Investing in campers, whether as a personal asset or a business venture, has gained popularity in recent years, particularly as outdoor recreation has surged. The COVID-19 pandemic catalyzed a shift towards camping and RV travel, making these investments appealing for many individuals and families seeking safe and flexible travel options. However, potential investors must carefully analyze the financial implications, market trends, and risks associated with camper ownership and campground investments. This article delves into the current state of the camper market, investment strategies, risk considerations, regulatory aspects, and future outlook to provide a comprehensive understanding of whether campers are a good investment.

| Key Concept | Description/Impact |

|---|---|

| Market Growth | The global travel trailer and camper market is projected to grow from $96.27 billion in 2023 to $104.59 billion in 2024, indicating strong demand for camping experiences. |

| Investment Opportunities | Investing in campgrounds can yield high returns due to increased outdoor activity and demand for recreational spaces. |

| Depreciation | Campers typically depreciate like vehicles; thus, they may not be traditional investments that appreciate over time. |

| Cost of Ownership | Owning a camper involves significant upfront costs, maintenance expenses, insurance, and potential financing costs. |

| Rental Market Potential | The RV rental market is booming, expected to grow from $6.9 billion in 2023 to nearly $9 billion in 2024, presenting lucrative opportunities for investors. |

| Regulatory Environment | Investors must navigate various regulations regarding campground operations and RV ownership that can affect profitability. |

Market Analysis and Trends

The camping industry has seen significant growth recently due to changing consumer preferences towards outdoor activities. According to the Outdoor Industry Association, camping is now one of the most popular recreational activities in the United States, attracting over 40 million participants annually. This trend has been fueled by factors such as:

- Pandemic Effects: The COVID-19 pandemic prompted many families to seek safe vacation alternatives, leading to increased interest in camping.

- Affordability: Camping is often more cost-effective than traditional vacations. With rising travel costs, many families are opting for campers as a way to save money on accommodation.

- Market Growth: The travel trailer and camper market is expected to grow at a compound annual growth rate (CAGR) of 8.6%, reaching $104.59 billion in 2024. This growth is attributed to the rise of adventure tourism and family travel.

- RV Rental Boom: The RV rental market is projected to expand significantly, with an expected CAGR of 30.14% from 2024 to 2032. This trend highlights the increasing popularity of flexible travel options.

Implementation Strategies

For individuals considering investing in campers or campgrounds, several strategies can optimize returns:

- Research Market Trends: Understanding local demand for camping sites and camper rentals can help identify profitable opportunities.

- Diversify Investments: Consider diversifying between owning a camper for personal use and investing in campground properties or RV rental businesses.

- Leverage Technology: Use online platforms for RV rentals or campground bookings to enhance visibility and attract customers.

- Focus on Sustainability: Eco-friendly campers and sustainable campground practices are increasingly appealing to environmentally conscious consumers.

Risk Considerations

Investing in campers comes with inherent risks that potential investors should consider:

- Depreciation: Campers generally depreciate quickly—similar to vehicles—making them less attractive as long-term investments.

- Maintenance Costs: Upkeep can be expensive; regular maintenance, repairs, insurance premiums, and storage fees should be factored into the overall cost of ownership.

- Market Volatility: The camping industry can be cyclical; economic downturns may lead consumers to cut back on discretionary spending like travel.

- Regulatory Risks: Investors must comply with local zoning laws and environmental regulations that can impact campground operations.

Regulatory Aspects

Understanding the regulatory landscape is critical for anyone looking to invest in campers or campgrounds:

- Zoning Laws: Local regulations dictate where campgrounds can be established and what amenities can be offered.

- Health & Safety Standards: Compliance with health codes regarding waste disposal and facility maintenance is essential for operating campgrounds legally.

- Insurance Requirements: Investors should ensure they have adequate insurance coverage for both campers and campground properties.

Future Outlook

The outlook for camper investments appears promising based on current trends:

- Continued Growth in Camping Popularity: As more people embrace outdoor activities post-pandemic, demand for camping gear and facilities will likely continue growing.

- Technological Advancements: Innovations such as smart RVs equipped with connectivity features are expected to enhance user experience and attract tech-savvy consumers.

- Sustainable Practices: Increasing awareness of environmental issues may drive demand for eco-friendly camping options.

Overall, while campers may not appreciate like traditional investments (e.g., real estate), they offer unique opportunities for enjoyment and potential income through rentals or campground investments.

Frequently Asked Questions About Are Campers A Good Investment

- What are the main benefits of investing in a camper?

