Cash flow from investing activities (CFIA) is a critical component of a company’s cash flow statement, reflecting the cash spent on or generated from investment-related activities during a specific period. This section provides insights into how a firm allocates its capital, which is essential for assessing its financial health and growth potential. Understanding CFIA helps investors gauge a company’s strategic direction, operational efficiency, and overall financial stability.

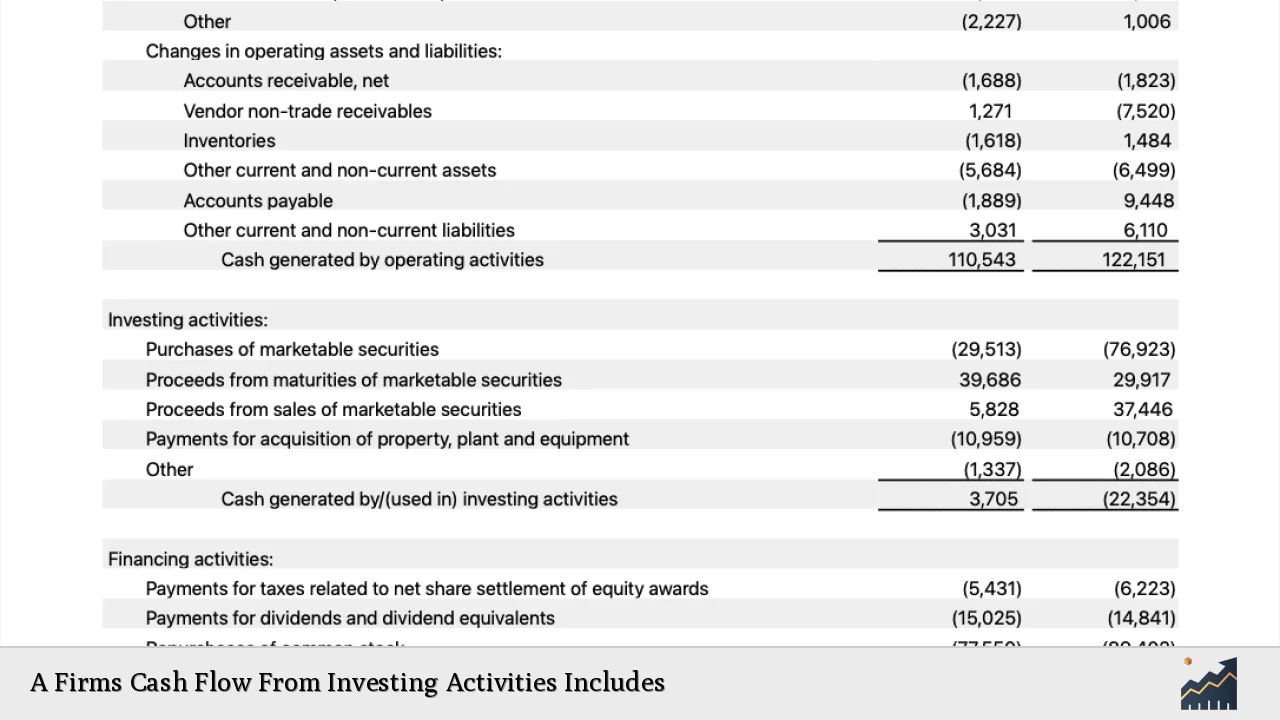

The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities. CFIA specifically focuses on transactions that involve the acquisition and disposal of long-term assets and investments. These activities can significantly impact a firm’s cash position and are vital for stakeholders looking to evaluate the company’s investment strategies.

| Key Concept | Description/Impact |

|---|---|

| Capital Expenditures (CapEx) | Cash spent on acquiring or upgrading physical assets such as property, plant, and equipment (PP&E). High CapEx can indicate growth initiatives but may also lead to negative cash flow if not managed properly. |

| Sale of Assets | Cash inflows from selling long-term assets or investments. This can provide immediate liquidity to the firm, improving its cash position. |

| Investments in Securities | Cash flows related to the purchase or sale of stocks, bonds, or other marketable securities. This reflects the company’s strategy in managing its portfolio for liquidity and returns. |

| Acquisitions | Cash outflows for acquiring other businesses. While this can lead to growth and increased market share, it also requires careful evaluation to avoid overpaying or integrating challenges. |

| Divestitures | Cash inflows from selling parts of the business or investments that are no longer aligned with corporate strategy. This can help streamline operations and focus on core areas. |

| Loan Repayments | Cash outflows associated with repaying loans taken for investment purposes. Effective management of debt repayments is crucial for maintaining financial health. |

| Market Trends Impacting CFIA | The overall economic environment influences CFIA through interest rates, inflation, and market demand for goods and services. Companies must adapt their investment strategies accordingly. |

Market Analysis and Trends

The landscape of cash flow from investing activities has evolved significantly in recent years due to various market dynamics. Key trends include:

- Increased Focus on Sustainability: Companies are increasingly investing in sustainable practices and technologies. This shift not only aligns with global environmental goals but also attracts socially conscious investors.

