An increase of $1 billion in investment can have significant implications for various sectors of the economy, influencing growth, employment, and overall market dynamics. This article explores the multifaceted effects of such an investment boost, analyzing current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

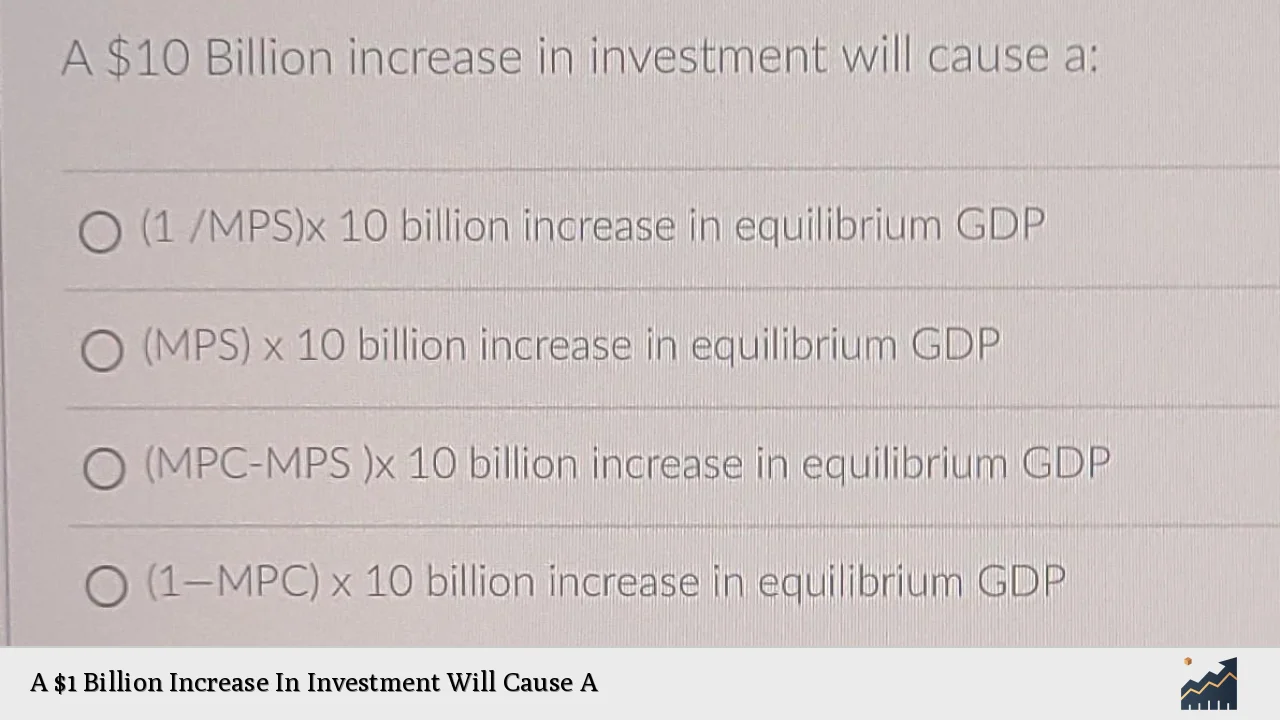

| Economic Growth | An increase in investment typically leads to higher economic output. For instance, a $1 billion investment can stimulate GDP growth through direct spending and the multiplier effect, potentially increasing output by approximately $400 million in the short term based on historical multipliers. |

| Job Creation | Increased investment often results in job creation. For every $1 million invested, it is estimated that 10 jobs can be created in sectors like construction and manufacturing. |

| Sectoral Impact | Different sectors respond variably to increased investments. Technology and infrastructure tend to see more immediate benefits due to their capital-intensive nature. |

| Private Sector Confidence | A significant increase in investment can bolster private sector confidence, encouraging further spending and investment from businesses. |

| Inflationary Pressures | Increased demand from higher investments may lead to inflationary pressures if the economy is near full capacity. |

| Regulatory Compliance | Investments must align with regulatory frameworks which can vary by region. Compliance costs may affect net returns on investment. |

| Long-Term Growth Potential | Sustained increases in investment can enhance productivity and innovation, leading to long-term economic growth potential. |

Market Analysis and Trends

The current economic landscape is characterized by a recovery phase post-pandemic, with investments increasingly directed towards technology, infrastructure, and green energy. As of 2024, the global investment market is projected to grow significantly, with a compound annual growth rate (CAGR) of approximately 7.5%, reaching an estimated $5.68 trillion by 2028.

