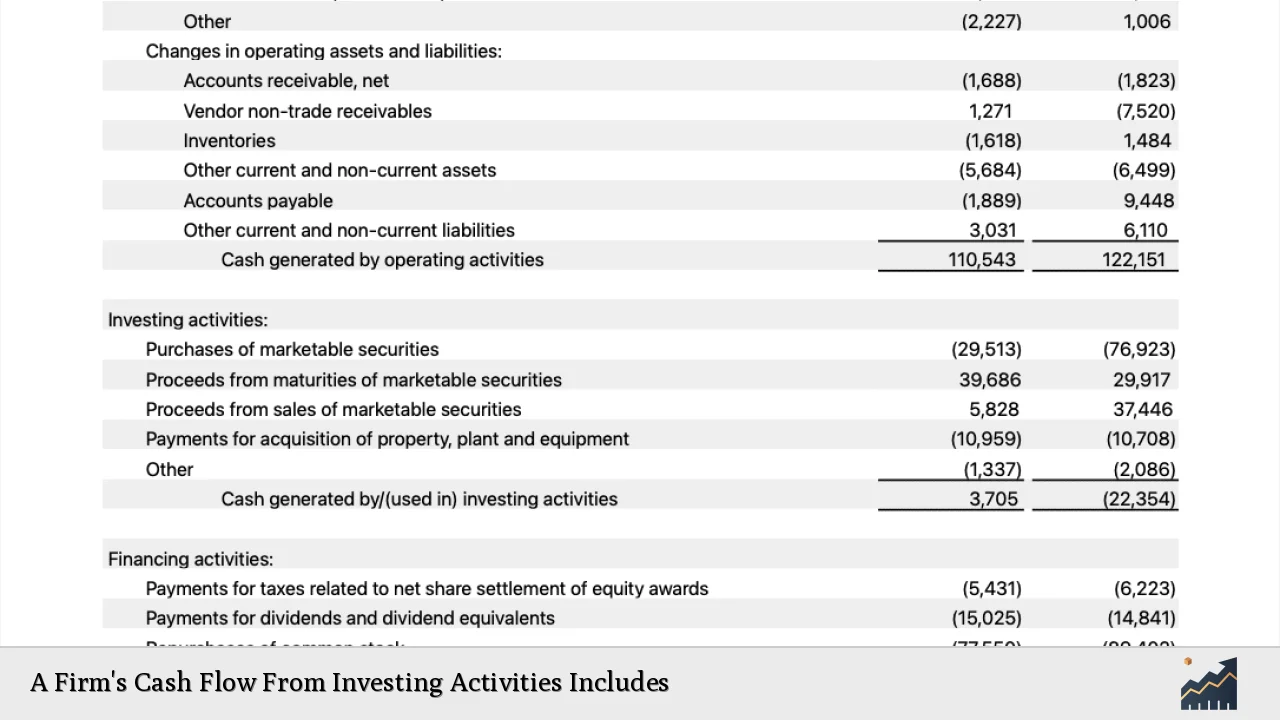

Cash flow from investing activities is a crucial component of a company’s cash flow statement, reflecting how much cash is generated or spent on investments during a specific period. This section provides insights into a firm’s investment strategy, including purchases and sales of long-term assets, acquisitions, and other investment-related transactions. Understanding this cash flow is vital for investors and analysts as it indicates the company’s growth potential and financial health.

| Key Concept | Description/Impact |

|---|---|

| Capital Expenditures (CapEx) | Cash outflows for purchasing or upgrading physical assets like property, plant, and equipment (PP&E). High CapEx indicates growth but can lead to negative cash flow. |

| Investment in Marketable Securities | Cash spent on buying stocks, bonds, or other securities. This can provide liquidity but also represents cash tied up in investments. |

| Acquisitions | Cash outflows for purchasing other businesses. This can enhance market share and capabilities but involves significant risk. |

| Sale of Assets | Cash inflows from selling fixed assets or investments. Positive inflows can improve liquidity but may indicate divestment from core operations. |

| Lending Activities | Cash outflows for loans provided to third parties. While this can generate interest income, it also ties up cash that could be used elsewhere. |

| Repayment of Loans | Cash inflows when loans made to third parties are repaid. This improves liquidity but may reflect reduced lending activity. |

Market Analysis and Trends

The landscape of cash flow from investing activities is influenced by various market trends and economic conditions. In recent years, companies have been increasingly focusing on digital transformation and sustainability initiatives, leading to significant investments in technology and green energy projects.

