The role of a manager in an investment center is pivotal within an organization, as it encompasses the responsibility for managing revenues, costs, and the invested capital of the center. This managerial position not only requires a keen understanding of financial metrics but also demands strategic decision-making to optimize returns on investments. Investment center managers are tasked with maximizing profitability while ensuring efficient use of resources, making their role critical to the overall financial health of the organization.

| Key Concept | Description/Impact |

|---|---|

| Revenue Management | Investment center managers are responsible for generating revenue through effective sales strategies and market positioning. |

| Cost Control | They must manage and control costs, ensuring that expenditures do not exceed budgeted amounts while maintaining operational efficiency. |

| Asset Management | The manager oversees the utilization of assets to generate returns, focusing on both current performance and long-term value creation. |

| Return on Investment (ROI) | Investment centers are evaluated based on their ROI, which reflects how well the manager is using invested capital to generate profits. |

| Strategic Decision-Making | Managers must make informed decisions regarding investments, resource allocation, and operational strategies to enhance performance. |

| Risk Management | They assess and mitigate risks associated with investment decisions, ensuring that potential downsides are managed effectively. |

| Compliance and Regulation | Investment center managers must adhere to regulatory requirements and ensure compliance with financial reporting standards. |

Market Analysis and Trends

The investment management landscape is continuously evolving, influenced by technological advancements, regulatory changes, and shifting investor preferences. As of 2024, several key trends are shaping the responsibilities of investment center managers:

- Increased Focus on ESG: Environmental, social, and governance (ESG) factors are becoming crucial in investment decisions. Managers are expected to integrate these considerations into their strategies to attract socially-conscious investors.

- Technological Integration: The rise of artificial intelligence (AI) and data analytics tools is transforming how investment centers operate. Managers are leveraging technology for enhanced decision-making, risk assessment, and operational efficiency.

- Market Volatility: Economic uncertainties, including inflationary pressures and geopolitical tensions, necessitate agile management strategies. Investment center managers must adapt quickly to changing market conditions to protect assets and optimize returns.

- Diversification Strategies: With traditional asset classes facing challenges, there is a growing emphasis on diversifying portfolios. Managers are exploring alternative investments such as private equity and real estate to enhance returns.

Implementation Strategies

To effectively manage an investment center, managers can adopt several strategies:

- Performance Metrics: Establishing clear performance indicators (KPIs) such as ROI, profit margins, and cost-to-income ratios helps in assessing the effectiveness of management strategies.

- Budgeting and Forecasting: Implementing robust budgeting processes allows managers to allocate resources efficiently while forecasting potential revenue streams and expenses accurately.

- Continuous Training: Investing in ongoing education for staff ensures that team members stay updated with market trends and regulatory changes, enhancing overall performance.

- Stakeholder Engagement: Regular communication with stakeholders—including investors, employees, and regulatory bodies—fosters transparency and builds trust in the management process.

Risk Considerations

Investment center managers face various risks that can impact their operations:

- Market Risk: Fluctuations in market conditions can affect asset values significantly. Managers must develop strategies to hedge against potential downturns.

- Operational Risk: Inefficiencies in processes or failures in systems can lead to increased costs or lost opportunities. Implementing strong internal controls is essential.

- Regulatory Risk: Non-compliance with evolving regulations can result in penalties or reputational damage. Staying informed about regulatory changes is crucial for effective risk management.

- Credit Risk: The potential for loss due to a borrower’s failure to repay loans or meet contractual obligations requires careful assessment of counterparties.

Regulatory Aspects

Investment center managers operate within a framework of regulatory requirements that dictate how they manage assets:

- SEC Regulations: In the U.S., the Securities and Exchange Commission (SEC) imposes strict guidelines on reporting practices for investment firms. Compliance with these regulations is essential for maintaining investor confidence.

- ESG Reporting Standards: New regulations require detailed disclosures regarding ESG practices. Managers must ensure that their investment strategies align with these standards.

- Liquidity Management Rules: Regulations governing liquidity risk management have become more stringent post-financial crisis. Managers need to maintain adequate liquidity levels to meet obligations.

Future Outlook

Looking ahead, investment center managers will likely encounter several developments:

- Increased Automation: The integration of AI-driven solutions will streamline operations, enhance data analysis capabilities, and improve decision-making processes.

- Greater Emphasis on Sustainability: As investors increasingly prioritize sustainability, managers will need to align their strategies accordingly to attract capital.