Key Trends Influencing Investment

- Technological Advancements: Investments in artificial intelligence (AI) are expected to surge, with projections indicating a global AI investment nearing $200 billion by 2025. This trend reflects a broader shift towards digital transformation across industries.

- Sustainable Investing: There is a growing emphasis on environmental, social, and governance (ESG) factors influencing investment decisions. Regulatory frameworks are increasingly supporting sustainable finance initiatives.

- Public vs. Private Investment: Public sector investments have shown to crowd in private investments, particularly in infrastructure projects. For example, an increase in public investment by 1% of GDP can lead to a corresponding increase in private investment due to improved economic conditions.

Implementation Strategies

To effectively harness the benefits of a $1 billion increase in investment, stakeholders should consider the following strategies:

- Targeted Sector Investment: Focus on sectors with high growth potential such as technology, renewable energy, and healthcare. These areas are likely to yield higher returns due to their innovative nature.

- Public-Private Partnerships (PPPs): Collaborating with government entities can enhance project viability and access additional funding sources while sharing risks.

- Utilizing Data Analytics: Implementing advanced data analytics can optimize decision-making processes regarding where and how to invest effectively.

- Diversification: Investors should diversify their portfolios across various asset classes to mitigate risks associated with market volatility.

Risk Considerations

Investing involves inherent risks that must be managed carefully:

- Market Volatility: Fluctuations in market conditions can impact returns on investments significantly. Investors should be prepared for potential downturns.

- Regulatory Risks: Changes in government policies or regulations can affect the viability of certain investments. Staying informed about regulatory developments is crucial.

- Economic Conditions: Broader economic factors such as inflation rates and interest rates can influence investment performance. Monitoring these indicators helps in making timely adjustments.

Regulatory Aspects

Understanding regulatory requirements is essential for successful investments:

- Compliance Requirements: Investors must ensure adherence to local and international regulations governing their investments. This includes understanding tax implications and reporting obligations.

- Impact of Policy Changes: Legislative changes can create new opportunities or challenges for investors. For instance, tax incentives for renewable energy projects can stimulate further investments in that sector.

- Investment Facilitation Initiatives: Governments often implement measures to facilitate foreign direct investment (FDI), which can enhance market attractiveness for investors.

Future Outlook

The outlook for increased investments remains positive amid ongoing economic recovery:

- Growth Projections: Economists forecast continued growth driven by technological advancements and infrastructure development. The U.S. economy is expected to grow at an annual rate of around 2% through 2024.

- AI Integration: The integration of AI into business processes will likely enhance productivity and efficiency across sectors, leading to increased profitability and further investments.

- Sustainable Growth: The shift towards sustainable practices will continue shaping investment strategies as stakeholders prioritize long-term environmental impacts alongside financial returns.

Frequently Asked Questions About A $1 Billion Increase In Investment Will Cause A

- What immediate effects does a $1 billion increase in investment have on the economy?

A significant boost in investment typically leads to increased GDP growth, job creation, and enhanced business confidence. - How does this increase impact inflation?

If the economy is operating near full capacity, increased demand from higher investments may lead to inflationary pressures. - Which sectors benefit most from such an increase?

Sectors like technology, infrastructure, and renewable energy tend to see immediate benefits from increased investments. - What risks should investors consider?

Investors should be aware of market volatility, regulatory changes, and broader economic conditions that could affect their investments. - How do public investments influence private sector spending?

Public sector investments often crowd in private investments by improving economic conditions and creating new opportunities. - What role does technology play in shaping future investments?

Technological advancements are driving substantial increases in capital allocation towards AI and digital transformation initiatives. - How important are regulatory considerations when investing?

Understanding regulatory requirements is crucial as they can significantly impact the viability and returns of investments. - What is the long-term outlook for increased investments?

The long-term outlook remains positive with expectations of sustained economic growth driven by technological innovation and sustainable practices.

This comprehensive analysis illustrates that a $1 billion increase in investment has far-reaching implications across various economic dimensions. By understanding these dynamics, individual investors and finance professionals can make informed decisions that align with current trends while navigating potential risks effectively.