Investing in bonds has always been a popular choice for those seeking stability and predictable income. As we move into 2025, many investors are questioning whether bonds remain a viable investment option. With fluctuating interest rates, inflation concerns, and shifting economic landscapes, understanding the current bond market is crucial for making informed investment decisions.

Bonds are essentially loans made by investors to borrowers, typically governments or corporations, in exchange for periodic interest payments and the return of the bond’s face value at maturity. They are often viewed as safer investments compared to stocks, particularly in volatile markets. The current economic indicators suggest a mixed outlook for bonds, influenced by various factors such as central bank policies and inflation rates.

| Factor | Impact on Bonds |

|---|---|

| Interest Rates | Higher rates can lead to lower bond prices. |

| Inflation | Rising inflation can erode real returns. |

| Economic Growth | Stronger growth may push yields higher. |

Current Economic Landscape

The economic environment heading into 2025 is characterized by a cautious optimism. Central banks, particularly the Federal Reserve, are expected to continue easing monetary policies as inflation shows signs of stabilizing. This shift could create a favorable backdrop for bond investments. Investors should be aware that while yields may remain range-bound, the potential for positive real yields—returns adjusted for inflation—exists.

Recent forecasts indicate that U.S. Treasury yields could slightly decline from their current levels, which hover around 4.4%. This decline is anticipated as the Fed cuts interest rates to stimulate economic growth further. Additionally, emerging markets are projected to offer attractive returns due to better-than-average economic growth compared to developed markets.

However, it’s essential to note that the bond market is not without risks. Potential global trade tensions and unexpected economic shifts could lead to increased volatility in bond yields, impacting investor returns significantly.

Types of Bonds and Their Performance

When considering bonds as an investment, it’s crucial to differentiate between various types of bonds available in the market. Each type comes with its own risk and return profile:

- Government Bonds: Typically considered low-risk investments that provide stable returns.

- Corporate Bonds: These generally offer higher yields than government bonds but come with increased risk.

- Municipal Bonds: Often tax-exempt, these can be attractive for investors looking for tax-efficient income.

- High-Yield Bonds: These carry more risk but offer higher potential returns.

In 2025, investment-grade corporate bonds are expected to perform well, driven by strong corporate fundamentals and healthy balance sheets. Conversely, high-yield bonds may face challenges due to tighter credit spreads and rising default risks.

Interest Rates and Inflation Dynamics

Interest rates play a pivotal role in bond investment strategies. As central banks navigate through economic recovery phases, interest rate adjustments can significantly impact bond prices. Generally, when interest rates rise, existing bond prices fall due to the inverse relationship between yield and price.

Inflation remains a critical concern for bond investors. While current inflation rates have shown signs of moderation, any resurgence could erode the purchasing power of fixed-income returns. Investors should focus on bonds that offer positive real yields, which means their returns exceed inflation rates.

In 2025, analysts expect inflation to stabilize around target levels set by central banks. If this trend continues, it could enhance the attractiveness of bonds as a reliable income source.

Diversification Benefits of Bonds

Bonds can serve as an essential component of a diversified investment portfolio. They typically exhibit lower volatility compared to equities and can provide a buffer during market downturns. Incorporating bonds into an investment strategy can help mitigate risks associated with stock market fluctuations.

Moreover, during periods of economic uncertainty or recessionary pressures, bonds often outperform stocks due to their stable income characteristics. This makes them particularly appealing for conservative investors or those nearing retirement who prioritize capital preservation over aggressive growth.

Tactical Bond Strategies

Given the current market dynamics, employing tactical strategies in bond investing can yield better outcomes. Investors may consider:

- Laddering: This involves purchasing bonds with varying maturities to manage interest rate risk effectively.

- Barbell Strategy: Combining short-term and long-term bonds allows investors to capture higher yields while maintaining liquidity.

- Bullet Strategy: Investing in bonds that mature at similar times can align with specific financial goals or cash flow needs.

These strategies enable investors to adapt their portfolios according to changing market conditions while optimizing yield opportunities.

Risks Associated with Bond Investments

While bonds are generally viewed as safer investments compared to stocks, they are not without risks. Key risks include:

- Interest Rate Risk: As mentioned earlier, rising interest rates can lead to falling bond prices.

- Credit Risk: Corporate bonds carry the risk of issuer default; thus evaluating credit ratings is essential.

- Inflation Risk: If inflation outpaces bond yields, real returns diminish.