Investing in a camper provides flexibility for travel, potential savings on accommodation costs, and opportunities for rental income. - How much does it cost to maintain a camper?

Maintenance costs can vary widely but typically include insurance (around $1,000 annually), storage fees (if applicable), regular maintenance (approximately $500-$1,500 annually), and repairs. - Is renting out my camper a good way to make money?

Yes, renting out your camper can generate significant income—especially during peak seasons—given the growing demand for RV rentals. - What should I consider before buying a camper?

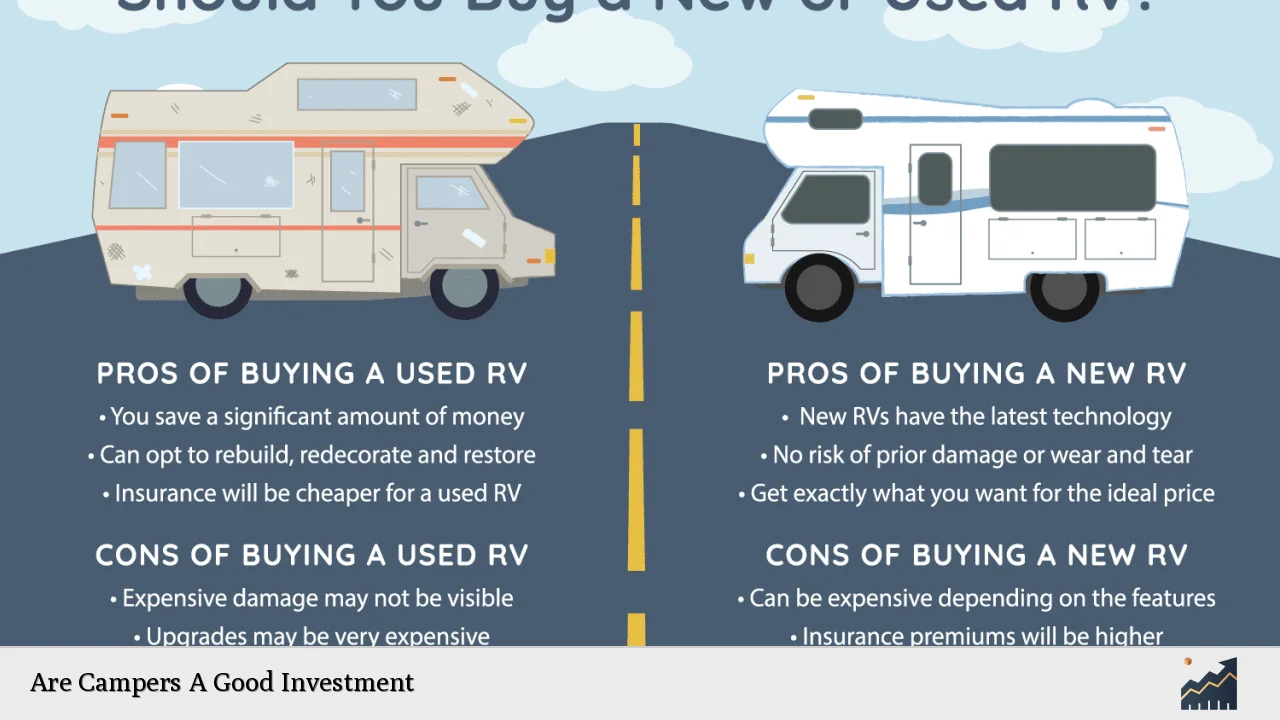

You should assess your budget (including purchase price and ongoing costs), intended use (personal vs. rental), type of camper (travel trailer vs. motorhome), and financing options available. - How do I choose the right campground investment?

Consider location, amenities offered, occupancy rates of nearby campgrounds, competition levels, and local tourism trends when evaluating campground investments. - Are there financing options available for purchasing a camper?

Yes, various financing options exist including personal loans, RV loans through banks or credit unions, or dealer financing programs. - What are common pitfalls when investing in campers?

Common pitfalls include underestimating depreciation rates, neglecting maintenance costs, failing to research market demand thoroughly, and not complying with local regulations. - Can I live full-time in my camper?

Yes! Many people choose full-time RV living; however, it requires planning regarding parking locations, utilities access, maintenance logistics, and lifestyle adjustments.

In conclusion, while campers may not fit the traditional mold of appreciating assets like real estate or stocks due to depreciation concerns, they offer unique investment opportunities aligned with current consumer trends towards outdoor recreation. By understanding market dynamics and effectively managing risks associated with ownership or rental ventures within this sector, investors can potentially reap substantial rewards while enjoying their investment firsthand.