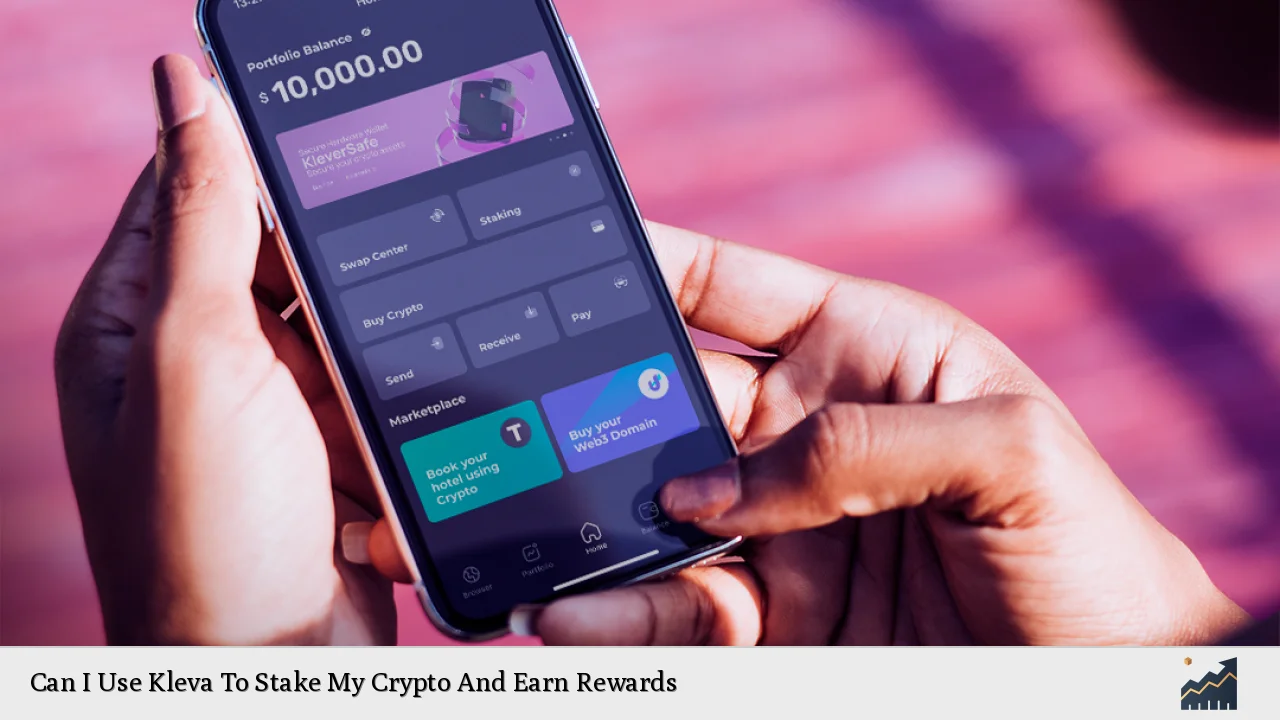

Kleva Protocol is revolutionizing the decentralized finance (DeFi) landscape by offering innovative leveraged yield farming opportunities on the Klaytn blockchain. This protocol allows users to maximize their crypto holdings’ potential through staking and earning rewards. By bringing together lenders and farmers, Kleva creates an ecosystem where participants can amplify their yields and generate passive income.

| Key Concept | Description/Impact |

|---|---|

| Leveraged Yield Farming | Allows users to borrow funds to increase their position, potentially earning higher yields |

| Under-Collateralized Loans | Enhances capital efficiency, resulting in higher APYs for both farmers and lenders |

| Multiple Investment Strategies | Offers various tactics for earning money, including lending, position hedging, and long/short positions |

| Economic Incentives | KLEVA tokens capture protocol incentives, with performance fees rewarded to ibKLEVA stakers |

Market Analysis and Trends

The DeFi sector continues to evolve rapidly, with protocols like Kleva at the forefront of innovation. As of December 2024, the total value locked (TVL) in DeFi protocols has reached new heights, indicating growing investor confidence in decentralized financial services. Kleva Protocol has positioned itself as a key player in this expanding market by offering unique features that address common pain points in traditional DeFi staking.

Ethereum, the largest smart contract platform, has seen robust growth in staking activities despite market challenges. Over 60% of Ethereum stakers are currently in profit, with the staking ratio increasing to 28.89% of the total ETH supply. This trend underscores the growing appetite for staking opportunities across the crypto ecosystem, which bodes well for platforms like Kleva that offer enhanced staking capabilities.

The rise of leveraged yield farming, as pioneered by Kleva, represents a significant shift in how users interact with DeFi protocols. By allowing users to amplify their positions, Kleva taps into the market’s desire for higher yields in a low-interest-rate environment. This approach has attracted both retail and institutional investors looking to maximize their returns on crypto assets.

Implementation Strategies

To use Kleva for staking and earning rewards, users should follow these strategic steps:

- Asset Selection: Choose the cryptocurrencies you wish to stake. Kleva supports various assets on the Klaytn blockchain.

- Platform Familiarization: Understand Kleva’s interface and features. The protocol offers multiple investment strategies, so it’s crucial to select the one that aligns with your risk tolerance and investment goals.

- Wallet Connection: Connect a compatible wallet to the Kleva platform. Ensure your wallet supports Klaytn-based tokens.

- Deposit Funds: Transfer your chosen assets to the Kleva protocol. This step may involve bridging assets if they’re not native to the Klaytn network.

