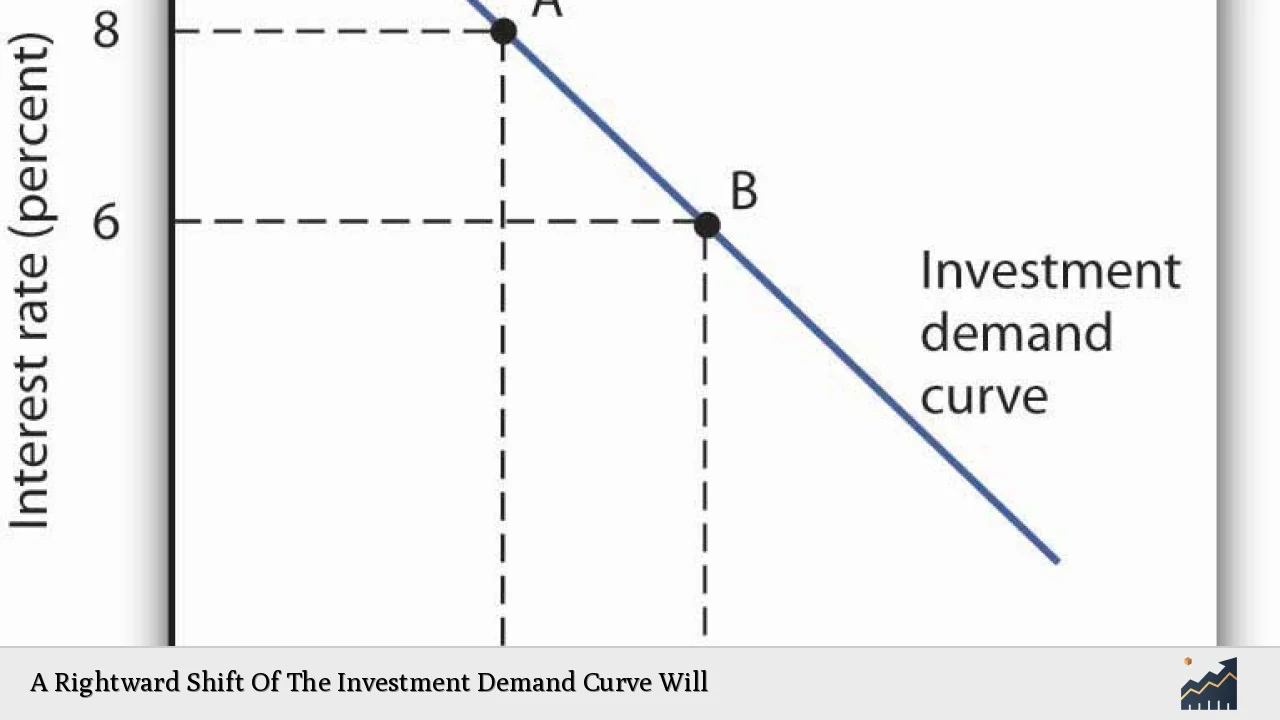

The investment demand curve is a fundamental concept in economics that illustrates the relationship between the quantity of investment demanded and the prevailing interest rates. A rightward shift of this curve indicates an increase in investment demand at all interest rates, which can be attributed to various factors such as improved business expectations, technological advancements, and favorable economic conditions. Understanding these shifts is crucial for investors and policymakers as they navigate the complexities of the financial landscape.

| Key Concept | Description/Impact |

|---|---|

| Business Expectations | When businesses anticipate higher future sales and profits, they are more likely to invest in new projects, leading to a rightward shift in the investment demand curve. |

| Interest Rates | Lower interest rates reduce the cost of borrowing, encouraging firms to invest more, thus shifting the curve to the right. |

| Technological Innovation | Advancements in technology can create new investment opportunities, prompting businesses to increase their capital expenditures. |

| Economic Growth | A growing economy typically boosts business confidence and investment levels, resulting in a rightward shift of the curve. |

| Government Policies | Tax incentives and subsidies can encourage investment by reducing costs for businesses, shifting the investment demand curve outward. |

| Global Economic Conditions | Favorable international trade agreements or stable geopolitical environments can enhance investor confidence, leading to increased investment demand. |

Market Analysis and Trends

The current economic landscape is marked by several trends that are influencing the investment demand curve:

- Interest Rate Environment: As central banks globally have begun to lower interest rates in response to economic challenges, borrowing costs have decreased. This environment encourages businesses to take on new investments. For instance, recent data indicates that U.S. private equity-backed M&A activity surged by 40% in early 2024 compared to the previous year, reflecting heightened investment activity driven by lower financing costs.

