Investing in short-term rentals has become a popular avenue for generating income and diversifying investment portfolios. With the rise of platforms like Airbnb and Vrbo, many individuals are considering whether short-term rentals can provide better returns compared to traditional long-term rental properties. This comprehensive analysis will explore the current market trends, implementation strategies, risks, regulatory considerations, and future outlook for short-term rental investments.

| Key Concept | Description/Impact |

|---|---|

| Market Growth | The global short-term rental market is projected to grow from USD 124.6 billion in 2024 to USD 477.9 billion by 2037, reflecting a CAGR of over 10.9%. |

| Income Potential | Short-term rentals can yield higher daily rates compared to long-term leases, often generating profits of 25% to 50% of annual rental income. |

| Occupancy Rates | Occupancy rates can vary significantly; successful properties often achieve rates above 70% in high-demand areas. |

| Regulatory Challenges | Many cities impose strict regulations on short-term rentals, including licensing requirements and limits on rental days. |

| Market Competition | The increasing number of hosts and properties can lead to heightened competition, affecting pricing and occupancy rates. |

| Management Requirements | Short-term rentals require active management, including guest communication, cleaning, and maintenance between stays. |

| Tax Implications | Owners may benefit from various tax deductions related to property management costs but must also navigate local tax regulations. |

Market Analysis and Trends

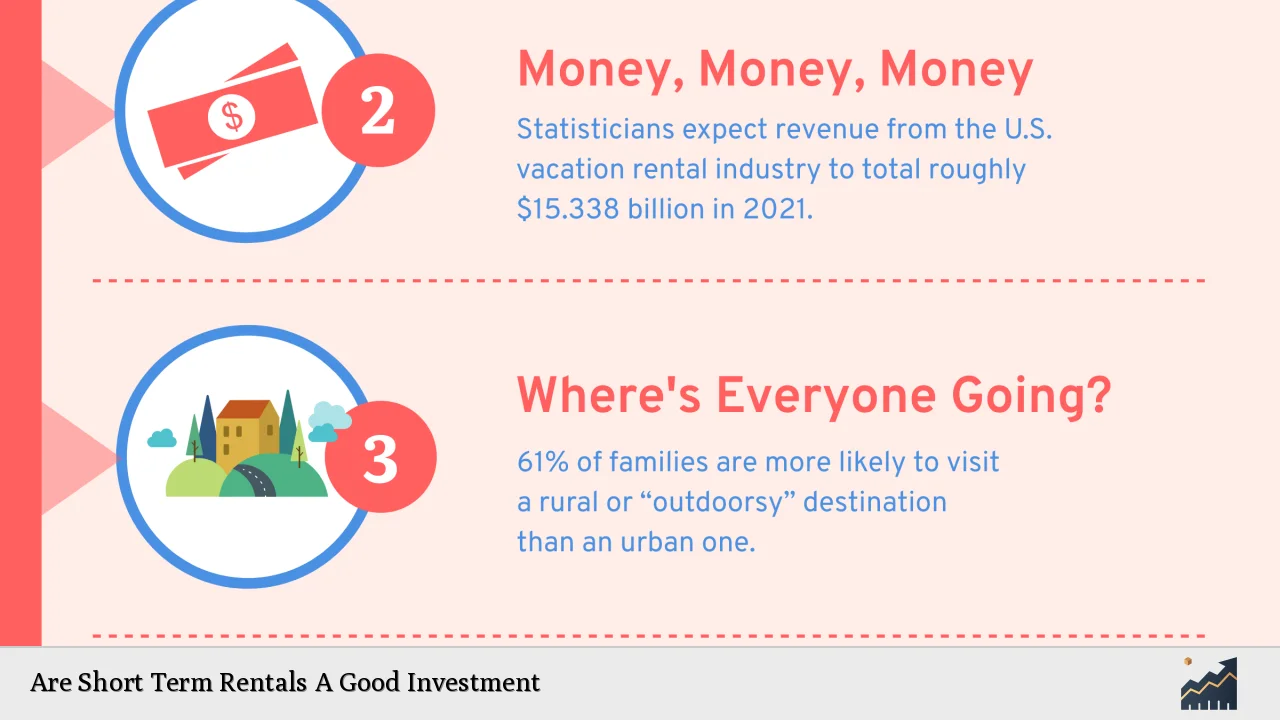

The short-term rental market has experienced remarkable growth due to changing consumer preferences for travel accommodations. Travelers increasingly seek unique experiences that traditional hotels cannot provide. As of 2024, the market is valued at approximately USD 124.6 billion and is expected to expand significantly over the next decade.

