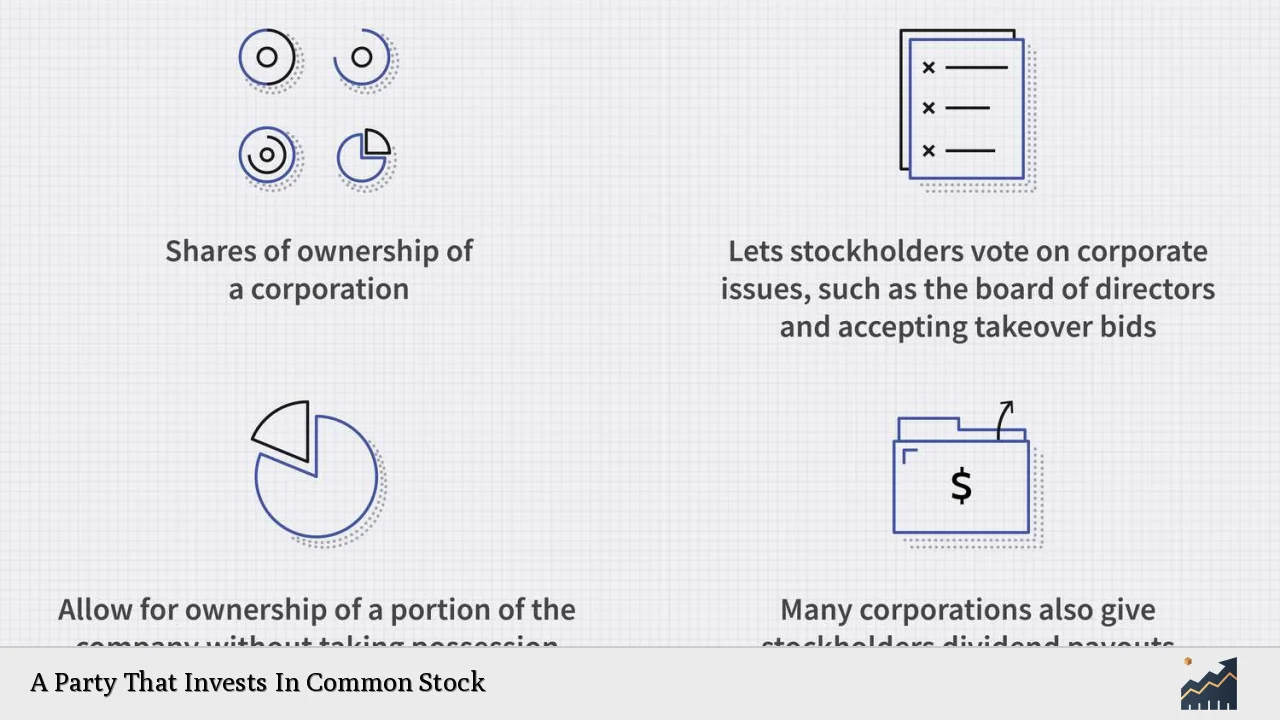

Investing in common stock is a fundamental strategy for individuals and institutions seeking to build wealth and participate in the growth of public companies. As one of the most popular forms of equity investment, common stock represents partial ownership in a corporation, offering potential returns through capital appreciation and dividends. This comprehensive guide explores the intricacies of common stock investment, providing valuable insights for both novice and experienced investors.

| Key Concept | Description/Impact |

|---|---|

| Ownership | Represents partial ownership in a company, entitling investors to voting rights and potential dividends |

| Capital Appreciation | Potential for stock value to increase over time, leading to investment gains |

| Dividends | Optional payments distributed to shareholders from company profits |

| Liquidity | Ability to buy and sell shares easily on stock exchanges |

| Risk | Potential for loss of investment value due to market fluctuations and company performance |

Market Analysis and Trends

The common stock market has shown remarkable resilience and growth over the long term, despite periodic volatility and economic challenges. As of 2024, the U.S. stock market, as represented by the S&P 500 index, has delivered an average annual return of approximately 10% over the past century, accounting for inflation and dividend reinvestment.

Recent trends indicate a growing interest in common stock investments among retail investors. In 2024, approximately 62% of American adults reported having money invested in the stock market, either through individual stocks, mutual funds, or retirement accounts. This figure has remained relatively stable in recent years, reflecting a continued confidence in equity investments despite economic uncertainties.

The rise of online brokerages and commission-free trading platforms has democratized access to the stock market, allowing more individuals to participate in common stock investments. This trend has been accompanied by an increase in market volatility, as seen in the rapid market movements during the COVID-19 pandemic and subsequent recovery.

Institutional investors, including pension funds, endowments, and mutual funds, continue to play a significant role in the common stock market. As of 2024, institutional investors hold approximately 80% of the total market capitalization of U.S. publicly traded companies, underscoring their influence on market trends and individual stock performances.

Implementation Strategies

Successful common stock investing requires a well-thought-out strategy tailored to individual financial goals, risk tolerance, and investment horizon. Here are some key strategies for parties investing in common stock:

Diversification

Diversification is a cornerstone of prudent investing. By spreading investments across various sectors, industries, and even geographical regions, investors can mitigate company-specific and sector-specific risks. A well-diversified portfolio typically includes a mix of growth and value stocks, as well as stocks of different market capitalizations.

Dollar-Cost Averaging

This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. Dollar-cost averaging can help reduce the impact of market volatility on the overall investment and potentially lower the average cost per share over time.

Value Investing

Value investors seek out stocks that appear undervalued relative to their intrinsic worth. This approach involves analyzing financial statements, assessing company fundamentals, and identifying stocks trading below their perceived true value.

