As we approach 2025, municipal bonds are emerging as an increasingly attractive investment option for many investors. With yields at compelling levels and credit quality improving, these tax-exempt securities offer a unique balance of risk and reward, particularly for those in higher tax brackets. The municipal bond market is poised for potential growth and stability, driven by factors such as expected Federal Reserve rate cuts, strong credit fundamentals, and increased infrastructure spending.

| Key Concept | Description/Impact |

|---|---|

| Yield Attractiveness | Municipal bonds are offering yields above historical averages, with potential for tax-equivalent yields exceeding 6% for high-income investors |

| Credit Quality | Improved credit ratings and strong fundamentals suggest lower default risk and increased stability |

| Market Supply | Expected record issuance of $520 billion in 2025, providing ample investment opportunities |

| Interest Rate Environment | Potential Federal Reserve rate cuts could boost bond prices and total returns |

Market Analysis and Trends

The municipal bond market is showing strong signs of potential growth and stability as we look towards 2025. Several key factors are contributing to this positive outlook:

Yield Attractiveness

Municipal bond yields are currently at levels that many investors find compelling. As of late 2024, the average yield for municipal bonds stands above 3.5%, which is significantly higher than the 10-year average. For investors in higher tax brackets, the tax-equivalent yield can be even more attractive, potentially exceeding 6% when compared to taxable bonds.

Improved Credit Quality

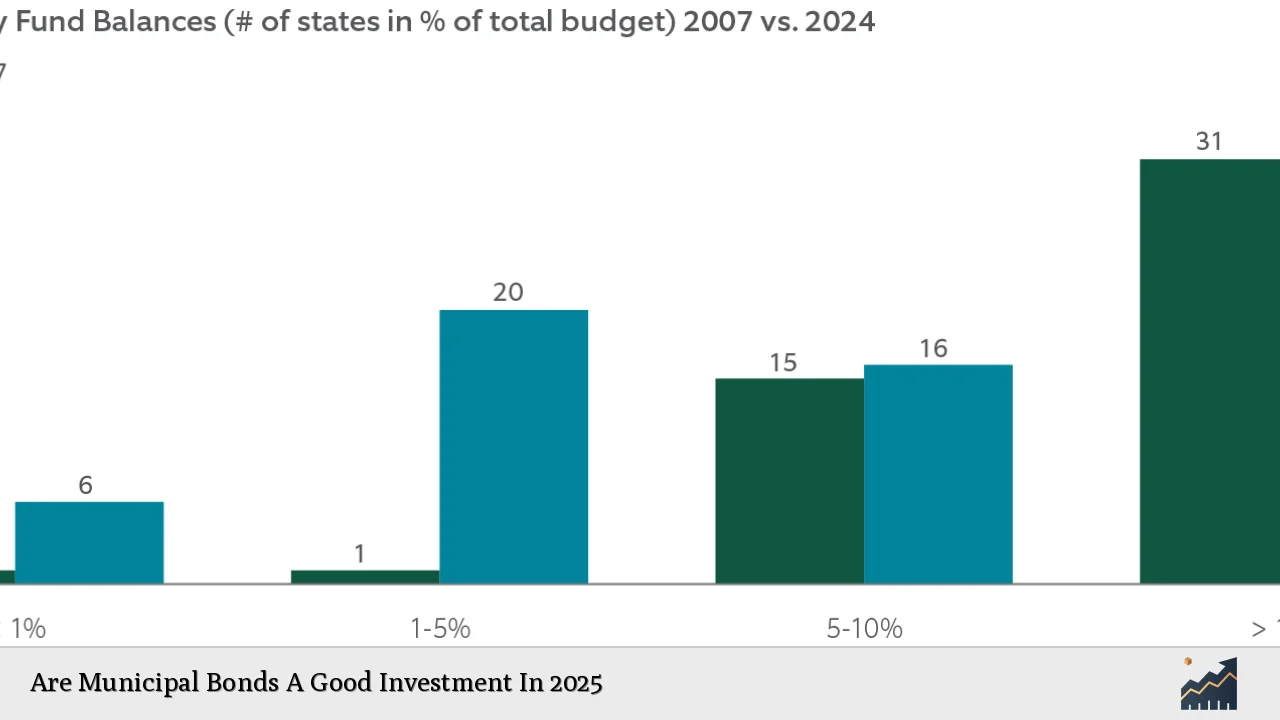

One of the most notable trends in the municipal bond market is the improvement in credit quality. The share of AAA and AA rated issuers in the Bloomberg Municipal Bond Index is near its highest level since the 2007/2008 credit crisis. This improvement in credit quality suggests that municipal bond issuers are in a strong position to meet their debt obligations, which can provide investors with added security.

Supply and Demand Dynamics

The supply of municipal bonds is expected to reach record levels in 2025. Bank of America analysts project that state and local governments will issue $520 billion of debt in 2025, which would be an all-time high. This increased supply is likely to be met with strong demand, as evidenced by positive fund flows in the municipal bond sector. Year-to-date municipal fund flows were up to $25 billion as of late 2024, with particularly strong inflows into long duration and high yield municipal bond funds.

Interest Rate Environment

The Federal Reserve’s monetary policy will play a crucial role in shaping the municipal bond market in 2025. With expectations of potential rate cuts, municipal bonds could see price appreciation, enhancing total returns for investors. Historically, municipal bonds have delivered positive total returns after the Fed starts cutting rates, which bodes well for the market if rate cuts materialize as expected.