Key Market Drivers

- Increasing Demand for Unique Experiences: Travelers prefer accommodations that offer local flavor and amenities like kitchens.

- Technological Advancements: The proliferation of online booking platforms has made it easier for hosts to list properties and for guests to find suitable accommodations.

- Rising Tourism: Global tourism trends indicate a steady increase in travel, particularly in regions like North America and Asia Pacific.

Current Statistics

- The U.S. short-term rental market is expected to grow from USD 36.17 billion in 2025 to USD 42.1 billion by the end of 2024.

- The average daily rate (ADR) for short-term rentals has shown resilience post-pandemic, with many markets reporting increased pricing power as demand rebounds.

Implementation Strategies

Investors looking to enter the short-term rental market should consider several strategic approaches:

- Location Selection: Properties in tourist-heavy areas or near major attractions tend to perform better. Researching local demand patterns is crucial.

- Property Management: Effective management is key; investors may choose to manage properties themselves or hire professional property management services.

- Marketing Techniques: Utilizing multiple platforms (Airbnb, Vrbo) and maintaining an appealing online presence can enhance visibility and attract bookings.

- Dynamic Pricing: Adjusting rental prices based on demand fluctuations can maximize revenue. Tools like PriceLabs or Beyond Pricing can assist with this strategy.

Risk Considerations

While short-term rentals can be lucrative, they come with inherent risks:

- Income Variability: Unlike long-term leases that provide consistent monthly income, short-term rentals can experience significant fluctuations in occupancy rates.

- Regulatory Risks: Many municipalities are tightening regulations on short-term rentals, which can impact profitability. Investors must stay informed about local laws.

- Management Overhead: The need for frequent cleaning and maintenance between guests increases operational demands compared to traditional rentals.

- Market Saturation: As more investors enter the market, competition increases, potentially leading to lower occupancy rates and pricing pressures.

Regulatory Aspects

Understanding the regulatory landscape is essential for successful investment in short-term rentals:

- Licensing Requirements: Many cities require hosts to obtain licenses or permits before renting out their properties.

- Rental Limits: Some jurisdictions impose limits on the number of days a property can be rented out as a short-term rental.

- Tax Obligations: Hosts may be subject to local hotel taxes or transient occupancy taxes that must be collected from guests.

Investors should consult local regulations and consider hiring legal counsel if necessary to ensure compliance.

Future Outlook

The future of short-term rentals appears promising but will depend on several factors:

- Technological Innovations: Continued advancements in booking technology and property management tools will likely enhance operational efficiency for hosts.

- Changing Travel Patterns: The rise of remote work may lead to longer stays as travelers seek temporary housing solutions that accommodate work-life balance.

- Sustainability Trends: Increasing consumer interest in eco-friendly practices may drive demand for sustainable rental options.

Overall, while challenges exist, the potential for significant returns makes short-term rentals an attractive investment opportunity for many investors willing to navigate the complexities involved.

Frequently Asked Questions About Are Short Term Rentals A Good Investment

- What are the main benefits of investing in short-term rentals?

Short-term rentals typically offer higher daily rates compared to long-term leases, potential tax benefits, and flexibility in usage. - How do I determine if a location is suitable for a short-term rental?

Research local tourism trends, occupancy rates of existing rentals, and seasonal demand patterns. - What are common pitfalls when investing in short-term rentals?

Pitfalls include underestimating management responsibilities, failing to comply with local regulations, and not accounting for variable income streams. - How much can I expect to earn from a short-term rental?

Earnings vary widely based on location and property type; however, many investors report annual returns between 25% and 50% of gross rental income. - What are the tax implications of owning a short-term rental?

Owners may deduct expenses related to property management but should also be aware of local taxes applicable to short-term rentals. - Is it necessary to hire a property manager?

If you lack time or expertise in managing bookings and maintenance, hiring a property manager can be beneficial despite additional costs. - What should I consider before purchasing a property for short-term renting?

Consider location desirability, potential renovation costs, local regulations, and your capacity for hands-on management. - How do economic conditions affect the short-term rental market?

Evolving economic conditions such as inflation rates or shifts in disposable income can influence travel behavior and demand for rentals.

In conclusion, while investing in short-term rentals presents opportunities for substantial returns, it requires careful consideration of market conditions, regulatory environments, and effective management strategies. By understanding these dynamics, investors can make informed decisions that align with their financial goals.