Growth Investing

Growth investors focus on companies with strong potential for above-average growth in earnings and revenue. While these stocks may have higher valuations, they offer the potential for significant capital appreciation.

Dividend Investing

Some investors prioritize stocks that pay regular dividends, providing a steady income stream in addition to potential capital gains. Dividend-paying stocks are often associated with more established, financially stable companies.

Index Investing

Investing in index funds or exchange-traded funds (ETFs) that track broad market indices can provide instant diversification and exposure to a wide range of common stocks. This passive investment strategy aims to match the performance of the overall market rather than trying to outperform it.

Risk Considerations

While common stock investments offer significant potential for returns, they also come with inherent risks that investors must carefully consider:

Market Risk

Stock prices can be volatile and subject to broad market movements influenced by economic conditions, geopolitical events, and investor sentiment. Even well-performing companies can see their stock prices decline in a general market downturn.

Company-Specific Risk

Individual companies face risks related to their business operations, financial health, management decisions, and competitive landscape. Poor performance or negative news can significantly impact a company’s stock price.

Sector Risk

Certain industries or sectors may face challenges that affect all companies within that space. For example, regulatory changes, technological disruptions, or shifts in consumer behavior can impact entire sectors.

Liquidity Risk

While most common stocks traded on major exchanges are highly liquid, some smaller or less frequently traded stocks may be difficult to buy or sell without impacting the stock price.

Currency Risk

For investors holding international stocks, fluctuations in currency exchange rates can affect the value of investments when converted back to the investor’s home currency.

Regulatory Aspects

Common stock investments are subject to various regulations designed to protect investors and maintain market integrity. In the United States, the Securities and Exchange Commission (SEC) is the primary regulatory body overseeing the stock market.

Key regulatory aspects include:

Disclosure Requirements

Publicly traded companies must provide regular financial reports and disclose material information that could affect their stock price. This includes annual reports (10-K), quarterly reports (10-Q), and current reports (8-K) for significant events.

Insider Trading Regulations

Trading based on material, non-public information is illegal. Company insiders, including executives and major shareholders, must report their stock transactions to the SEC.

Market Manipulation Rules

Regulations prohibit practices designed to artificially inflate or deflate stock prices, such as spreading false information or engaging in coordinated trading activities.

Broker-Dealer Regulations

Firms that facilitate stock trades must comply with various regulations, including capital requirements, customer protection rules, and best execution practices.

Investment Company Regulations

Mutual funds and other investment companies that pool investor money to invest in common stocks are subject to specific regulations under the Investment Company Act of 1940.

Future Outlook

The future of common stock investing is likely to be shaped by several key trends and developments:

Technological Advancements

Artificial intelligence and machine learning are increasingly being used in stock analysis and trading strategies. These technologies may lead to more sophisticated investment tools and potentially change the dynamics of stock market participation.

ESG Investing

Environmental, Social, and Governance (ESG) factors are becoming increasingly important to investors. Companies with strong ESG profiles may attract more investment, potentially influencing stock performance and corporate behavior.

Market Structure Changes

The rise of alternative trading systems, dark pools, and high-frequency trading continues to impact market structure and liquidity. Regulators and market participants will need to adapt to these evolving dynamics.

Global Economic Shifts

Changing global economic patterns, including the rise of emerging markets and potential shifts in economic power, may influence the relative attractiveness of different stock markets and sectors.

Demographic Changes

Aging populations in developed countries and the growing influence of millennial and Gen Z investors may impact investment preferences and stock market trends.

As the common stock market continues to evolve, investors must stay informed about these trends and adapt their strategies accordingly. While past performance does not guarantee future results, the historical resilience and long-term growth potential of common stocks suggest they will remain a crucial component of investment portfolios for the foreseeable future.

Frequently Asked Questions About A Party That Invests In Common Stock

- What is the minimum amount needed to start investing in common stocks?

There is no set minimum to invest in common stocks. With fractional share investing offered by many brokers, you can start with as little as $1. However, it’s advisable to have a diversified portfolio, which may require a larger initial investment. - How do I choose which common stocks to invest in?

Choosing stocks involves researching company financials, understanding the industry, analyzing market trends, and assessing your risk tolerance. Many investors start with blue-chip companies or use index funds for broad market exposure. Consider consulting with a financial advisor for personalized advice. - What’s the difference between common stock and preferred stock?

Common stock represents ownership in a company and typically comes with voting rights. Preferred stock usually doesn’t have voting rights but has priority over common stock for dividend payments and asset claims in case of liquidation. Common stock generally offers higher potential returns but with greater risk. - How often should I review my common stock investments?

While it’s important to stay informed, avoid obsessing over daily price movements. A quarterly or semi-annual review of your portfolio is often sufficient for long-term investors. However, significant company news or major market events may warrant more frequent assessments. - Can I lose all my money investing in common stocks?

While it’s possible to lose your entire investment in a single stock if a company goes bankrupt, this risk can be significantly reduced through diversification. By spreading investments across multiple stocks or using index funds, you can mitigate the impact of poor performance from any single company. - How are common stock dividends taxed?

In the U.S., qualified dividends are typically taxed at the long-term capital gains rate, which is lower than ordinary income tax rates for most investors. However, tax treatment can vary based on holding period and other factors. Consult a tax professional for advice specific to your situation. - What’s the best way to stay informed about my common stock investments?

Stay updated through a combination of company financial reports, reputable financial news sources, and your brokerage’s research tools. Many investors also use stock tracking apps or set up alerts for significant price movements or news related to their holdings.