- Increased Capital Expenditures: Many firms are ramping up their CapEx to modernize infrastructure and adopt new technologies. For instance, in 2024, capital expenditures in the tech sector are projected to grow by 12% as companies invest in AI and cloud computing capabilities.

- Market Volatility: Economic uncertainty has led firms to be more cautious with their investments. The volatility seen in stock markets has prompted many companies to shift their focus towards stable, long-term investments rather than speculative ones.

- Sustainability Investments: There is a growing trend towards sustainable investing, with firms allocating more resources towards renewable energy projects and sustainable supply chains. This shift reflects both regulatory pressures and changing consumer preferences.

Implementation Strategies

To effectively manage cash flow from investing activities, firms should adopt several strategic approaches:

- Prioritize High-Return Investments: Companies should focus on investments that promise high returns while aligning with their long-term strategic goals. Evaluating potential projects through rigorous financial modeling can help identify the best opportunities.

- Monitor Cash Flow Regularly: Implementing robust cash flow forecasting tools allows firms to anticipate future cash needs and adjust their investment strategies accordingly.

- Diversify Investments: By diversifying their investment portfolio across different asset classes and sectors, firms can mitigate risks associated with market fluctuations.

- Leverage Technology: Utilizing financial technology solutions for real-time data analysis can enhance decision-making processes related to capital expenditures and investment strategies.

Risk Considerations

Investing activities inherently carry risks that must be managed effectively:

- Market Risk: Fluctuations in market conditions can adversely affect the value of investments. Companies need to stay informed about market trends to make timely adjustments.

- Liquidity Risk: Cash tied up in long-term investments may limit a firm’s ability to respond to short-term financial needs. Maintaining a balanced approach between liquid assets and long-term investments is crucial.

- Operational Risk: Acquisitions can lead to integration challenges that may impact overall performance. Thorough due diligence before any acquisition is essential to minimize operational risks.

Regulatory Aspects

Understanding the regulatory environment is vital for firms engaged in significant investing activities:

- Financial Reporting Standards: Companies must adhere to accounting standards such as GAAP or IFRS when reporting cash flows from investing activities. Accurate reporting ensures transparency for investors and compliance with regulations.

- Investment Regulations: Depending on the jurisdiction, there may be specific regulations governing certain types of investments or acquisitions. Firms should consult legal experts to navigate these complexities effectively.

- Environmental Regulations: As sustainability becomes a priority, companies must comply with environmental regulations when making investments in green technologies or infrastructure.

Future Outlook

The future of cash flow from investing activities will likely be shaped by several key factors:

- Technological Advancements: As technology continues to evolve, firms that invest in innovative solutions are likely to gain competitive advantages. The integration of AI and machine learning into investment strategies will enhance predictive analytics capabilities.

- Sustainability Focus: The trend towards sustainable investing is expected to grow, driven by consumer demand and regulatory changes. Firms that prioritize sustainability will not only comply with regulations but also attract socially conscious investors.

- Global Economic Conditions: Economic recovery post-pandemic will influence corporate investment decisions. Firms need to remain agile in adapting their strategies based on global economic indicators such as inflation rates and interest rates.

Frequently Asked Questions About A Firm’s Cash Flow From Investing Activities Includes

- What are the main components of cash flow from investing activities?

The main components include capital expenditures (CapEx), purchases of marketable securities, acquisitions of other businesses, sales of assets, lending activities, and repayments of loans. - How does negative cash flow from investing activities impact a firm?

A negative cash flow from investing activities may indicate that a firm is heavily investing in growth opportunities; however, it could also raise concerns about liquidity if sustained over time. - Why is it important to analyze cash flow from investing activities?

This analysis provides insights into a firm’s investment strategy, growth potential, and how effectively it manages its resources for future profitability. - How do companies calculate cash flow from investing activities?

Companies calculate this by summing all cash inflows from investment sales and subtracting all cash outflows related to purchases or capital expenditures. - What role does technology play in managing cash flow?

Technology enhances forecasting accuracy, streamlines data analysis processes, and supports better decision-making regarding capital allocation. - What risks should companies consider when engaging in investing activities?

Companies should consider market risk, liquidity risk, operational risk, and regulatory compliance when planning their investing strategies. - How can firms ensure compliance with investment regulations?

Firms should stay informed about relevant regulations through legal counsel and ensure adherence during financial reporting practices. - What trends are shaping future cash flows from investing activities?

The focus on technological advancements, sustainability initiatives, and global economic conditions will significantly shape future investment strategies.

This comprehensive overview of a firm’s cash flow from investing activities highlights its importance in assessing financial health and strategic direction while providing actionable insights for investors and finance professionals alike.