Kleva Protocol, known for its decentralized finance (DeFi) capabilities on the Klaytn blockchain, has emerged as a notable player in the cryptocurrency market. However, the question of whether users can directly buy or sell cryptocurrencies using Kleva requires a nuanced understanding of its functionalities, trading mechanisms, and market positioning.

Kleva primarily functions as a protocol for leveraged yield farming, allowing users to enhance their liquidity and earn rewards through various DeFi activities. While it provides significant opportunities for earning passive income, direct trading of cryptocurrencies through Kleva is not supported in the same manner as traditional exchanges. Instead, users typically engage with Kleva by utilizing other platforms to facilitate their trading activities.

| Key Concept | Description/Impact |

|---|---|

| Kleva Protocol | A DeFi protocol on the Klaytn blockchain focused on leveraged yield farming. |

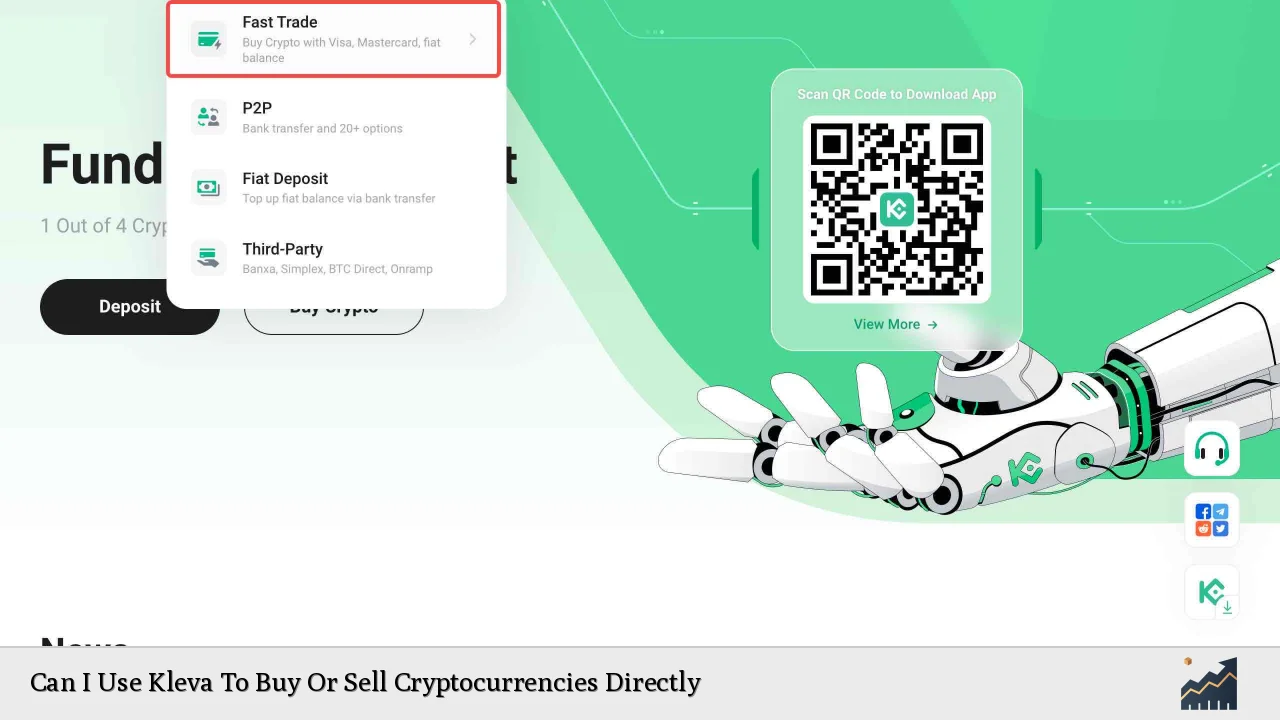

| Direct Trading | Kleva does not support direct buying/selling of cryptocurrencies; trades must occur on external exchanges. |

| Supported Exchanges | Kleva tokens can be traded on platforms like ProBit Exchange, primarily using USDT pairs. |

| Market Positioning | Kleva aims to amplify liquidity and total value locked (TVL) in the DeFi ecosystem. |

| Security Features | Kleva offers robust security measures for asset management but relies on external exchanges for trading. |

Market Analysis and Trends

The cryptocurrency market is characterized by rapid changes and evolving technologies. As of December 2024, Bitcoin has reached significant milestones, hitting an all-time high of approximately $106,000. This surge has not only bolstered Bitcoin’s market cap beyond $2 trillion but also revitalized interest in altcoins like Kleva Protocol.

