Yes, you can obtain a Home Equity Line of Credit (HELOC) on an investment property. This financial product allows property owners to borrow against the equity they have built in their real estate. Unlike traditional mortgages, HELOCs provide a revolving line of credit, which means you can withdraw funds as needed up to a certain limit. This flexibility makes them appealing for investors looking to finance renovations, cover unexpected expenses, or even make additional investments without liquidating other assets.

However, obtaining a HELOC on an investment property comes with its own set of challenges and requirements. Lenders typically impose stricter criteria compared to those for primary residences. This article will explore the intricacies of securing a HELOC for investment properties, including eligibility requirements, potential uses, and the application process.

| Key Feature | Description |

|---|---|

| HELOC Definition | A revolving line of credit secured by the equity in your investment property. |

| Common Uses | Renovations, covering repairs, or purchasing additional properties. |

Understanding HELOCs for Investment Properties

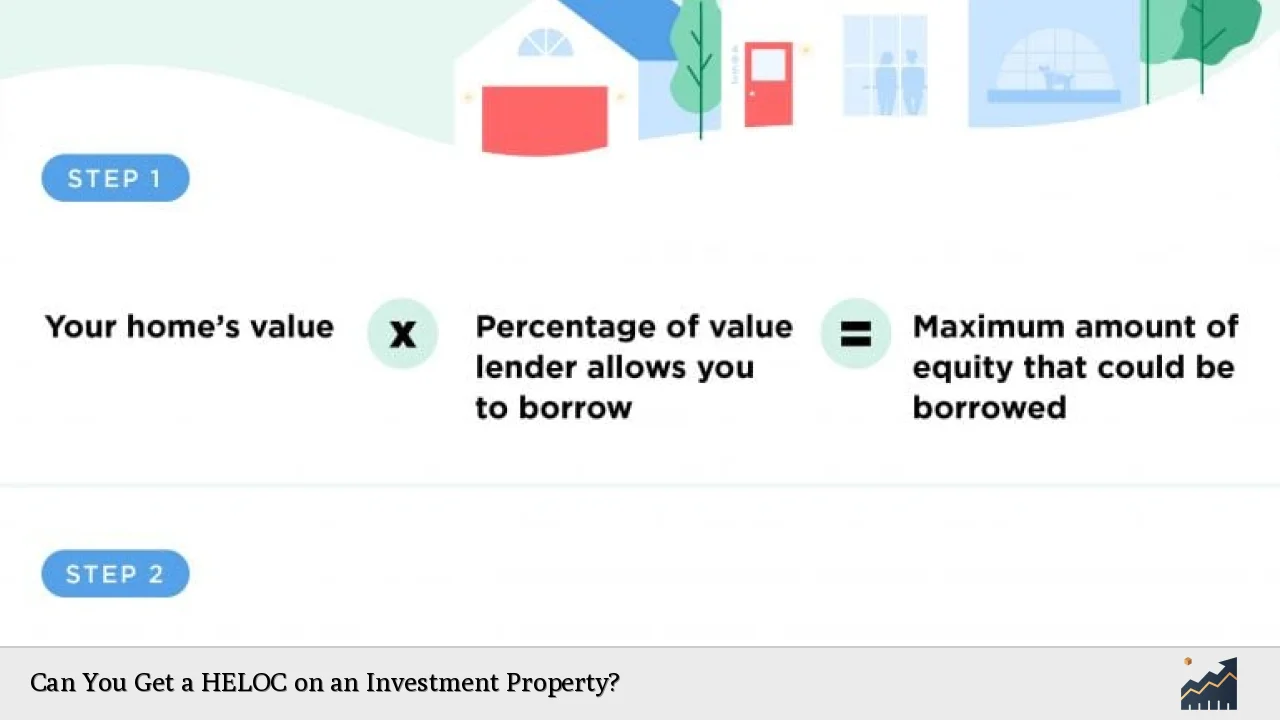

A HELOC functions similarly to a credit card but is secured by your property. You can borrow against the equity you have in your investment property, which is calculated as the difference between the property’s current market value and the outstanding mortgage balance. The amount you can borrow typically depends on the loan-to-value (LTV) ratio set by lenders.

Investment properties are generally defined as real estate purchased primarily for generating income rather than for personal use. Common examples include rental homes, vacation rentals, and commercial properties. When you take out a HELOC on such properties, it allows you to access funds without selling your asset.