Implementation Strategies

For investors considering municipal bonds in 2025, several strategies can be employed to maximize potential returns while managing risk:

Barbell Approach

A barbell strategy, which involves investing in both short-term and long-term bonds while underweighting intermediate maturities, has shown promise. This approach can help investors capture attractive short-term yields while also positioning for potential gains from longer-term bonds if interest rates decline.

Focus on High-Quality Issues

Given the improved credit quality in the municipal market, focusing on high-quality issues can provide a good balance of yield and safety. AAA and AA rated bonds are offering attractive yields relative to their historical levels, providing an opportunity to earn solid returns without taking on excessive credit risk.

Consider High Yield Municipals

For investors with a higher risk tolerance, high yield municipal bonds may offer opportunities for enhanced returns. With yields above 7% and expectations of below-average defaults, this segment of the market could provide attractive total returns, albeit with increased volatility compared to investment-grade municipals.

Diversification Across Sectors and Regions

Diversifying across different municipal bond sectors (such as general obligation, revenue, and essential service bonds) and geographic regions can help mitigate risk and potentially enhance returns. Each state and sector may have unique economic drivers and credit considerations, so a well-diversified portfolio can help smooth out potential volatility.

Risk Considerations

While municipal bonds are showing promise for 2025, investors should be aware of potential risks:

Interest Rate Risk

If interest rates rise unexpectedly, bond prices could decline. However, the higher starting yields provide a cushion against potential price declines, and the income component of returns can help offset price volatility.

Credit Risk

Although credit quality has improved, there’s always the possibility of downgrades or defaults, particularly in the high yield segment. Thorough credit analysis and ongoing monitoring are essential.

Political and Fiscal Policy Risk

Changes in tax policy or government spending priorities could impact the municipal bond market. For example, reductions in federal support for state and local governments could strain some issuers’ finances.

Liquidity Risk

Municipal bonds can sometimes be less liquid than other fixed-income securities, which could impact an investor’s ability to sell bonds quickly at desired prices, especially during market stress.

Regulatory Aspects

The regulatory environment plays a crucial role in shaping the municipal bond market:

Tax Considerations

The tax-exempt status of municipal bond interest is a key feature for many investors. Any changes to tax laws could significantly impact the attractiveness of municipal bonds. As of 2024, the tax exemption remains intact, but investors should stay informed about potential policy changes.

Disclosure Requirements

The Securities and Exchange Commission (SEC) continues to emphasize the importance of timely and accurate disclosure by municipal issuers. Enhanced disclosure practices can benefit investors by providing more transparent and up-to-date information about bond issuers’ financial health.

Infrastructure Spending Initiatives

Federal infrastructure spending programs can impact the municipal bond market by affecting the supply of bonds and the financial health of state and local governments. Investors should monitor developments in this area, as they could create new investment opportunities.

Future Outlook

The outlook for municipal bonds in 2025 appears positive, driven by several factors:

Economic Recovery

Continued economic recovery is likely to support the financial health of state and local governments, potentially leading to improved credit quality and stable or rising bond prices.

Demographic Trends

An aging population may increase demand for tax-exempt income, potentially supporting municipal bond prices and keeping yields attractive relative to taxable alternatives.

Technological Advancements

Improvements in data analytics and trading platforms could enhance price discovery and liquidity in the municipal bond market, potentially benefiting investors through more efficient trading and better access to information.

Climate Change Considerations

Growing focus on climate change may lead to increased issuance of green municipal bonds, providing new investment opportunities and potentially attracting a broader investor base to the municipal market.

In conclusion, municipal bonds appear to offer a compelling investment opportunity in 2025. With attractive yields, improved credit quality, and the potential for price appreciation in a falling rate environment, they merit serious consideration for investors seeking tax-efficient income and portfolio diversification. However, as with any investment, careful analysis of individual issues and ongoing monitoring of market conditions are essential to navigate the complexities of the municipal bond market successfully.

Frequently Asked Questions About Are Municipal Bonds A Good Investment In 2025

- How do municipal bonds compare to other fixed-income investments for 2025?

Municipal bonds offer tax-exempt income, which can make them more attractive than taxable bonds for investors in higher tax brackets. With yields currently above historical averages and improved credit quality, they may offer a compelling risk-adjusted return compared to other fixed-income options. - What impact might potential Fed rate cuts have on municipal bonds in 2025?

If the Federal Reserve cuts interest rates as expected, it could lead to price appreciation for existing municipal bonds, potentially boosting total returns. However, new issues would likely come to market with lower yields. - Are there specific sectors within municipal bonds that look particularly attractive for 2025?

High-yield municipal bonds and essential service revenue bonds (such as water and sewer utilities) are showing promise due to strong fundamentals and attractive yields. However, individual investor circumstances and risk tolerance should guide sector allocation decisions. - How might the increased infrastructure spending affect municipal bonds in 2025?

Increased infrastructure spending could lead to a higher supply of municipal bonds, potentially offering more investment opportunities. It may also improve the financial health of some issuers, potentially enhancing credit quality in certain sectors. - What are the main risks to consider when investing in municipal bonds for 2025?

Key risks include interest rate risk (if rates rise unexpectedly), credit risk (potential downgrades or defaults), and political/policy risk (changes in tax laws or government spending priorities). Liquidity risk should also be considered, especially for less frequently traded issues. - How can investors best position their municipal bond portfolios for 2025?

A balanced approach that includes a mix of high-quality and selective high-yield issues, diversification across sectors and maturities, and ongoing credit monitoring is recommended. Considering a barbell strategy and staying informed about market trends and economic indicators can also help optimize portfolio positioning.