Certificates of Deposit (CDs) are financial instruments that have gained popularity as a safe investment option. They offer a fixed interest rate for a specified period, typically ranging from three months to five years. Investors deposit a certain amount of money into a CD, which earns interest over time. At maturity, they receive their initial deposit plus the accrued interest. CDs are considered one of the safest investment options, primarily because they are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per bank.

In today’s financial landscape, many investors are evaluating whether CDs are a good investment choice. With interest rates on the rise, particularly in the wake of aggressive Federal Reserve policies aimed at controlling inflation, CDs offer competitive yields that can surpass traditional savings accounts. However, potential investors must also consider factors such as liquidity needs and inflation risks when deciding if CDs align with their financial goals.

| Feature | Description |

|---|---|

| Safety | Insured by FDIC up to $250,000 |

| Interest Rates | Fixed rates typically higher than savings accounts |

| Maturity Terms | Ranges from 3 months to 5 years |

| Liquidity | Funds are locked until maturity; penalties for early withdrawal |

Understanding Certificates of Deposit

Certificates of Deposit are time-bound deposits offered by banks and credit unions that provide a fixed interest rate for the duration of the term. When you invest in a CD, you agree not to withdraw your funds until the maturity date, which can range from a few months to several years. In exchange for this commitment, banks typically offer higher interest rates compared to traditional savings accounts.

Investors often choose CDs for their predictability and safety. The interest rates on CDs are generally fixed, meaning that once you lock in a rate, it remains unchanged throughout the term. This characteristic makes them an attractive option for those who prefer stability in their investments.

However, it is crucial to understand that while CDs offer guaranteed returns, they also come with limitations. The primary drawback is liquidity; funds are not easily accessible until the CD matures. If you need to withdraw your money early, you may incur penalties that can significantly reduce your earnings.

Pros and Cons of Investing in CDs

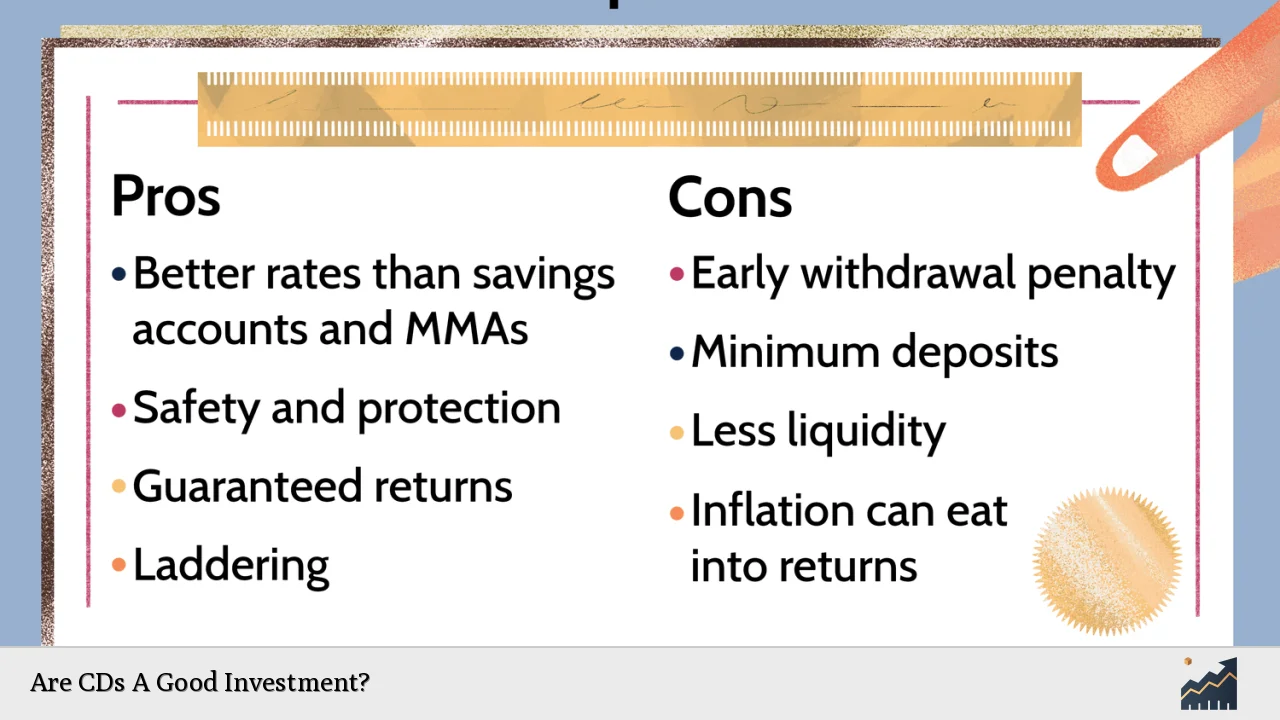

When considering whether to invest in CDs, it’s essential to weigh both the advantages and disadvantages.