- Strategy Selection: Choose between lending, farming, or leveraged positions. Each option comes with different risk-reward profiles.

- Position Management: Regularly monitor your positions. Kleva’s leveraged strategies require active management to optimize returns and mitigate risks.

- Reward Claiming: Periodically claim your earned rewards. Depending on the strategy, rewards may be in KLEVA tokens or other supported assets.

It’s important to note that while Kleva offers the potential for higher yields through leverage, it also comes with increased risks. Users should carefully consider their risk appetite and investment horizon before engaging in leveraged strategies.

Risk Considerations

While Kleva Protocol offers attractive staking and farming opportunities, users must be aware of the associated risks:

- Market Volatility: Cryptocurrency markets are highly volatile. Leveraged positions can amplify both gains and losses.

- Smart Contract Risk: As with all DeFi protocols, there’s an inherent risk of smart contract vulnerabilities or exploits.

- Liquidation Risk: Leveraged positions may face liquidation if market movements are unfavorable.

- Impermanent Loss: When providing liquidity to farming pools, users may experience impermanent loss if asset prices diverge significantly.

- Platform Risk: The overall health and sustainability of the Kleva Protocol and the Klaytn ecosystem can impact user investments.

To mitigate these risks, users should:

- Diversify their investments across multiple strategies and platforms

- Use stop-loss orders and other risk management tools

- Regularly monitor market conditions and adjust positions accordingly

- Only invest funds they can afford to lose

- Stay informed about protocol updates and potential vulnerabilities

Regulatory Aspects

The regulatory landscape for DeFi protocols like Kleva is still evolving. As of 2024, many jurisdictions are working to establish clear guidelines for decentralized financial services. Users should be aware of the following regulatory considerations:

- Jurisdiction-Specific Rules: Some countries may have restrictions on leveraged crypto trading or yield farming activities.

- Tax Implications: Earnings from staking and farming may be subject to capital gains or income tax, depending on local regulations.

- KYC/AML Compliance: While Kleva operates on a decentralized protocol, users may need to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations when using centralized on-ramps or off-ramps.

- Regulatory Uncertainty: The rapid evolution of DeFi may lead to new regulations that could impact Kleva’s operations or user accessibility.

It’s crucial for users to consult with legal and tax professionals to ensure compliance with local laws and regulations when using Kleva or any DeFi platform.

Future Outlook

The future of Kleva Protocol and similar DeFi platforms looks promising, driven by several key factors:

Technological Advancements: Ongoing improvements in blockchain technology, particularly in scalability and interoperability, are likely to enhance Kleva’s capabilities and user experience.

Market Maturation: As the DeFi sector matures, we can expect more sophisticated risk management tools and strategies to emerge, potentially making leveraged yield farming more accessible to a broader audience.

Institutional Adoption: Increased interest from institutional investors could bring more liquidity and stability to platforms like Kleva, potentially leading to more competitive yields and diverse investment options.

Cross-Chain Integration: The trend towards multi-chain DeFi ecosystems may see Kleva expanding beyond the Klaytn blockchain, offering users access to a wider range of assets and liquidity pools.

Regulatory Clarity: As regulatory frameworks for DeFi become more defined, compliant platforms like Kleva may gain a competitive advantage and attract users seeking more secure and legally sound investment options.

In conclusion, Kleva Protocol offers a compelling opportunity for users to stake their crypto and earn rewards through innovative leveraged yield farming strategies. While the potential for high yields is attractive, users must approach these opportunities with caution, understanding the risks involved and staying informed about market conditions and regulatory developments. As the DeFi landscape continues to evolve, platforms like Kleva are likely to play a significant role in shaping the future of decentralized finance.

Frequently Asked Questions About Can I Use Kleva To Stake My Crypto And Earn Rewards

- What cryptocurrencies can I stake on Kleva Protocol?

Kleva Protocol primarily supports staking and farming with Klaytn-based tokens. The exact list of supported assets may vary, but it typically includes KLAY, KLEVA, and other popular tokens on the Klaytn blockchain. - How does leveraged yield farming work on Kleva?

Leveraged yield farming on Kleva allows users to borrow additional funds to increase their farming position. This amplifies potential returns but also increases risk. Users can typically leverage their positions up to a certain multiple, depending on the specific pool and market conditions. - What are the potential returns for staking on Kleva?

Returns on Kleva can vary widely depending on the chosen strategy, market conditions, and level of leverage used. Some pools may offer APYs in the double or even triple digits, but it’s important to remember that higher returns come with higher risks. - Is there a minimum amount required to start staking on Kleva?

While Kleva doesn’t typically impose a strict minimum, the practical minimum may be determined by gas fees on the Klaytn network and the specific requirements of individual farming pools. It’s generally advisable to start with a sufficient amount to ensure that potential returns outweigh transaction costs. - How often can I claim my staking rewards on Kleva?

Reward claiming frequency can vary depending on the specific pool or strategy. Some rewards may accrue in real-time and be claimable at any point, while others might have set distribution periods. Users should check the details of their chosen strategy for specific claiming information. - What happens if the market value of my staked assets drops significantly?

In leveraged positions, a significant drop in asset value could lead to liquidation if it falls below the required collateral ratio. For non-leveraged staking, while you wouldn’t face liquidation, the value of your staked assets and rewards would decrease in line with market prices. - Can I unstake my crypto at any time on Kleva?

Most staking positions on Kleva can be exited at any time, subject to network congestion and gas fees. However, some specialized strategies or pools might have lock-up periods or exit fees. Always check the terms of your specific staking arrangement before entering a position.