- Technological Advancements: The rise of artificial intelligence (AI) and other technological innovations has created new sectors ripe for investment. Companies are increasingly allocating capital towards AI-driven solutions, which has been identified as a key theme for investors heading into 2025.

- Economic Recovery: Following periods of economic downturns, recovery phases often see a significant uptick in investment as businesses seek to capitalize on improving market conditions. The UNCTAD’s World Investment Report highlights that while global investment prospects remain challenging, modest growth is anticipated due to easing financial conditions.

Implementation Strategies

For investors looking to leverage a rightward shift in the investment demand curve, several strategies can be employed:

- Diversification: Investors should consider diversifying their portfolios across sectors that are expected to benefit from increased capital expenditure. This includes technology, renewable energy, and infrastructure.

- Focus on Growth Stocks: Companies that are poised for growth due to favorable market conditions or innovative products may provide significant returns as they increase their investments.

- Utilizing Financial Instruments: Options such as ETFs focused on sectors experiencing growth can provide exposure without requiring direct stock picking.

Risk Considerations

While a rightward shift in the investment demand curve signals potential growth opportunities, investors must also be aware of associated risks:

- Market Volatility: Economic conditions can change rapidly; unexpected downturns may lead to reduced investment demand despite current optimism.

- Interest Rate Fluctuations: If interest rates rise unexpectedly after a period of decline, it could dampen investment enthusiasm and lead to a leftward shift in the curve.

- Regulatory Changes: New regulations or changes in government policy can impact sectors differently. Investors should stay informed about legislative developments that could affect their investments.

Regulatory Aspects

Understanding regulatory frameworks is essential for navigating investment decisions:

- Tax Incentives: Governments often provide tax breaks or incentives for certain types of investments. Familiarizing oneself with these can enhance potential returns.

- Compliance Requirements: Investors must be aware of compliance obligations associated with different types of investments, especially in regulated industries like finance or healthcare.

- Global Trade Policies: Changes in trade agreements can significantly impact multinational companies’ operations and their subsequent investment strategies.

Future Outlook

Looking ahead, several factors will likely influence further shifts in the investment demand curve:

- Continued Technological Disruption: As technology evolves, industries will need to adapt quickly. Companies investing in innovation may outperform those that do not keep pace with technological advancements.

- Sustainability Trends: Increasing focus on environmental sustainability will drive investments towards green technologies and sustainable practices.

- Geopolitical Stability: Political stability will continue to play a crucial role in shaping investor confidence. A stable geopolitical environment typically fosters increased foreign direct investments (FDI).

Frequently Asked Questions About A Rightward Shift Of The Investment Demand Curve Will

- What causes a rightward shift in the investment demand curve?

A rightward shift occurs due to improved business expectations, lower interest rates, technological advancements, economic growth, favorable government policies, and stable global conditions. - How do interest rates affect investment decisions?

Lower interest rates reduce borrowing costs for businesses, making it more attractive for them to invest in new projects. - What role does government policy play?

Government policies such as tax incentives and subsidies can encourage businesses to increase their capital expenditures. - Why is understanding market trends important?

Market trends provide insights into potential future shifts in the investment demand curve and help investors make informed decisions. - What risks should investors consider?

Investors should consider market volatility, potential interest rate fluctuations, and regulatory changes that could impact their investments. - How can investors capitalize on these shifts?

Diversifying portfolios towards growth sectors and focusing on companies with strong innovation pipelines can help capitalize on positive shifts. - What is the long-term outlook for investments?

The long-term outlook remains positive with continued technological disruption and increasing focus on sustainability driving future investments. - How do global economic conditions influence local investments?

Global economic stability often enhances investor confidence locally, leading to increased capital inflows and higher levels of domestic investments.

In conclusion, understanding a rightward shift of the investment demand curve is essential for both individual investors and finance professionals. By analyzing current market trends and employing strategic implementation methods while considering risks and regulatory aspects, stakeholders can position themselves effectively within an evolving economic landscape.