Current Market Statistics

- Bitcoin (BTC): Trading around $106,000 with a market cap exceeding $2 trillion.

- Kleva Protocol (KLEVA): Currently priced at approximately $0.0442, with a trading volume of about $99.51K over the last 24 hours.

- Total Cryptocurrency Market Cap: Approximately $3.6 trillion.

The overall bullish sentiment in the market has led analysts to predict continued growth across various cryptocurrencies, including potential rebounds for lesser-known tokens like KLEVA.

Implementation Strategies

Investors looking to utilize Kleva for cryptocurrency transactions should consider the following strategies:

- Utilizing Exchanges: Since Kleva does not facilitate direct trading, investors must first acquire stablecoins like USDT on exchanges such as ProBit before converting them into KLEVA.

- Leveraged Yield Farming: Engage with Kleva’s core offering by participating in yield farming to maximize returns while holding KLEVA tokens.

- Diversification: Investors should consider diversifying their portfolios by incorporating both major cryptocurrencies and emerging tokens like KLEVA to balance risk and reward.

Risk Considerations

Investing in cryptocurrencies always carries inherent risks. Here are key considerations:

- Market Volatility: The crypto market is notoriously volatile; prices can fluctuate dramatically within short periods.

- Regulatory Risks: Changes in regulations can impact the usability and legality of certain tokens and exchanges.

- Liquidity Risks: While Kleva aims to enhance liquidity through its DeFi services, actual trading volumes may vary significantly across exchanges.

- Technological Risks: As a protocol built on blockchain technology, vulnerabilities can arise from smart contract bugs or security breaches.

Regulatory Aspects

The regulatory landscape for cryptocurrencies continues to evolve globally. In the United States, the SEC has been actively scrutinizing various crypto assets to determine their status as securities. This scrutiny could influence how protocols like Kleva operate and how tokens are traded.

Key Regulatory Points

- Compliance Requirements: Users must ensure they comply with KYC (Know Your Customer) regulations when using centralized exchanges.

- Tax Implications: Cryptocurrency transactions may have tax consequences that vary by jurisdiction; investors should consult financial advisors regarding their obligations.

Future Outlook

Looking ahead, the future of Kleva Protocol appears cautiously optimistic:

- Market Adoption: As decentralized finance continues to gain traction, protocols like Kleva that offer unique yield farming opportunities may attract more users.

- Price Predictions: Analysts suggest that KLEVA could see price increases in the coming years, potentially reaching levels between $0.11 and $0.20 by 2026 based on current trends and market dynamics.

- Technological Enhancements: Ongoing improvements in blockchain technology could enhance the functionality and appeal of platforms like Kleva.

Frequently Asked Questions About Can I Use Kleva To Buy Or Sell Cryptocurrencies Directly

- Can I buy cryptocurrencies directly through Kleva?

No, Kleva does not support direct purchases; transactions must occur via external exchanges. - What exchanges support KLEVA?

KLEVA is primarily traded on ProBit Exchange using USDT pairs. - Is it safe to use Kleva for yield farming?

Kleva offers robust security features; however, all investments carry risks inherent in DeFi protocols. - What are the risks associated with investing in KLEVA?

Market volatility, regulatory changes, and liquidity risks are significant considerations for investors. - How can I store my KLEVA tokens securely?

For long-term storage, consider using cold wallets such as hardware wallets or paper wallets. - What is leveraged yield farming?

Leveraged yield farming allows users to borrow funds to increase their investment size in yield-generating assets. - Are there any fees associated with trading KLEVA?

Yes, trading fees may apply depending on the exchange used for transactions. - What is the future price outlook for KLEVA?

Analysts predict potential price increases for KLEVA over the next few years based on current market trends.

In conclusion, while you cannot directly buy or sell cryptocurrencies using Kleva Protocol itself, it serves as a valuable tool within the broader DeFi landscape. By leveraging other exchanges and engaging with its unique offerings, investors can effectively navigate their cryptocurrency investments while capitalizing on emerging opportunities within this dynamic market.