- Evolving Investor Demands: The shift towards personalized investment solutions will require managers to adopt more flexible approaches tailored to individual client needs.

- Regulatory Adaptations: Continuous changes in regulatory frameworks will necessitate ongoing adjustments in compliance practices within investment centers.

Frequently Asked Questions About A Manager Of An Investment Center Is Responsible For

- What are the primary responsibilities of an investment center manager?

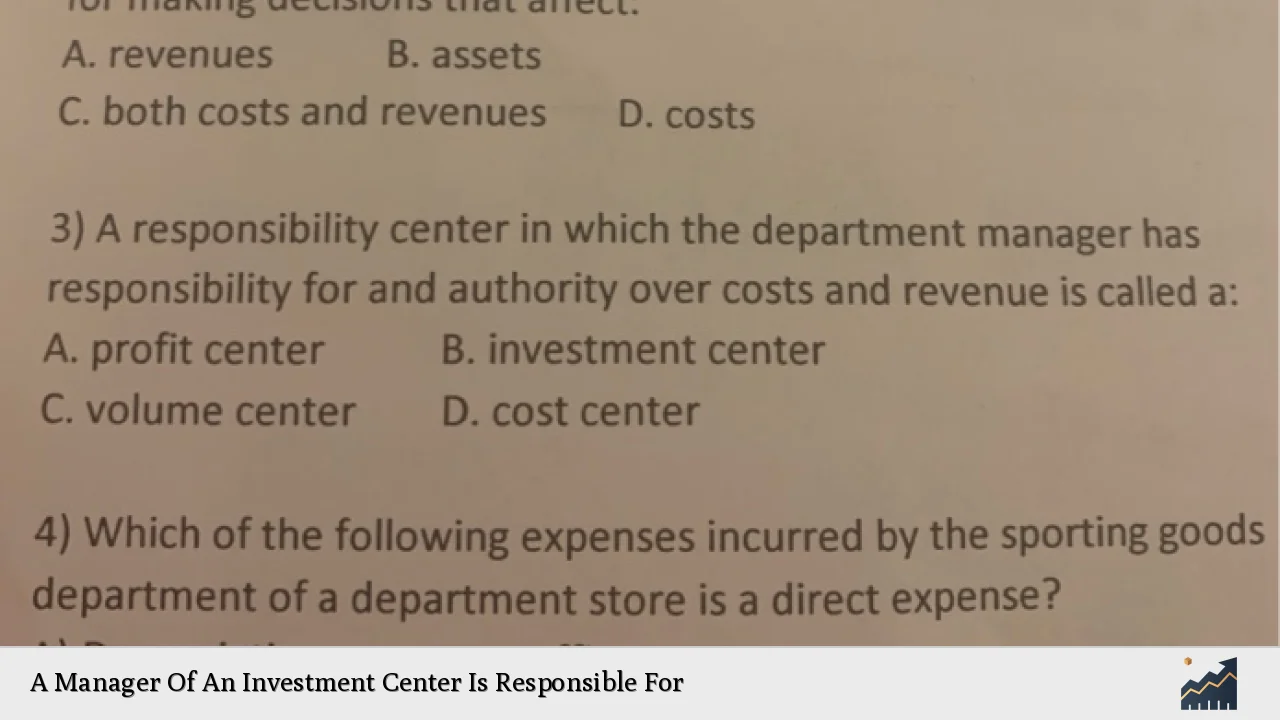

An investment center manager is responsible for managing revenues, costs, and investments within the center while maximizing return on investments (ROI). - How does an investment center differ from other responsibility centers?

Unlike cost or profit centers, an investment center has control over revenues, expenses, and asset investments, allowing for a broader scope of decision-making. - What metrics are used to evaluate an investment center’s performance?

Key performance metrics include ROI, profit margins, revenue growth rates, and cost-to-income ratios. - How do regulatory changes impact investment center management?

Regulatory changes can impose new compliance requirements that affect how managers operate their centers and report financial information. - What role does technology play in managing an investment center?

Technology enhances decision-making capabilities through data analytics and automation tools that streamline operations and improve efficiency. - Why is risk management important for investment center managers?

Effective risk management protects against potential losses from market fluctuations or operational inefficiencies that could impact profitability. - How can investment center managers prepare for future trends?

Staying informed about market developments, investing in technology adoption, and aligning strategies with evolving investor preferences are crucial for future readiness. - What challenges do investment center managers face today?

Current challenges include navigating market volatility, adapting to regulatory changes, managing operational risks, and meeting increasing investor expectations.