The draw period for a HELOC usually lasts around ten years, during which you can withdraw funds and make interest-only payments. After this period ends, you enter the repayment phase where both principal and interest payments are required.

Requirements for Obtaining a HELOC on an Investment Property

Securing a HELOC on an investment property involves meeting several stringent requirements that differ from those needed for primary residences. Here are some common criteria:

- Credit Score: Most lenders require a minimum credit score of 720 for investment properties, compared to around 620 for primary residences.

- Debt-to-Income Ratio: A lower debt-to-income (DTI) ratio is often required; many lenders prefer a DTI of less than 43%.

- Home Equity: You typically need at least 20% equity in the property to qualify.

- Loan-to-Value Ratio: The maximum LTV ratio is generally capped at 80%, meaning you cannot borrow more than 80% of your property’s value.

- Cash Reserves: Many lenders expect borrowers to have significant cash reserves—often at least six months’ worth of mortgage payments—to demonstrate financial stability.

These requirements reflect the higher risk lenders perceive when financing investment properties compared to primary homes.

The Application Process

Applying for a HELOC on an investment property involves several key steps:

- Assess Your Finances: Before applying, evaluate your financial situation. Calculate your property’s current value and determine how much equity you have available.

- Research Lenders: Not all lenders offer HELOCs on investment properties. It’s essential to shop around and compare terms from various financial institutions.

- Prepare Documentation: Gather necessary documents such as income statements, tax returns, and proof of rental income if applicable. Lenders will scrutinize your financial history closely.

- Submit Your Application: Complete the application process with your chosen lender. Be prepared for an appraisal of your property to establish its current market value.

- Wait for Approval: The approval process may take anywhere from a few days to several weeks, depending on the lender’s procedures and workload.

- Close the Loan: Upon approval, you’ll finalize the loan agreement and gain access to your funds.

Pros and Cons of Using a HELOC on Investment Properties

Using a HELOC can be beneficial but also comes with certain drawbacks that investors should consider:

Pros

- Access to Funds: A HELOC provides quick access to cash without needing to sell or refinance your property.

- Flexible Use: Funds can be used for various purposes like renovations or covering unexpected costs.

- Potential Tax Benefits: Interest paid on a HELOC may be tax-deductible if used for improving the rental property.

Cons

- Higher Interest Rates: Interest rates for investment property HELOCs are often higher than those for primary residences due to increased risk for lenders.

- Stricter Qualification Requirements: Meeting the stringent criteria can be challenging, especially if your financial situation is not robust.

- Risk of Foreclosure: Defaulting on payments could lead to foreclosure since your property is collateralized against the loan.

Common Uses of a HELOC on Investment Properties

Investors often utilize funds from a HELOC in various strategic ways:

- Property Improvements: Renovating or upgrading an investment property can increase its market value and rental income potential.

- Down Payment Assistance: Investors may use HELOC funds as down payments when purchasing additional rental properties, allowing them to expand their portfolios without liquidating other assets.

- Covering Vacancies or Repairs: A HELOC can provide cash flow during periods of vacancy or unexpected repairs that may arise with rental properties.

Alternatives to HELOCs for Investment Properties

While HELOCs offer flexibility and access to funds, there are alternative financing options that investors might consider:

- Home Equity Loans: Unlike HELOCs, these loans provide a lump sum payment with fixed interest rates but require similar qualification standards.

- Cash-Out Refinancing: This option allows homeowners to refinance their existing mortgage while borrowing additional funds based on their home equity.

- Personal Loans: For smaller amounts or short-term needs, personal loans may be easier to obtain but often come with higher interest rates compared to secured loans like HELOCs.

FAQs About Can You Get a HELOC on an Investment Property

- Can you do a HELOC on an investment property?

Yes, while your selection of lenders may be smaller and qualification requirements stricter. - What is the maximum LTV ratio for an investment property HELOC?

The maximum loan-to-value ratio is typically around 80%. - Can I write off interest from my investment property HELOC?

Yes, if used for improvements on the rental property. - What credit score do I need for an investment property HELOC?

A minimum credit score of 720 is usually required. - How long does it take to get approved for a HELOC?

The approval process can take anywhere from days to weeks depending on the lender.

In summary, obtaining a HELOC on an investment property is possible but requires careful consideration of various factors including eligibility requirements and potential risks involved. By understanding these elements and preparing adequately, investors can effectively leverage their property’s equity to enhance their financial strategies.