- Digital Transformation Investments: Firms are allocating substantial resources towards digital technologies to enhance operational efficiency. This includes investments in software, automation, and data analytics.

- Rising Interest Rates: With central banks adjusting interest rates in response to inflationary pressures, companies face higher costs of borrowing. This scenario necessitates careful planning regarding capital expenditures and financing strategies.

- Global Supply Chain Adjustments: The disruptions caused by the COVID-19 pandemic have prompted firms to rethink their supply chains, leading to increased investments in local production facilities and diversified sourcing strategies.

Implementation Strategies

To effectively manage cash flow from investing activities, companies should consider the following strategies:

- Prioritize High-Return Investments: Focus on projects with clear ROI metrics to ensure that capital is allocated efficiently.

- Regular Cash Flow Forecasting: Implement robust forecasting models that consider various scenarios to anticipate future cash needs related to investments.

- Leverage Financial Instruments: Utilize derivatives or other financial instruments to hedge against risks associated with interest rates or commodity prices that could impact investment costs.

- Monitor Market Conditions: Stay informed about economic indicators that could affect investment opportunities, such as GDP growth rates, unemployment levels, and consumer confidence indices.

Risk Considerations

Investing activities inherently carry risks that can impact a firm’s financial stability:

- Market Volatility: Fluctuations in market conditions can affect the value of investments in securities and long-term assets.

- Operational Risks: Acquisitions may lead to integration challenges that can disrupt operations and negatively impact cash flows.

- Liquidity Risks: Heavy investments without adequate liquidity management can strain a company’s financial resources during downturns.

- Regulatory Risks: Changes in regulations can affect the feasibility of certain investments or increase compliance costs.

Regulatory Aspects

Understanding regulatory requirements is essential for managing cash flows from investing activities:

- SEC Reporting Requirements: Public companies must adhere to strict reporting standards set by the Securities and Exchange Commission (SEC), ensuring transparency in how they report their investing activities.

- International Accounting Standards: Companies operating globally must comply with International Financial Reporting Standards (IFRS), which may differ from U.S. Generally Accepted Accounting Principles (GAAP).

- Tax Implications: Investments often come with tax consequences that need careful planning to optimize tax liabilities while ensuring compliance with local laws.

Future Outlook

Looking ahead, several factors will shape cash flow from investing activities:

- Technological Advancements: Continued innovation will drive new investment opportunities across various sectors, particularly in technology and renewable energy.

- Economic Recovery Post-Pandemic: As economies recover, firms will likely increase their investments to capitalize on growth opportunities while navigating potential inflationary pressures.

- Increased Competition for Capital: With more companies vying for investor attention, firms will need to clearly articulate their value propositions related to investment strategies.

- Focus on ESG Factors: Environmental, Social, and Governance (ESG) factors will play an increasingly important role in investment decisions as stakeholders demand greater accountability from corporations.

Frequently Asked Questions About A Firms Cash Flow From Investing Activities Includes

- What are the main components of cash flow from investing activities?

Cash flow from investing activities primarily includes capital expenditures on property, plant, equipment (CapEx), acquisitions of other businesses, sales of assets, and investments in marketable securities. - How do negative cash flows from investing activities affect a company?

A negative cash flow from investing activities indicates that a company is spending more on investments than it is generating through sales of assets. While this might raise concerns about liquidity, it could also signify strategic growth initiatives aimed at future profitability. - Why is cash flow from investing important for investors?

This metric helps investors assess how effectively a company is managing its capital expenditures and whether it is making sound investment decisions that align with its long-term growth strategy. - How can companies improve their cash flow from investing?

Companies can enhance their CFIA by prioritizing high-return projects, optimizing asset sales timing, managing debt levels effectively, and maintaining sufficient liquidity reserves. - What risks should be considered when analyzing CFIA?

Key risks include market volatility affecting asset values, operational risks associated with acquisitions, liquidity risks during downturns, and regulatory changes impacting investment strategies. - How does CFIA relate to overall financial health?

A healthy CFIA indicates that a company is effectively using its resources for growth while maintaining adequate liquidity. Conversely, persistent negative CFIA may signal potential financial distress if not backed by strong operating cash flows. - Can CFIA predict future performance?

While CFIA provides insights into past investment decisions and current resource allocation strategies, it should be analyzed alongside other financial metrics for a comprehensive view of future performance. - What role does technology play in shaping CFIA?

The adoption of new technologies can lead to significant capital investments but may also result in increased efficiencies that improve overall cash flows in the long term.

This comprehensive overview provides individual investors and finance professionals with essential insights into what constitutes cash flow from investing activities within firms. Understanding these elements is crucial for making informed investment decisions based on a company’s strategic direction and financial health.