can I invest in both mutual funds and ETFs?

Yes, many investors choose a combination of both based on their financial goals and strategies. - What type of investor is best suited for mutual funds?

Investors looking for professional management without needing daily attention may prefer mutual funds. - How do fees compare between mutual funds and ETFs?

ETFs typically have lower expense ratios than mutual funds; however, potential trading commissions should also be considered when evaluating overall costs. - Is it possible for an ETF to be actively managed?

Yes, there are actively managed ETFs that seek to outperform benchmarks through strategic investments. - What should I consider before switching from mutual funds to ETFs?

You should evaluate your investment strategy, tax implications, trading preferences, and any fees associated with selling your current investments. - How do I choose between a mutual fund or an ETF?

Your choice should depend on your investment goals, risk tolerance, cost considerations, and whether you prefer active or passive management.

In conclusion, both mutual funds and exchange-traded funds offer distinct advantages that cater to different investor needs. By understanding these differences along with current market trends and strategic considerations outlined above, investors can make informed decisions that align with their financial objectives.