- Liquidity Risk: Some bonds may be harder to sell quickly without incurring losses.

Investors should conduct thorough research and consider these risks before allocating significant portions of their portfolios to bonds.

Conclusion: Are Bonds a Good Investment Today?

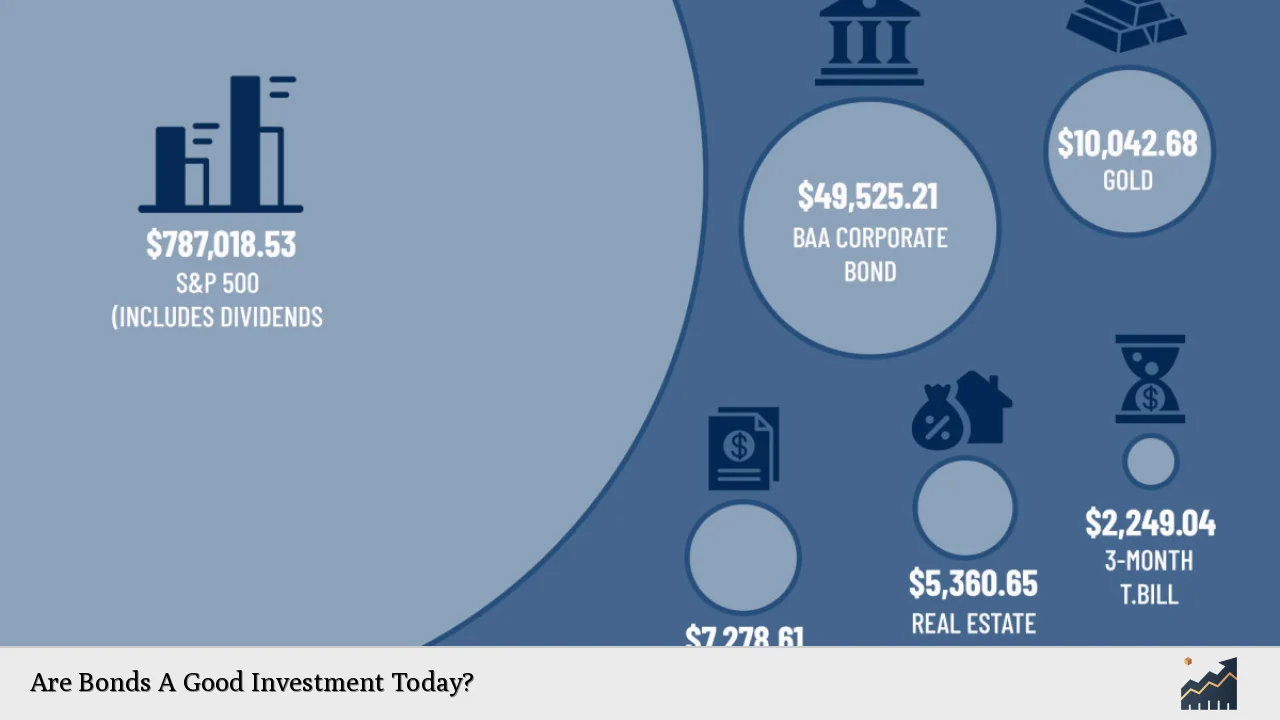

In conclusion, investing in bonds today presents both opportunities and challenges. With central banks poised to cut interest rates further and inflation showing signs of stabilization, there is potential for positive returns from fixed-income investments. However, investors must remain vigilant about economic indicators that could affect bond performance.

Bonds can play a crucial role in a diversified portfolio by providing stability and predictable income streams. As we move into 2025, those looking for lower-risk investment options should consider including bonds in their asset allocation strategy while being mindful of the associated risks and market conditions.

FAQs About Bonds

- What are the benefits of investing in bonds?

Bonds provide stable income through fixed interest payments and are generally less volatile than stocks. - How do interest rates affect bond prices?

When interest rates rise, existing bond prices typically fall because new issues offer higher yields. - What types of bonds should I consider?

Consider government bonds for safety, corporate bonds for higher yields, and municipal bonds for tax advantages. - Are high-yield bonds worth the risk?

High-yield bonds can offer attractive returns but come with increased default risk; careful analysis is necessary. - How can I reduce risks when investing in bonds?

Diversifying across different types of bonds and employing strategies like laddering can help mitigate risks.