Advantages of CDs

- Safety: CDs are one of the safest investment options available. They are insured by the FDIC up to $250,000 per depositor per bank, ensuring that your principal investment is protected even if the bank fails.

- Higher Interest Rates: Compared to standard savings accounts, CDs typically offer higher annual percentage yields (APYs). This makes them an appealing choice for conservative investors looking to earn more on their savings without taking on significant risk.

- Predictable Returns: The fixed interest rate means you can calculate exactly how much you’ll earn over the term of the CD. This predictability can aid in financial planning and goal setting.

- Variety of Terms: CDs come with various term lengths, allowing investors to choose options that align with their financial timelines and goals.

Disadvantages of CDs

- Limited Liquidity: One of the most significant downsides is that your money is tied up for the duration of the CD’s term. If unexpected expenses arise, accessing these funds can be challenging without incurring penalties.

- Inflation Risk: While CDs provide fixed returns, they may not keep pace with inflation. If inflation rises significantly during your investment period, the purchasing power of your returns could diminish.

- Opportunity Cost: By locking your money into a CD, you may miss out on other investment opportunities that could yield higher returns. For example, stocks or mutual funds may offer better growth potential over time.

Current Market Conditions for CDs

As of now, many financial institutions are offering competitive rates on CDs due to recent increases in federal interest rates. In many cases, one-year CDs have yields exceeding 5%, making them attractive for individuals looking to maximize their savings without exposing themselves to market volatility.

The current economic climate suggests that locking in these rates could be beneficial before potential decreases occur as inflation stabilizes or declines. Investors should carefully consider their financial needs and goals when selecting a CD term length and institution.

Strategies for Investing in CDs

Investing in CDs can be approached through various strategies tailored to individual financial goals and liquidity needs:

CD Laddering

This strategy involves spreading your investment across multiple CDs with staggered maturity dates. For example:

- $2,000 in a 1-year CD

- $2,000 in a 2-year CD

- $2,000 in a 3-year CD

- $2,000 in a 4-year CD

- $2,000 in a 5-year CD

By doing this, you maintain access to some funds each year while still benefiting from higher long-term rates on other portions of your investment.

CD Bullet Strategy

This approach focuses on using shorter-term CDs for specific upcoming expenses. For instance, if you plan to make a large purchase like a home or wedding within five years, you might opt for several short-term CDs maturing just before that expense occurs.

CD Barbell Strategy

This strategy combines short-term and long-term investments in CDs. It allows investors to take advantage of current high rates while keeping some liquidity available through shorter-term investments.

Evaluating Your Financial Goals

Before investing in CDs, it is crucial to assess your financial situation and goals thoroughly:

- Determine how much money you can afford to lock away without needing immediate access.

- Consider your risk tolerance; if you’re uncomfortable with market fluctuations but still want growth potential beyond traditional savings accounts, CDs may be suitable.

- Evaluate upcoming expenses or cash flow needs; if you anticipate needing funds soon or prefer flexibility, other investment vehicles might be more appropriate.

FAQs About Are CDs A Good Investment?

- What are the benefits of investing in CDs?

CDs offer safety through FDIC insurance and higher interest rates compared to savings accounts. - Are there risks associated with investing in CDs?

The primary risks include limited liquidity and potential inflation eroding returns. - How do I choose the right CD?

Consider factors like interest rates, terms available, and your financial goals. - Can I withdraw money from a CD before maturity?

You can withdraw early but may face penalties that reduce your earnings. - Are current CD rates competitive?

Yes, many banks offer attractive rates currently due to rising federal interest rates.

In conclusion, whether certificates of deposit (CDs) are a good investment depends on individual circumstances and financial objectives. They provide safety and predictable returns but come with limitations regarding liquidity and potential inflation risks. By understanding these factors and employing strategic approaches like laddering or bullet strategies, investors can effectively incorporate CDs into their overall financial plans while maximizing their benefits.